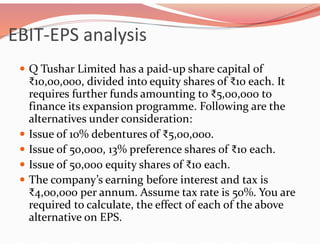

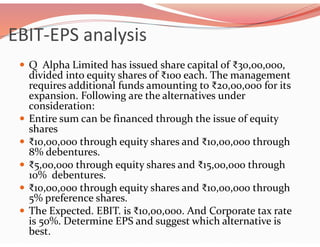

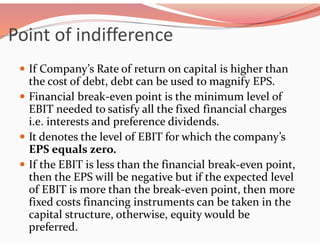

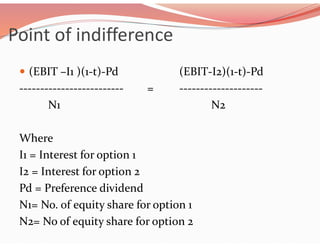

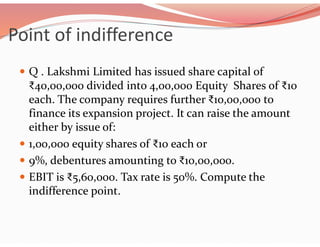

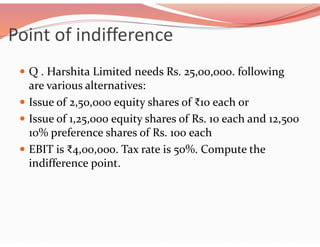

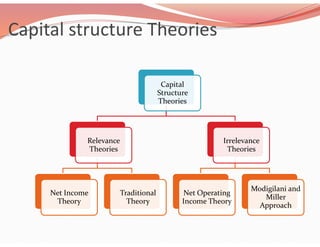

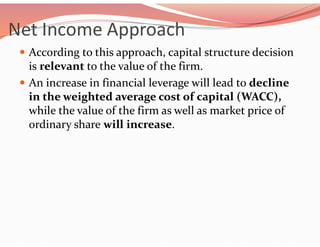

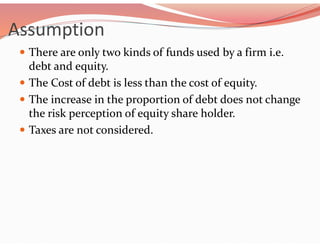

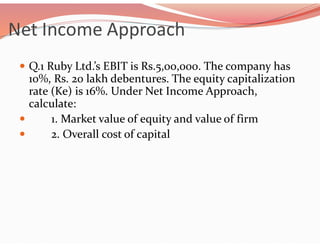

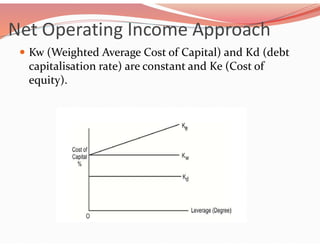

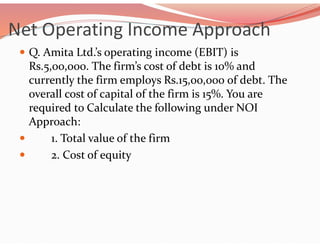

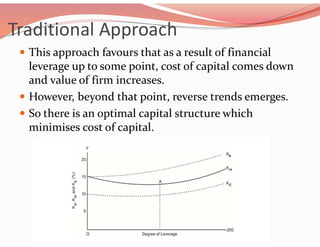

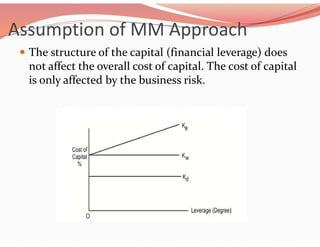

The document discusses capital structure and various theories related to it. It defines capital structure as the combination of capital from different sources of financing. It then discusses factors that affect capital structure decisions like control, risk, cost, size and nature of business. It explains optimal capital structure as the perfect mix of debt and equity that maximizes firm value while minimizing cost of capital. It also discusses various methods of analyzing optimal capital structure including EBIT-EPS analysis and indifference point analysis. Finally, it summarizes different theories around capital structure like net income, net operating income, traditional and Modigliani-Miller approaches.