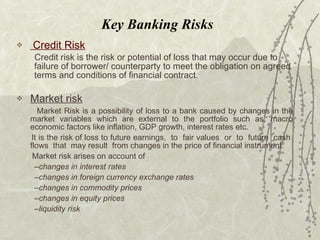

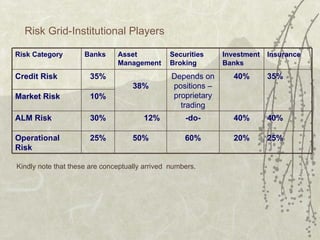

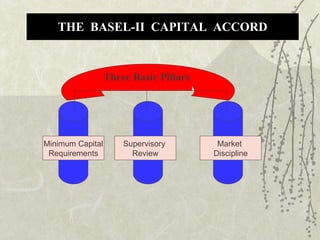

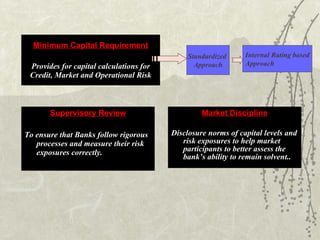

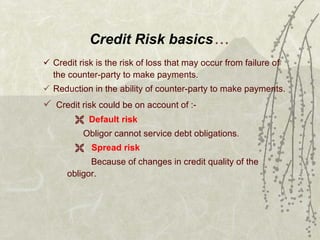

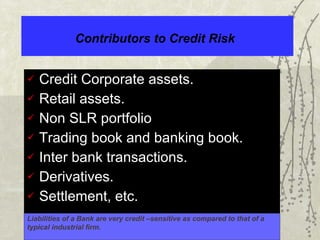

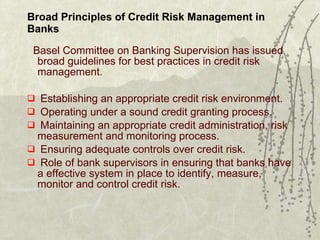

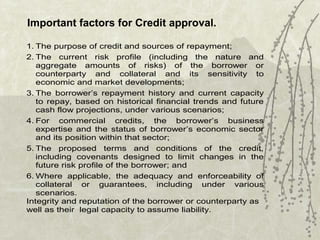

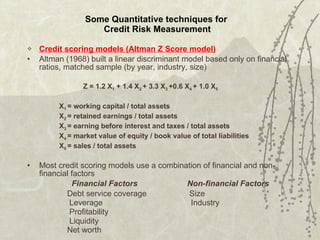

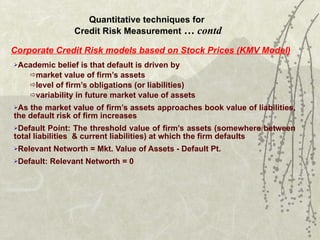

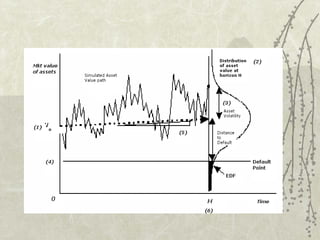

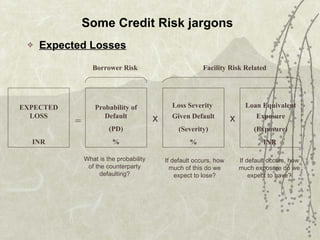

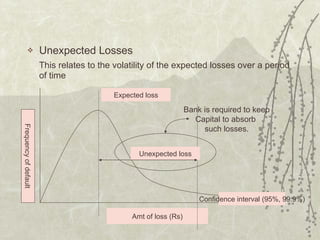

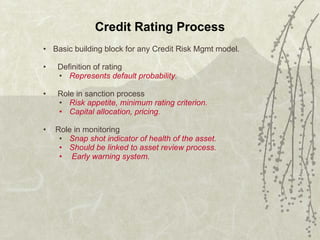

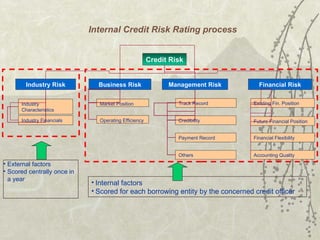

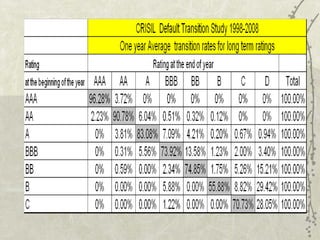

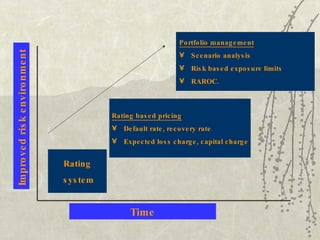

This document provides an overview of credit risk management practices from a banker's perspective. It discusses the key types of banking risks including credit, market, and operational risk. It describes credit risk measurement techniques such as credit scoring models and models based on stock prices. It also outlines the importance of internal credit risk rating processes and how rating systems can be used for risk-based pricing, portfolio management, and capital allocation. Finally, it discusses lessons learned from bank failures during the financial crisis, including the need for effective liquidity and balance sheet management and stress testing.