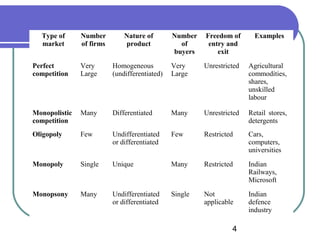

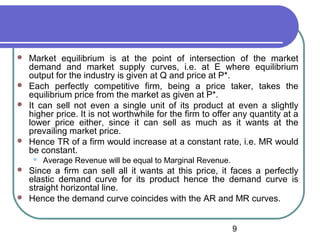

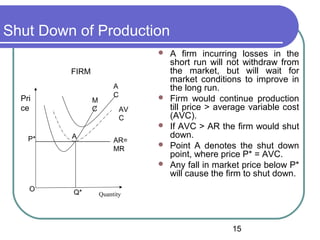

The document discusses the concept of perfect competition. It defines perfect competition as a market with many small firms, homogeneous products, free entry and exit, and perfect information. Under perfect competition in the short run, firms are price takers and will produce at the price that maximizes their profits where marginal revenue equals marginal cost. In the long run, perfectly competitive firms will earn only normal profits as entry and exit will cause prices to adjust until average costs are equal to prices.