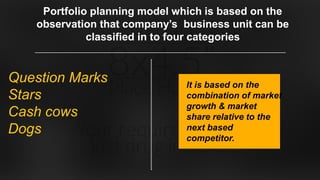

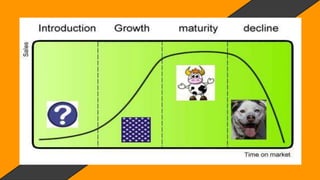

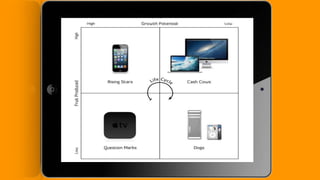

This document discusses the BCG matrix, a portfolio planning model developed by Bruce Henderson at Boston Consulting Group in the 1970s. The BCG matrix classifies business units into four categories based on their relative market share and market growth rate: Stars (high share, high growth), Cash Cows (high share, low growth), Question Marks (low share, high growth), and Dogs (low share, low growth). It is used to assess products/businesses, allocate resources, and make divestment decisions. The matrix is simple to understand and helps identify opportunities and maximize future growth and profits by determining where cash resources should be invested. However, it only considers two factors and data may not always be available.