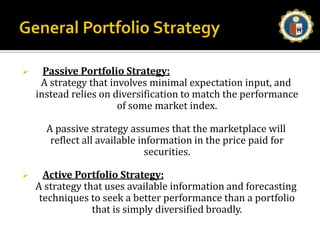

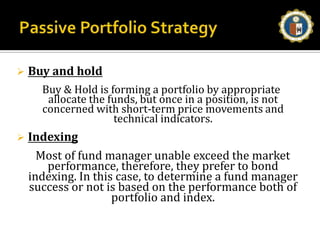

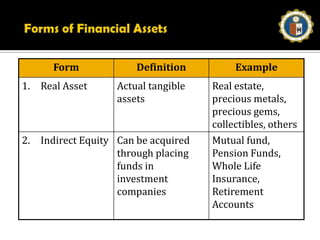

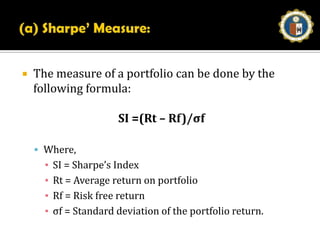

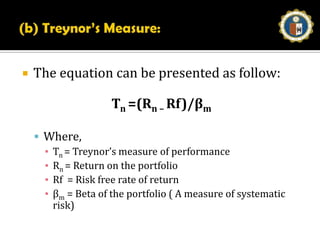

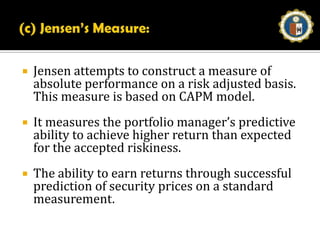

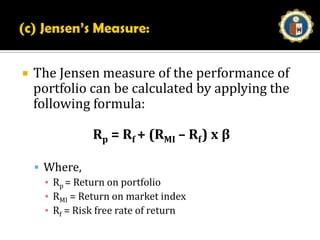

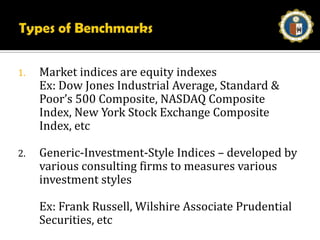

The document provides an overview of investment management including defining key terms, outlining the investment management process, and discussing portfolio evaluation methods. Specifically, it discusses creating an investment policy statement, selecting portfolio strategies such as passive and active, choosing asset types, and measuring performance using Sharpe's measure, Treynor's measure, and Jensen's measure which compare the portfolio return to benchmarks.