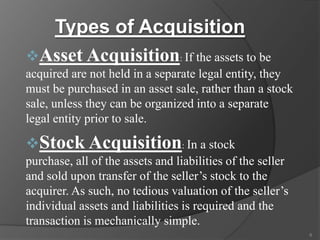

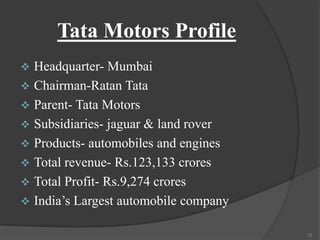

This document discusses a case study on the acquisition of Jaguar and Land Rover by Tata Motors. It provides background on both companies, including details on their profiles, products, revenues, and profits. It then examines the key features of the acquisition, noting that Tata Motors acquired two iconic British brands. The summary discusses the deal itself and potential benefits, as well as the road ahead for the combined company.