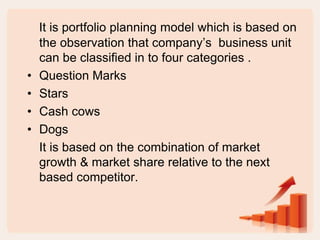

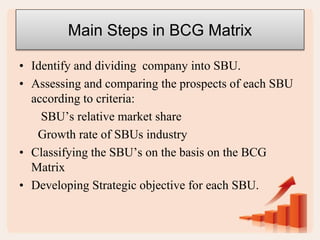

1. The document discusses the Boston Consulting Group (BCG) Matrix, a portfolio planning model created by BCG in 1970.

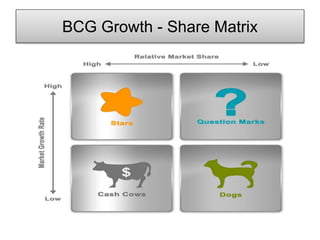

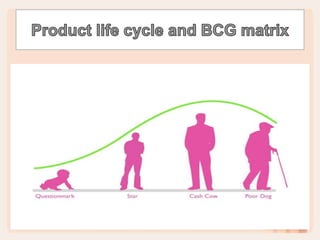

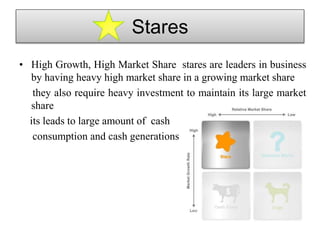

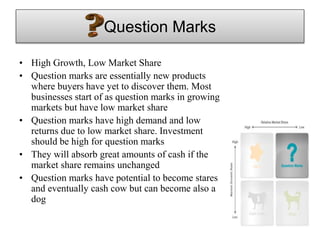

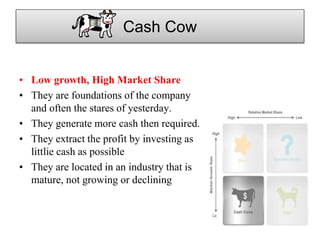

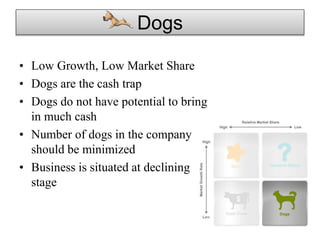

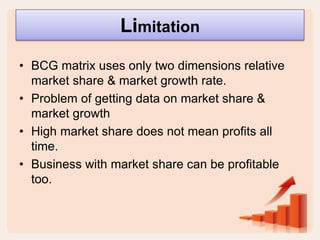

2. The BCG Matrix classifies business units into four categories based on their market share and market growth rate: Stars, Cash Cows, Question Marks, and Dogs.

3. Stars are high market share business units in high growth markets. Cash Cows are high market share units in low-growth markets. Question Marks have high growth but low market share. Dogs have low growth and market share.