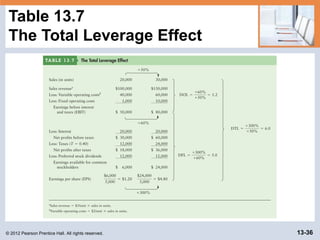

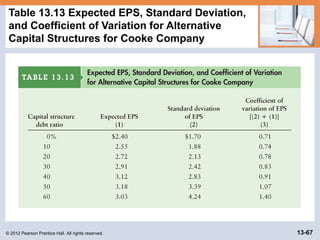

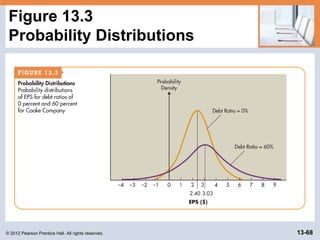

This document discusses leverage, capital structure, and types of capital. It defines leverage as the effects of fixed costs on shareholder returns. Capital structure refers to the mix of long-term debt and equity used by a firm. The document outlines operating, financial, and total leverage and how they relate to one another. It also describes the different types of capital available to firms, including debt, preferred stock, and common equity.