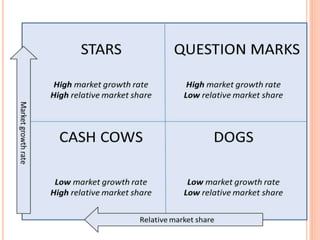

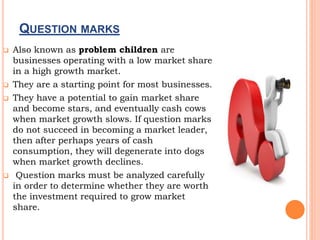

The BCG matrix is a portfolio analysis tool used to evaluate business units or product lines based on their relative market share and market growth. It categorizes products as Stars, Cash Cows, Question Marks or Dogs. Stars are high market share products in high growth markets, while Cash Cows have high share but in slow-growing markets. Question Marks have low share but are in high-growth markets, while Dogs have low share and are in slow-growth markets. The matrix is used to assess relative cash usage and allocation across a company's portfolio to maintain a balanced mix of these categories for long-term growth and profitability. It provides a framework to determine which products require investment, harvesting or divestment. However,