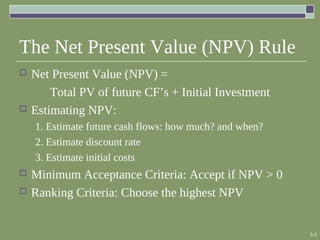

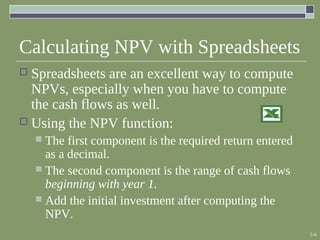

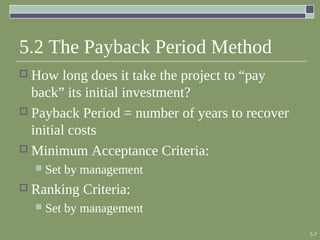

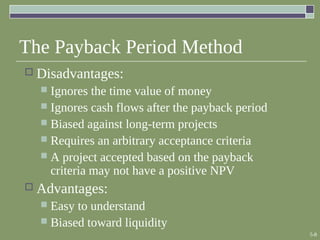

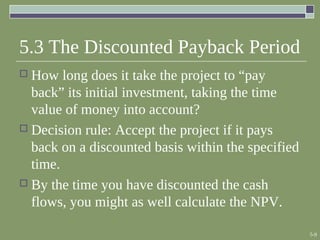

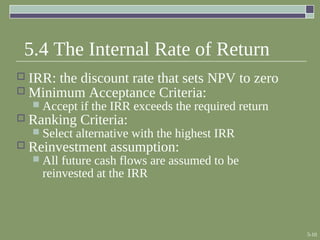

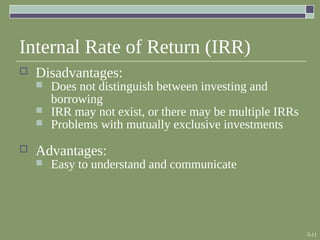

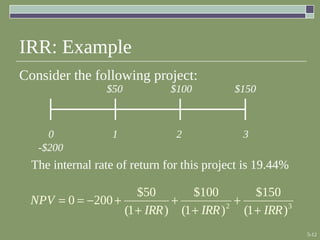

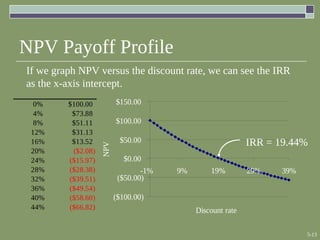

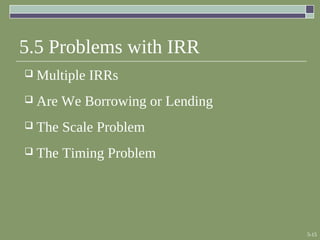

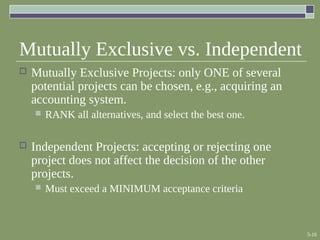

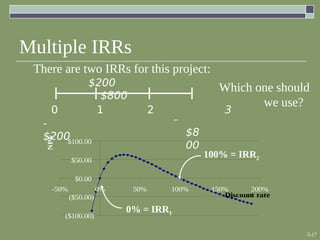

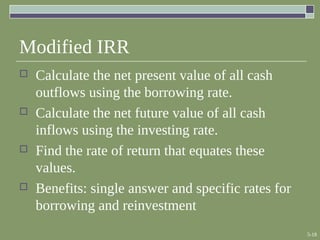

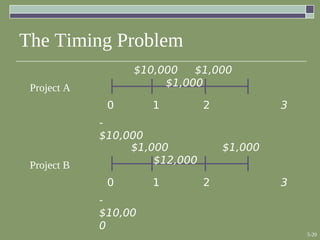

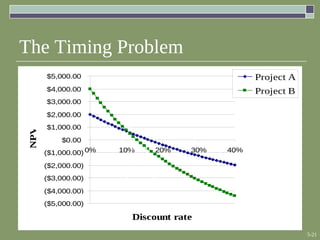

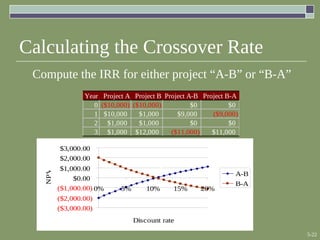

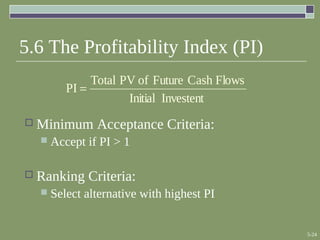

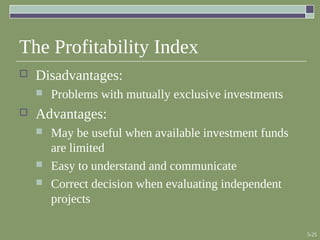

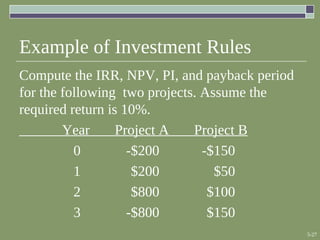

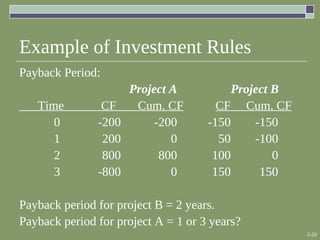

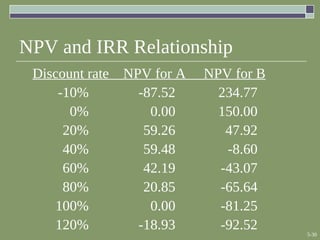

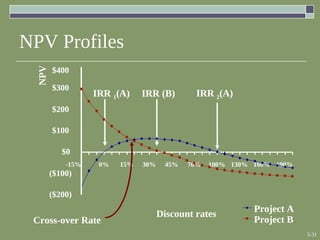

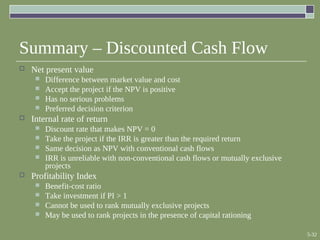

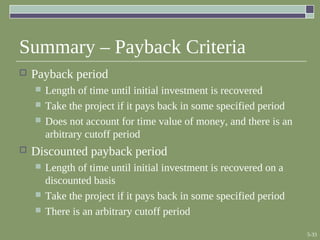

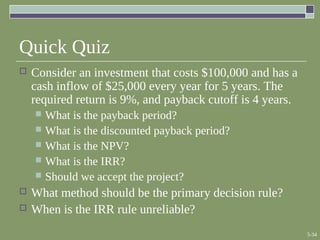

This chapter discusses various capital budgeting techniques for evaluating investment projects, including net present value (NPV), internal rate of return (IRR), payback period, and profitability index. It recommends using NPV as the primary decision rule, as NPV accounts for the time value of money and considers all cash flows. IRR can produce incorrect decisions for projects with multiple IRRs, differing scales of investments, or non-standard cash flow timing. Payback period ignores the time value of money.