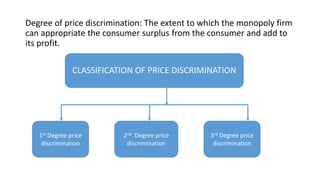

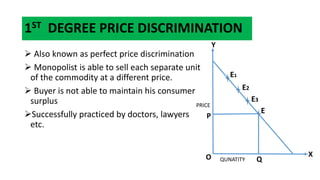

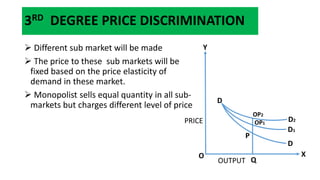

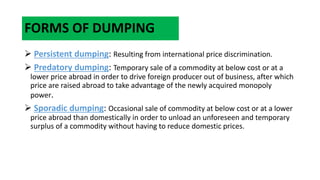

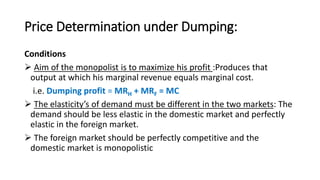

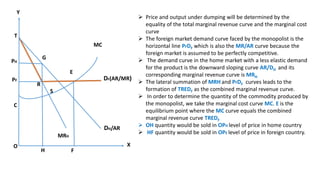

This document provides an overview of price discrimination and dumping. It defines price discrimination as selling identical goods at different prices in different markets. It classifies price discrimination into three degrees: first, second, and third. The essential conditions for price discrimination are also outlined. Dumping is defined as charging a lower price for goods in a foreign market than in a domestic market. The document discusses forms of dumping and the price determination process under dumping conditions. The potential effects of dumping are listed as well.