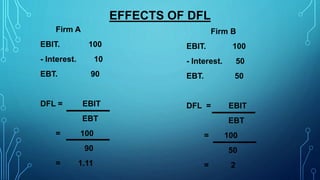

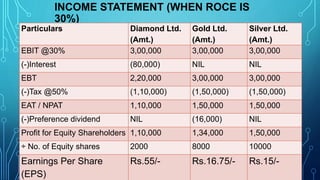

This document provides an overview of leverages including operating leverage, financial leverage, and combined leverage. It defines leverage as using assets or funds to pay fixed returns. It discusses the differences between debt and equity financing. It also covers various leverage concepts like trading on equity, break-even analysis, EBIT-EPS analysis, and measures of operating and financial leverage. The document aims to introduce students to important leverage concepts and their applications in financial management.