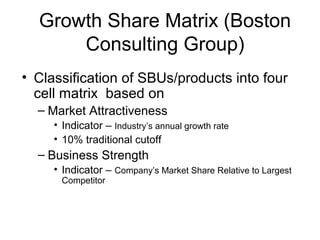

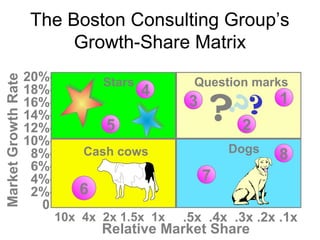

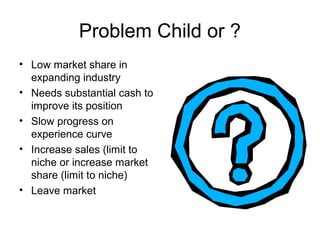

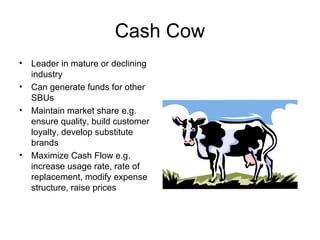

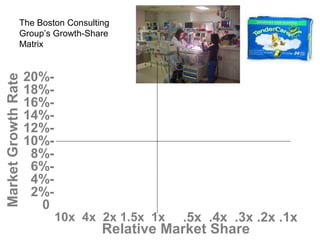

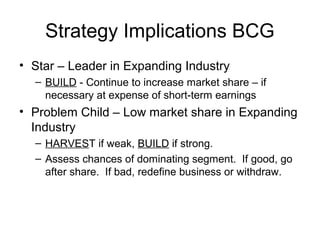

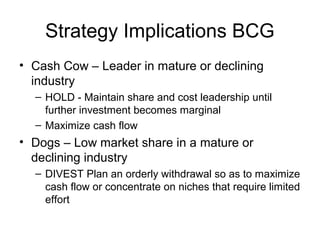

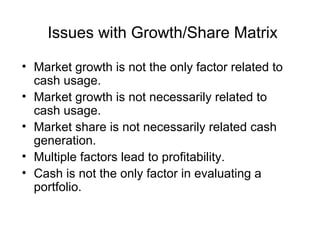

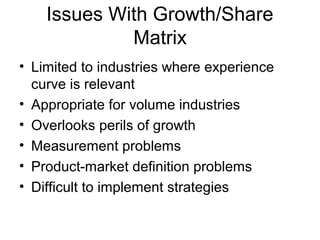

The document discusses the Boston Consulting Group's Growth-Share Matrix, which classifies business units based on their market growth and relative market share. It plots these factors to place units in one of four categories: stars, question marks, cash cows, and dogs. Each category has different strategic implications. Stars are in high growth markets and should focus on increasing market share. Question marks need investment to improve position. Cash cows provide cash flow. Dogs should be harvested or divested. The document outlines assumptions, strategies, and issues with the Growth-Share Matrix approach.