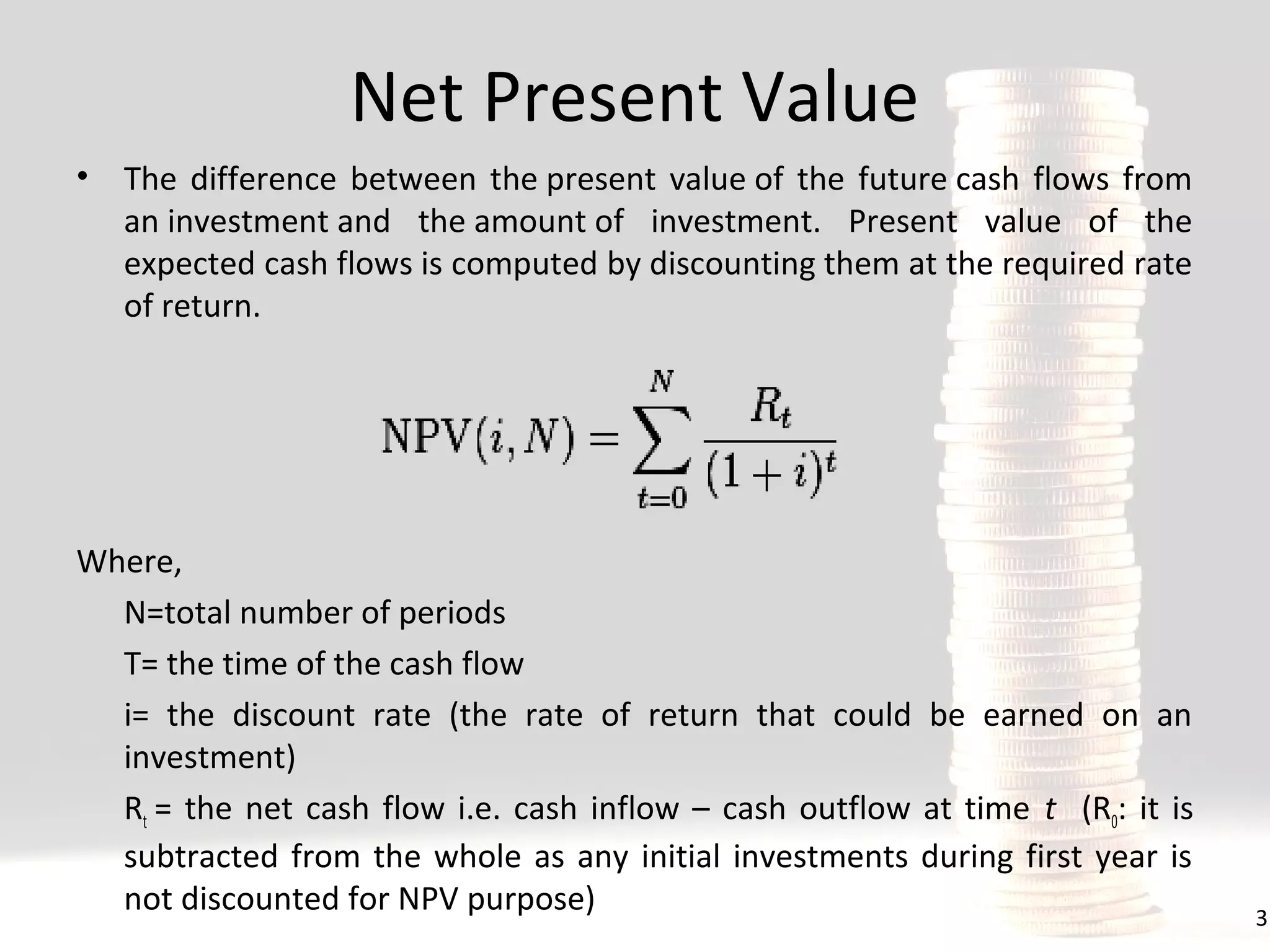

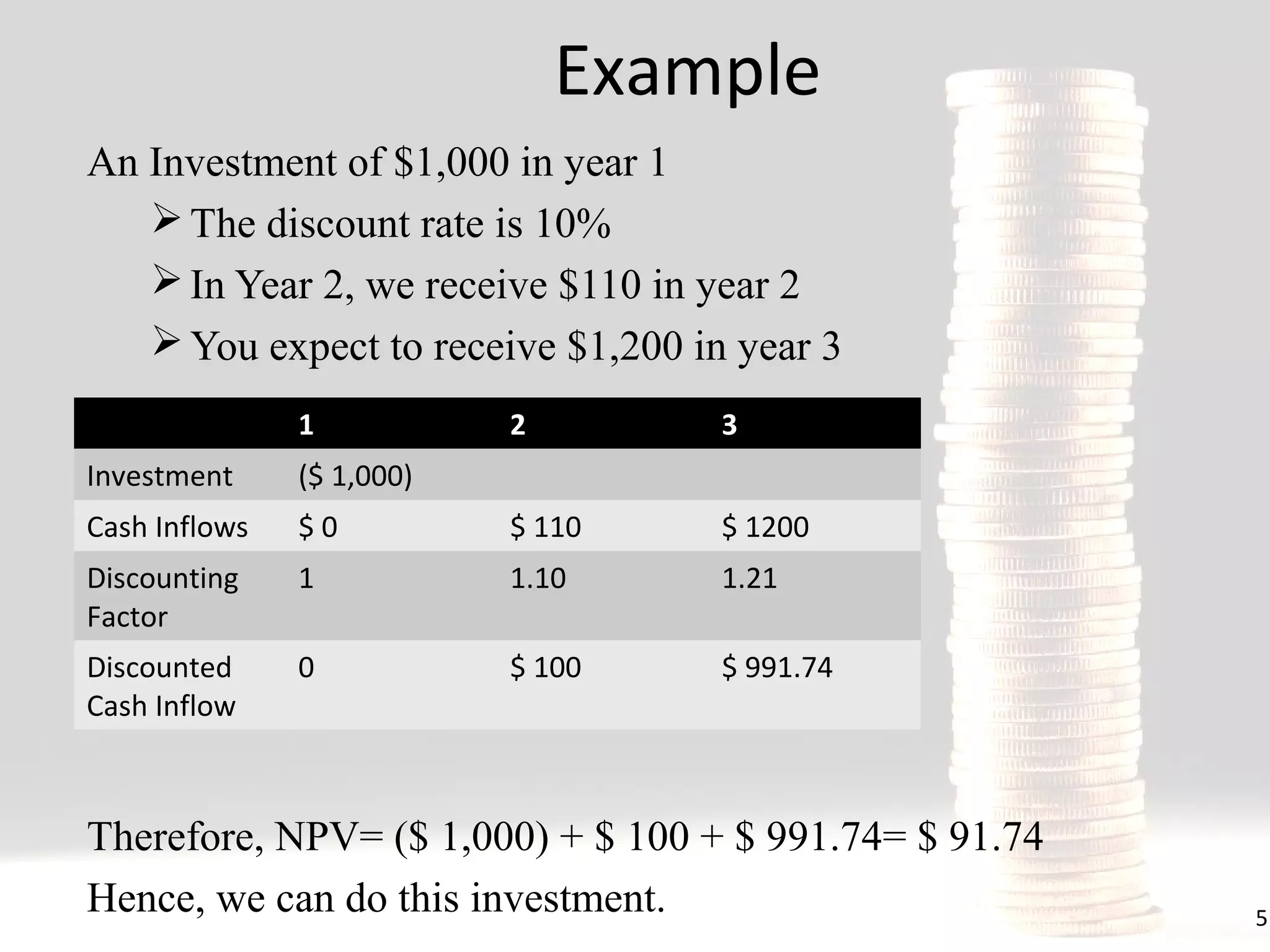

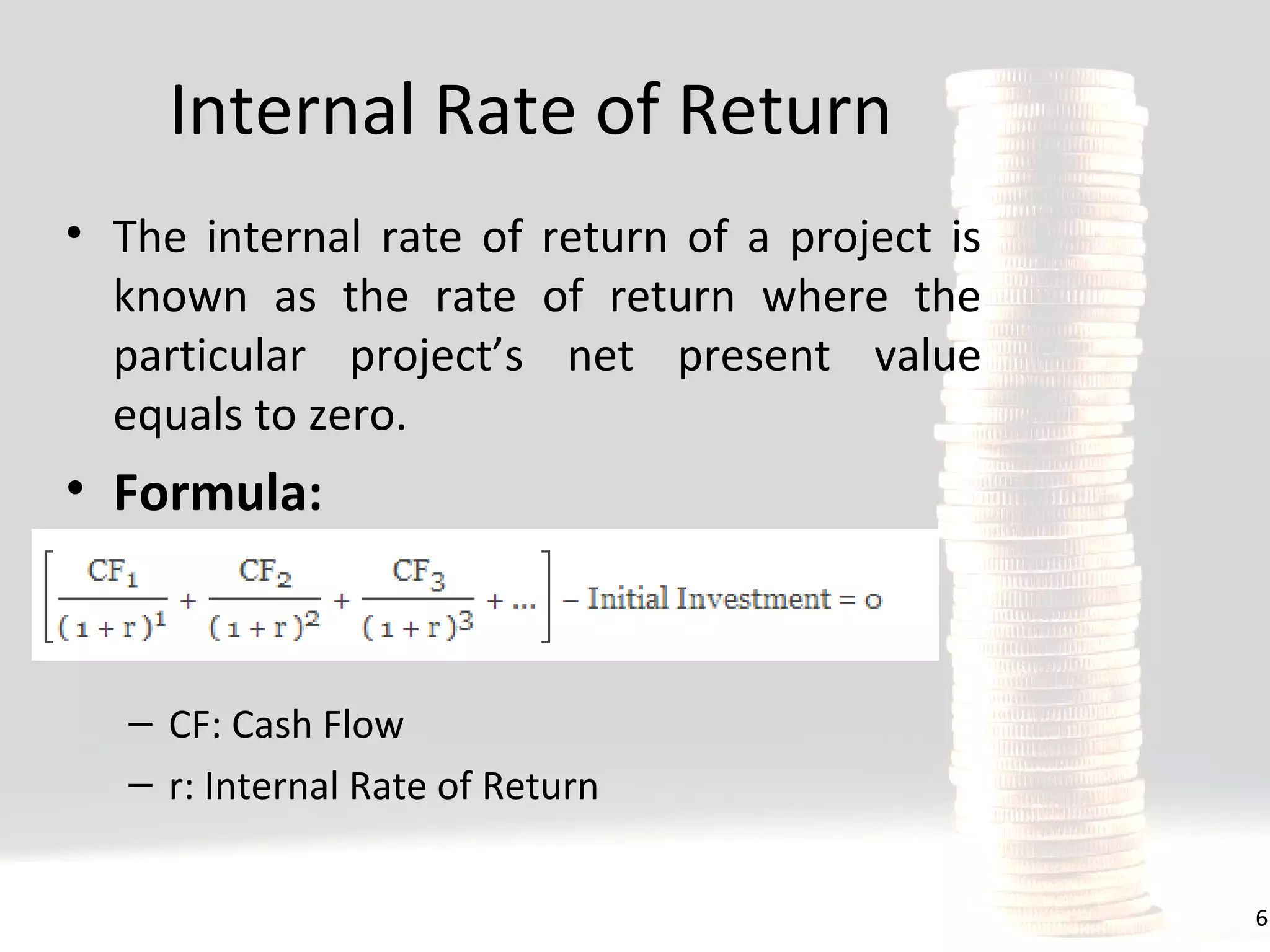

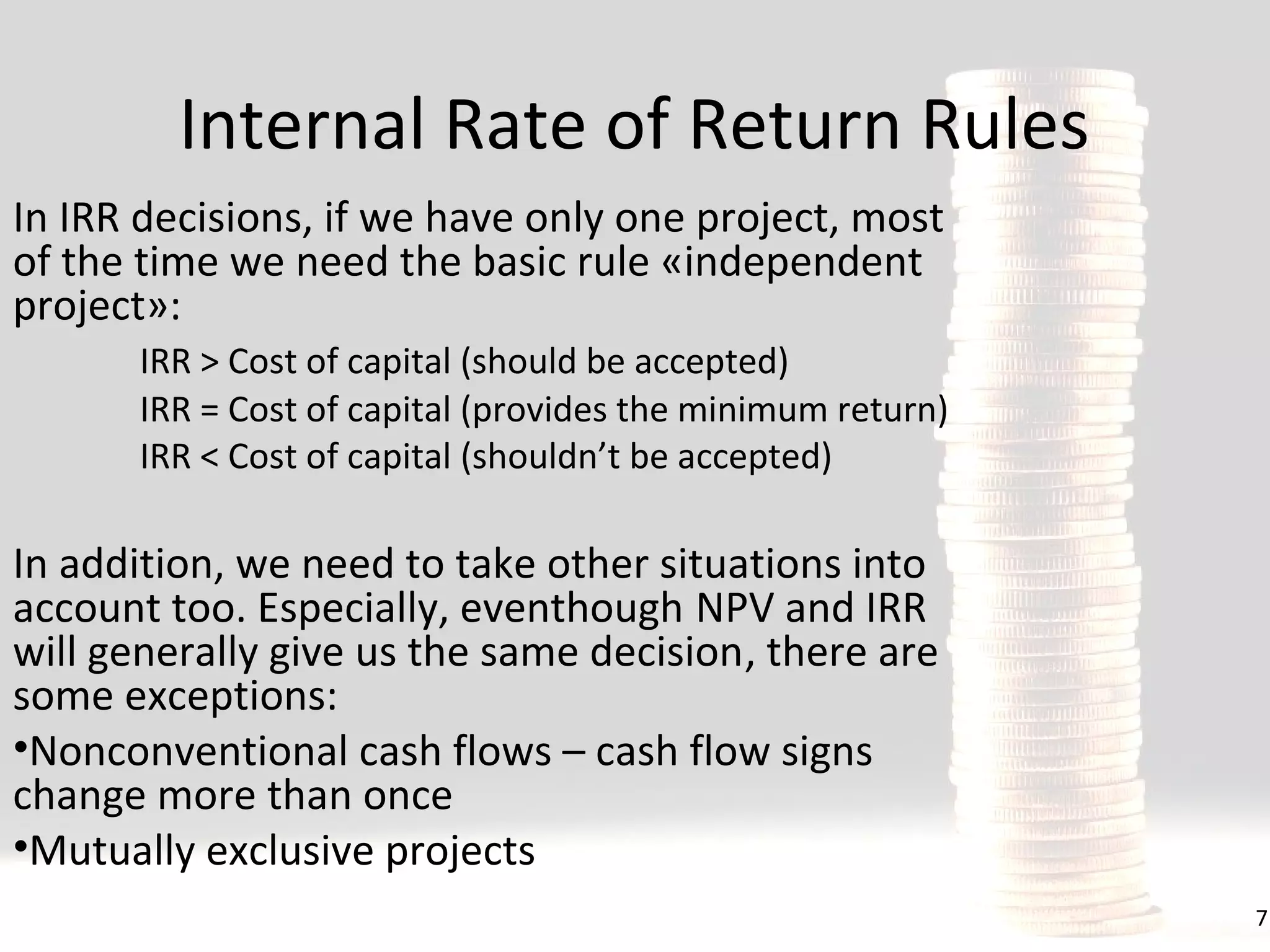

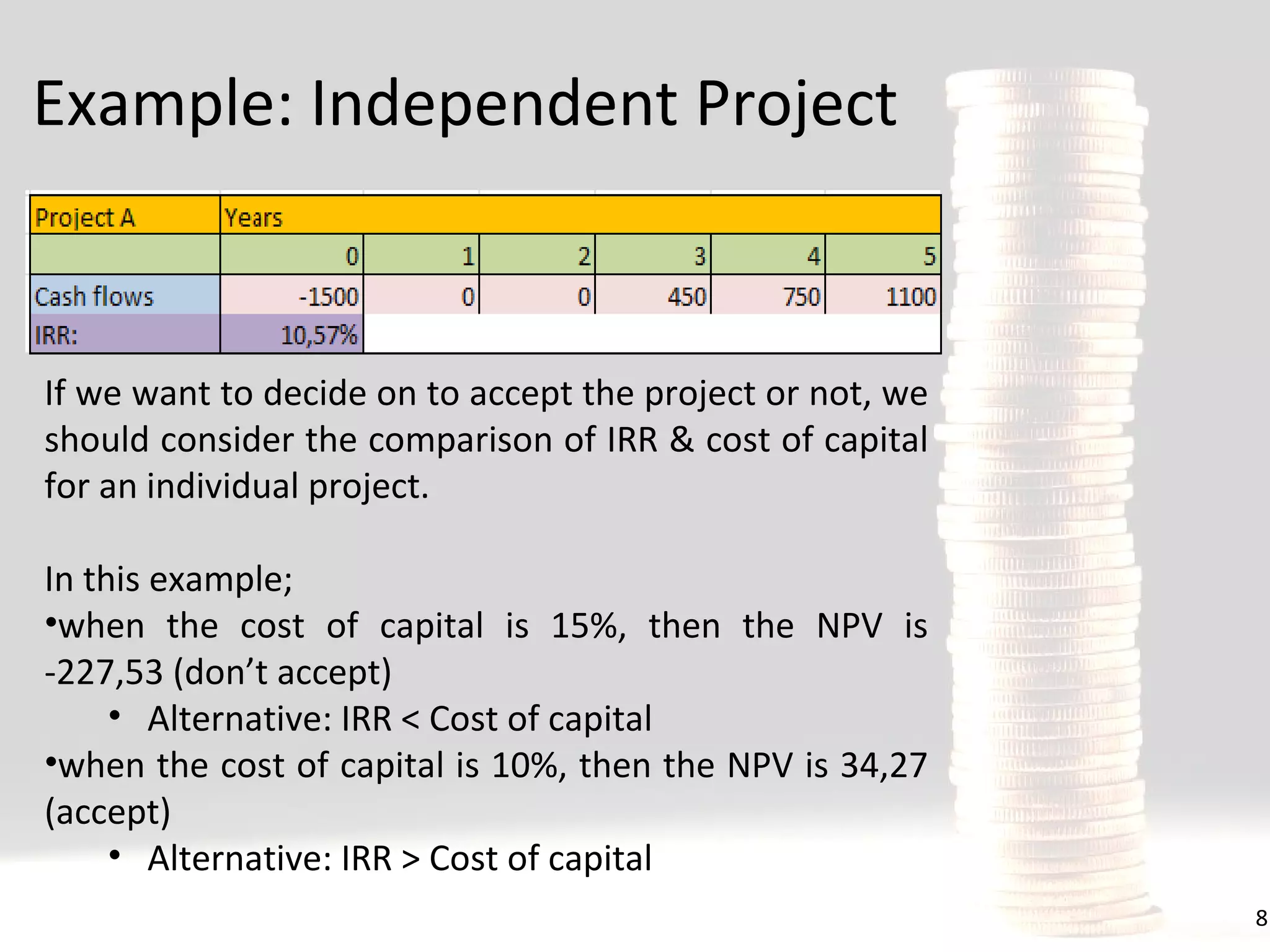

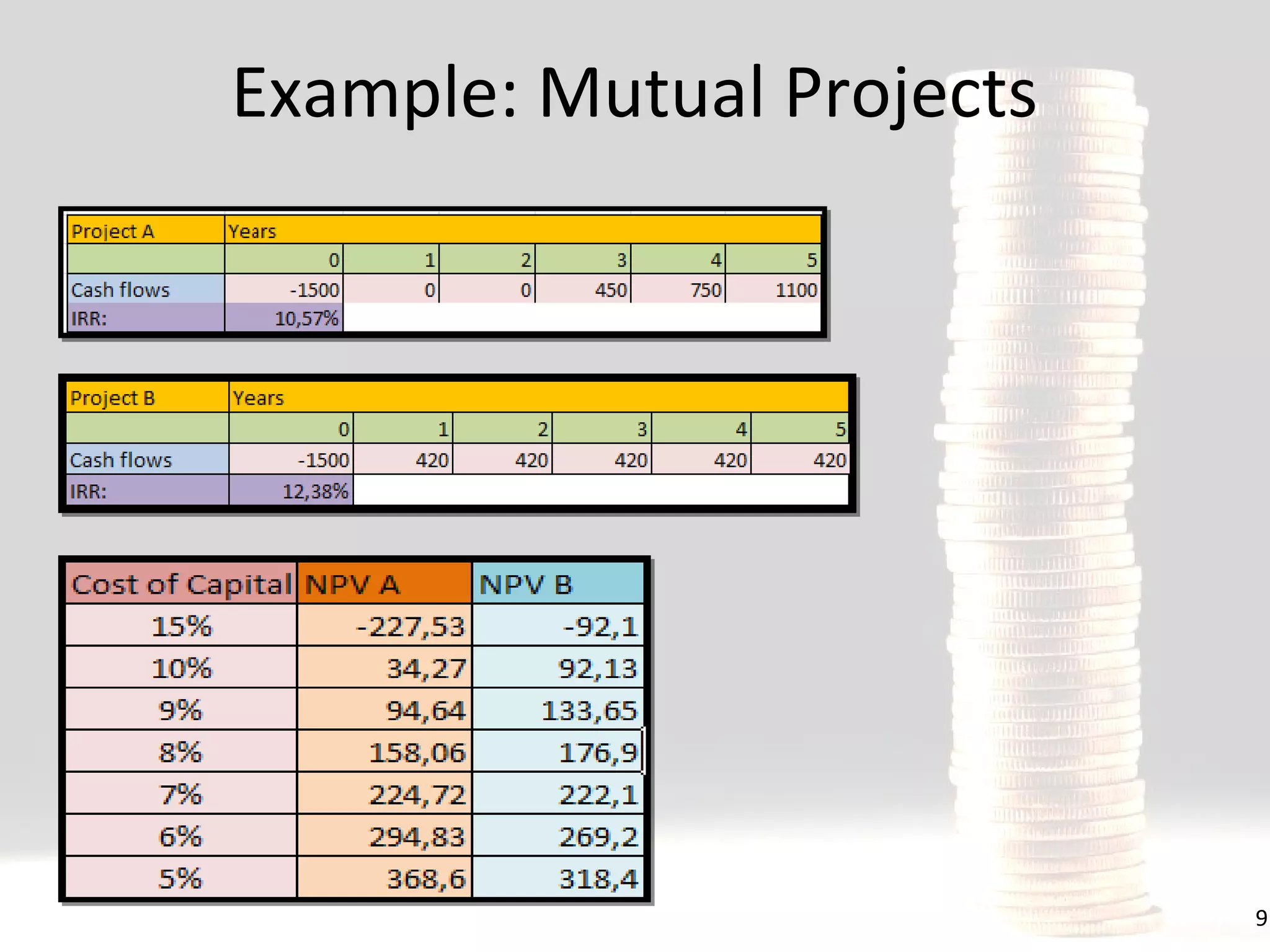

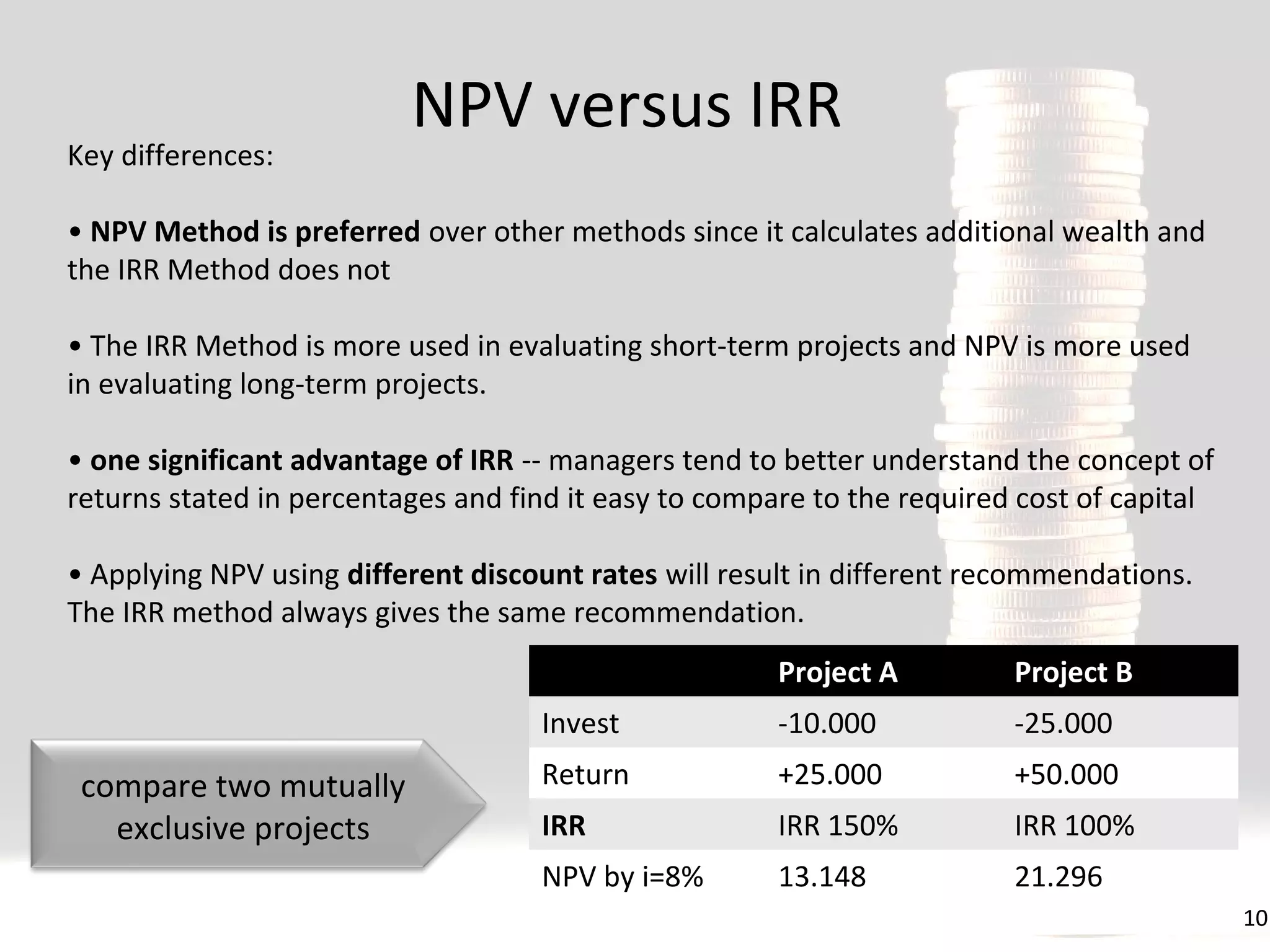

This document discusses two key measures for evaluating projects: net present value (NPV) and internal rate of return (IRR). It defines NPV as the difference between the present value of future cash flows from an investment and the initial investment amount. IRR is defined as the discount rate that results in an NPV of zero. The document provides examples of calculating NPV and IRR for projects and outlines the decision rules for accepting or rejecting projects based on whether their NPV is positive or negative and whether their IRR exceeds the cost of capital. It notes that while NPV and IRR typically provide the same decision, there are some exceptions like projects with non-conventional cash flows or mutually exclusive projects.