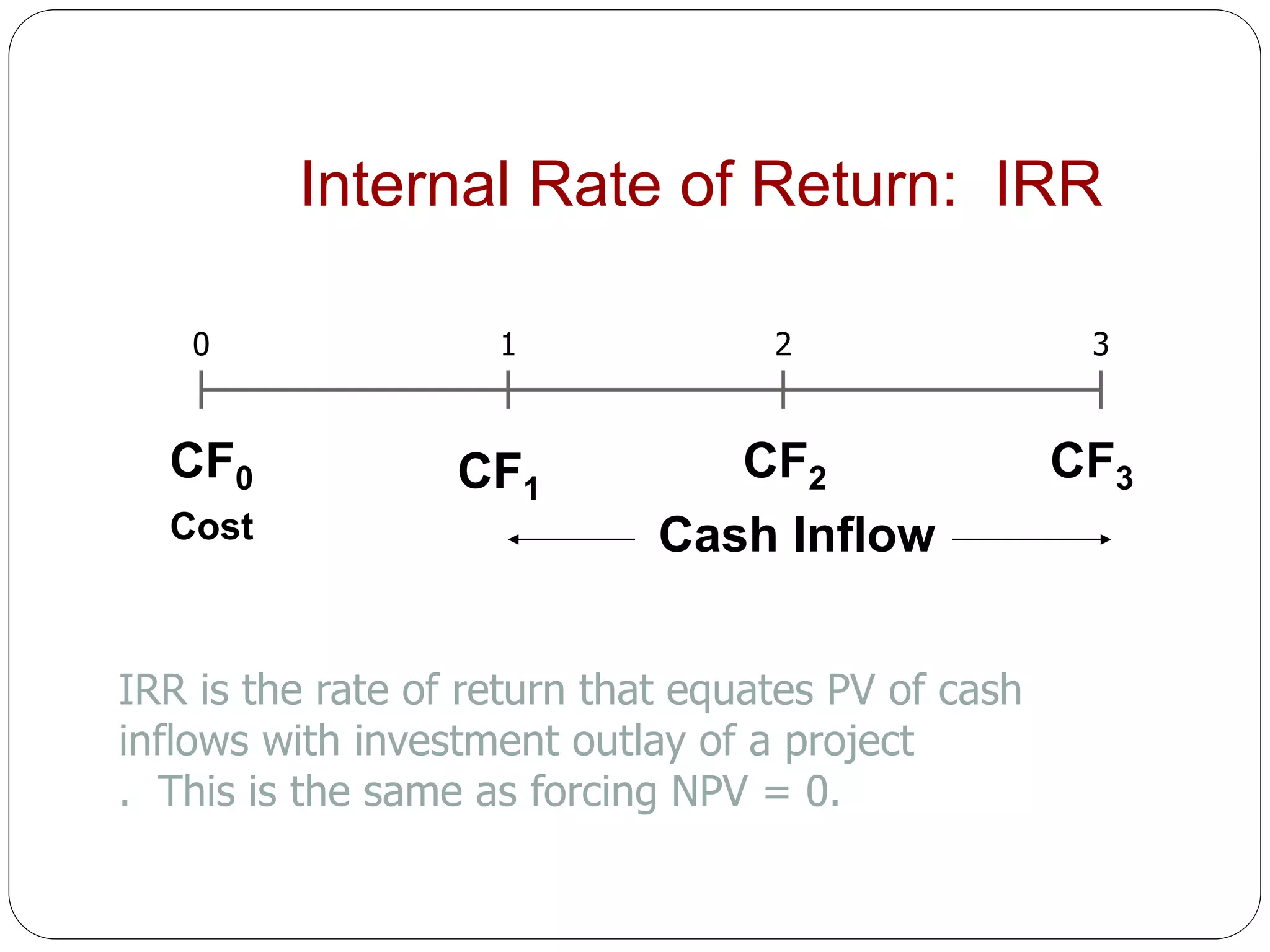

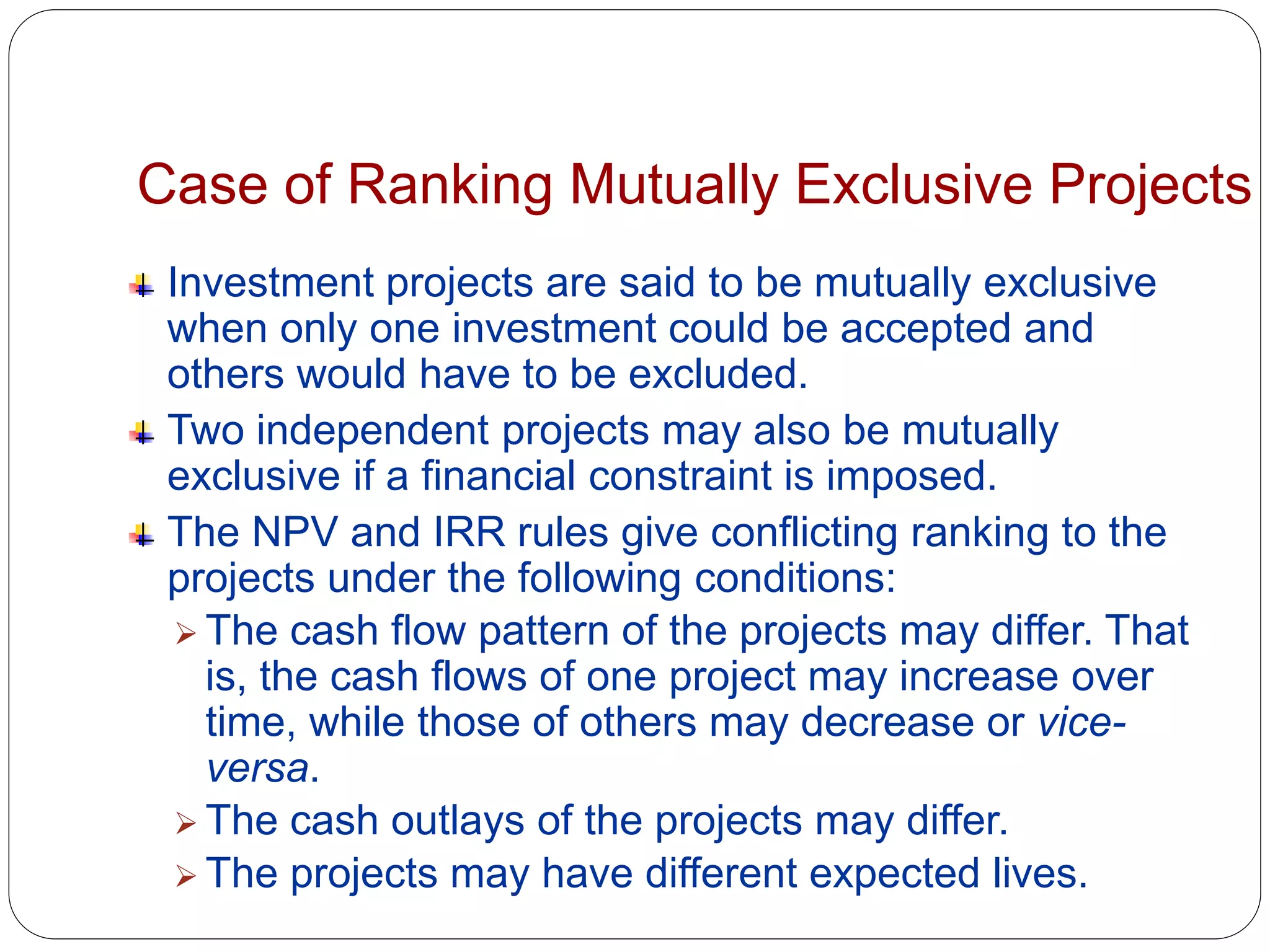

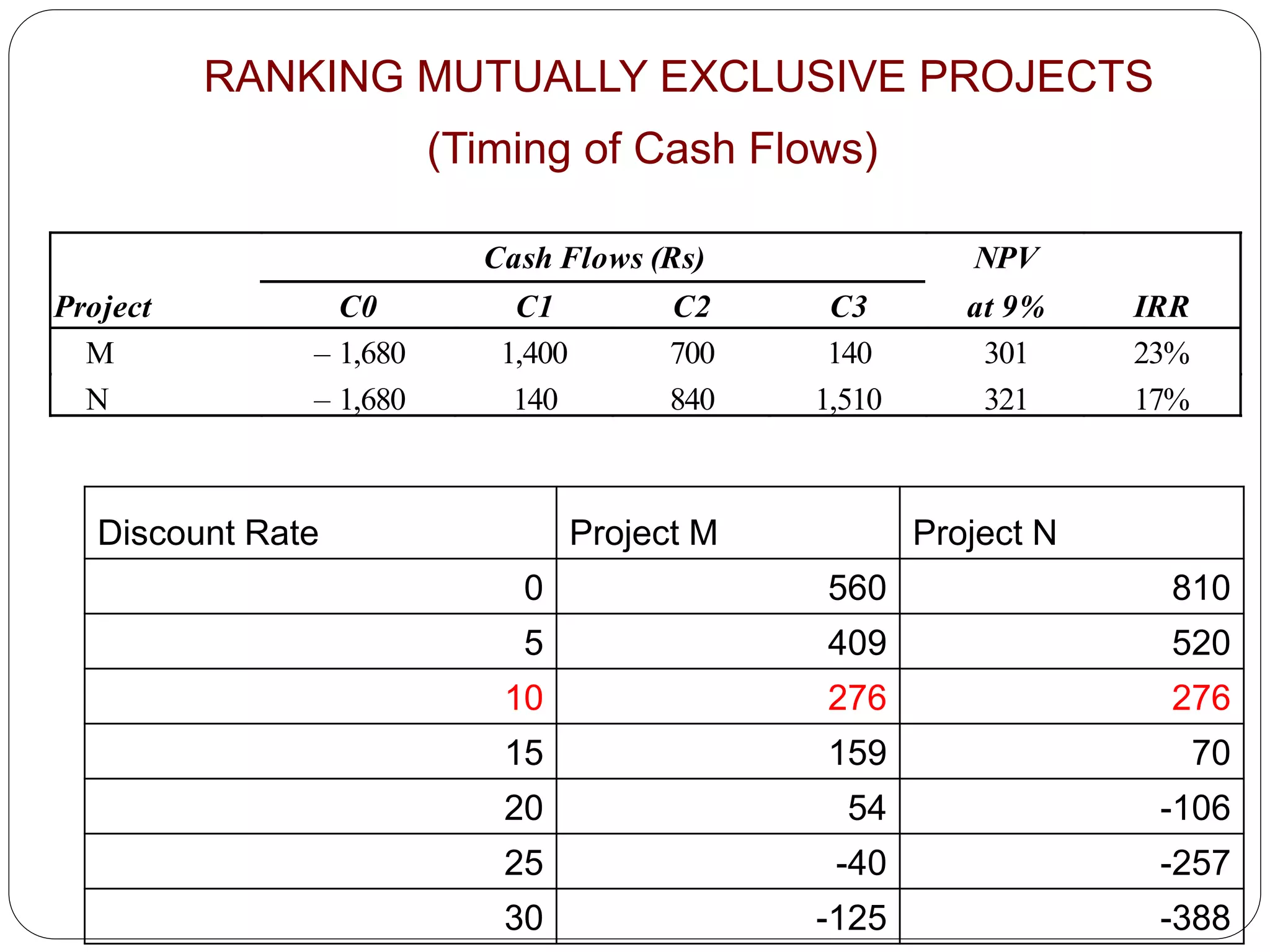

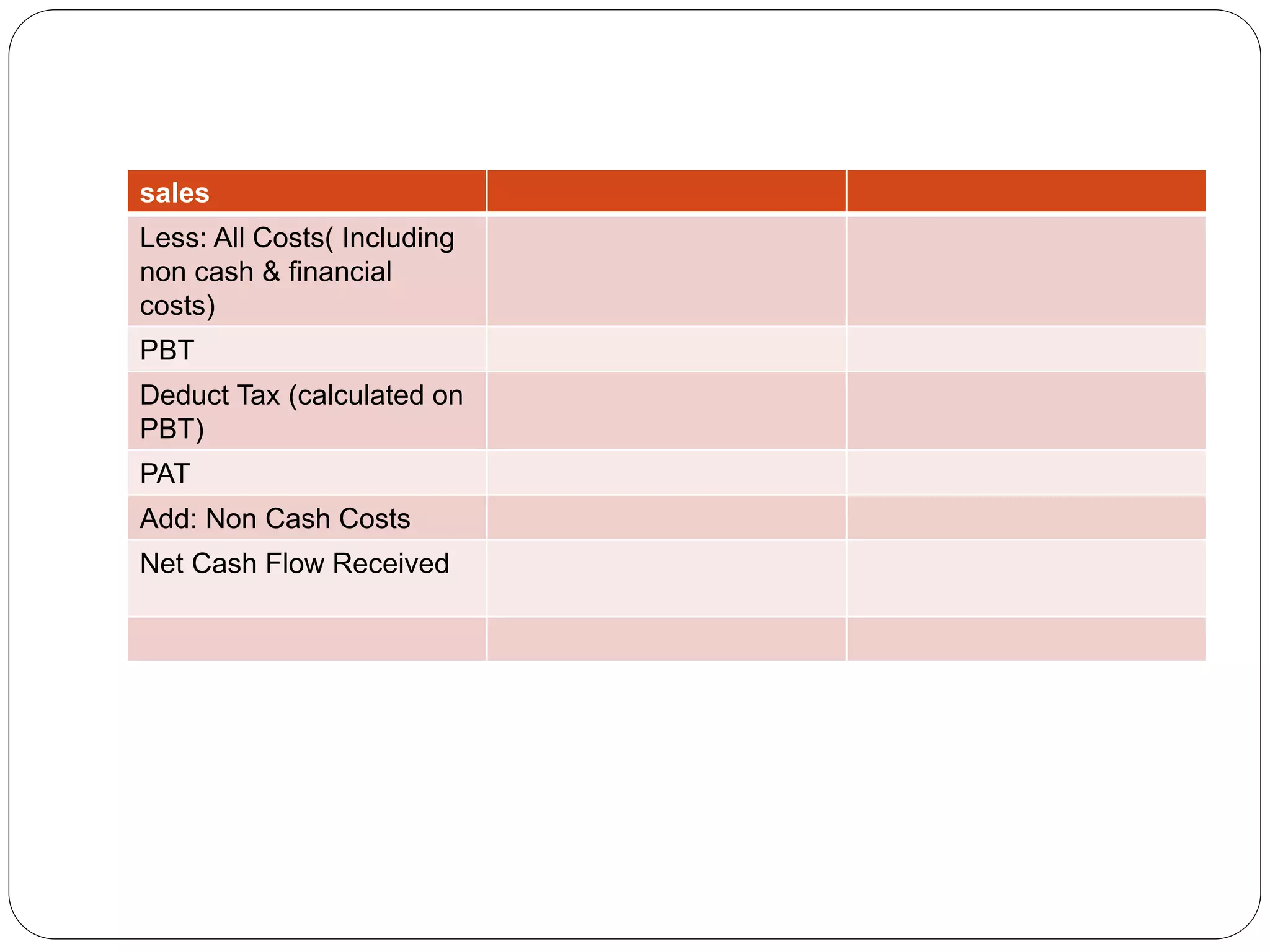

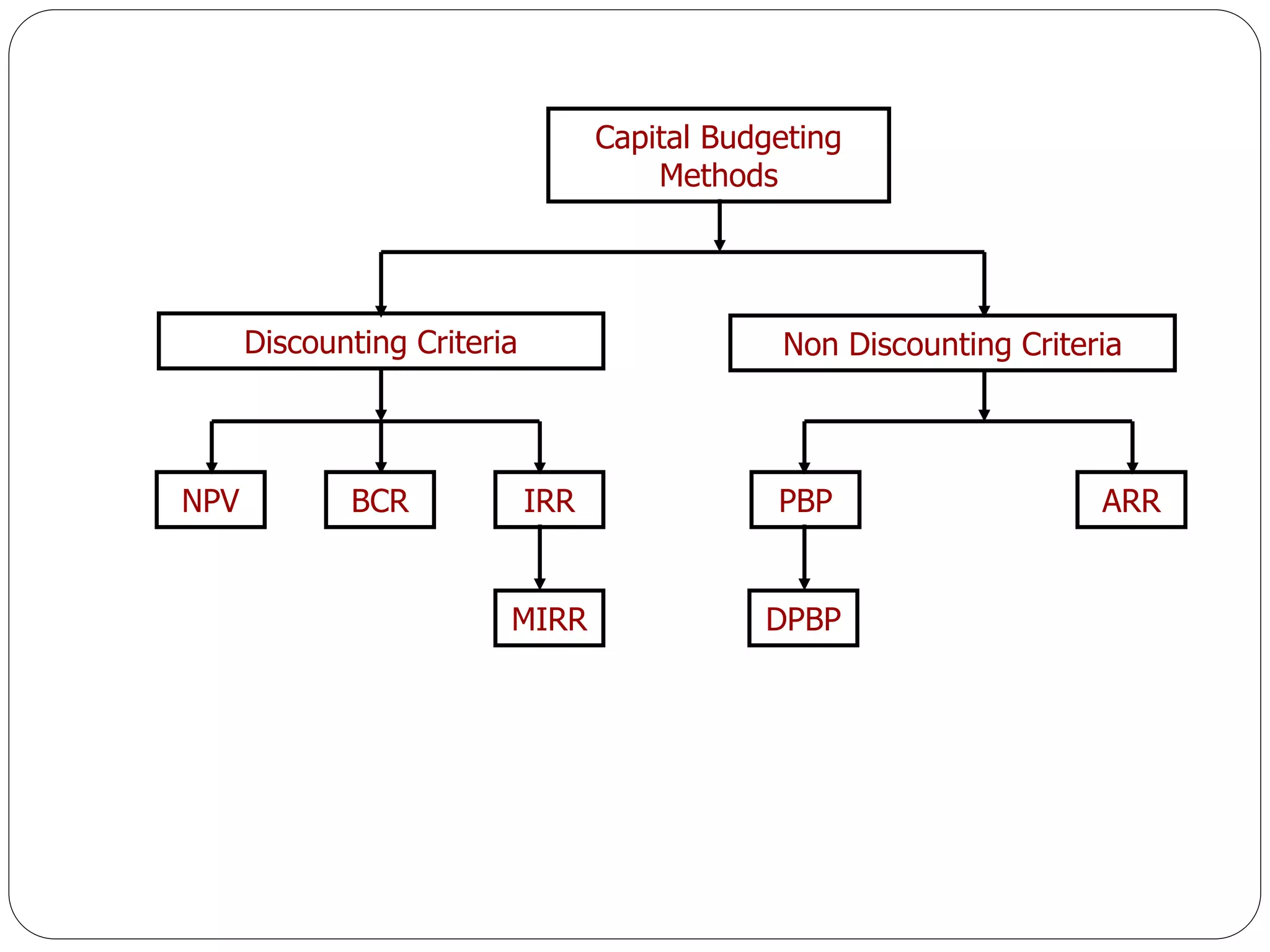

The document discusses capital budgeting decisions, focusing on how firms evaluate long-term investment options such as expansion and replacement of assets. It outlines various methods for assessing these investments, including Net Present Value (NPV), Benefit-Cost Ratio (BCR), Internal Rate of Return (IRR), and the Payback Period, while highlighting their advantages and disadvantages. Additionally, it emphasizes the importance of considering cash flow patterns and the time value of money in making informed investment choices.

![CALCULATING NET PRESENT VALUE

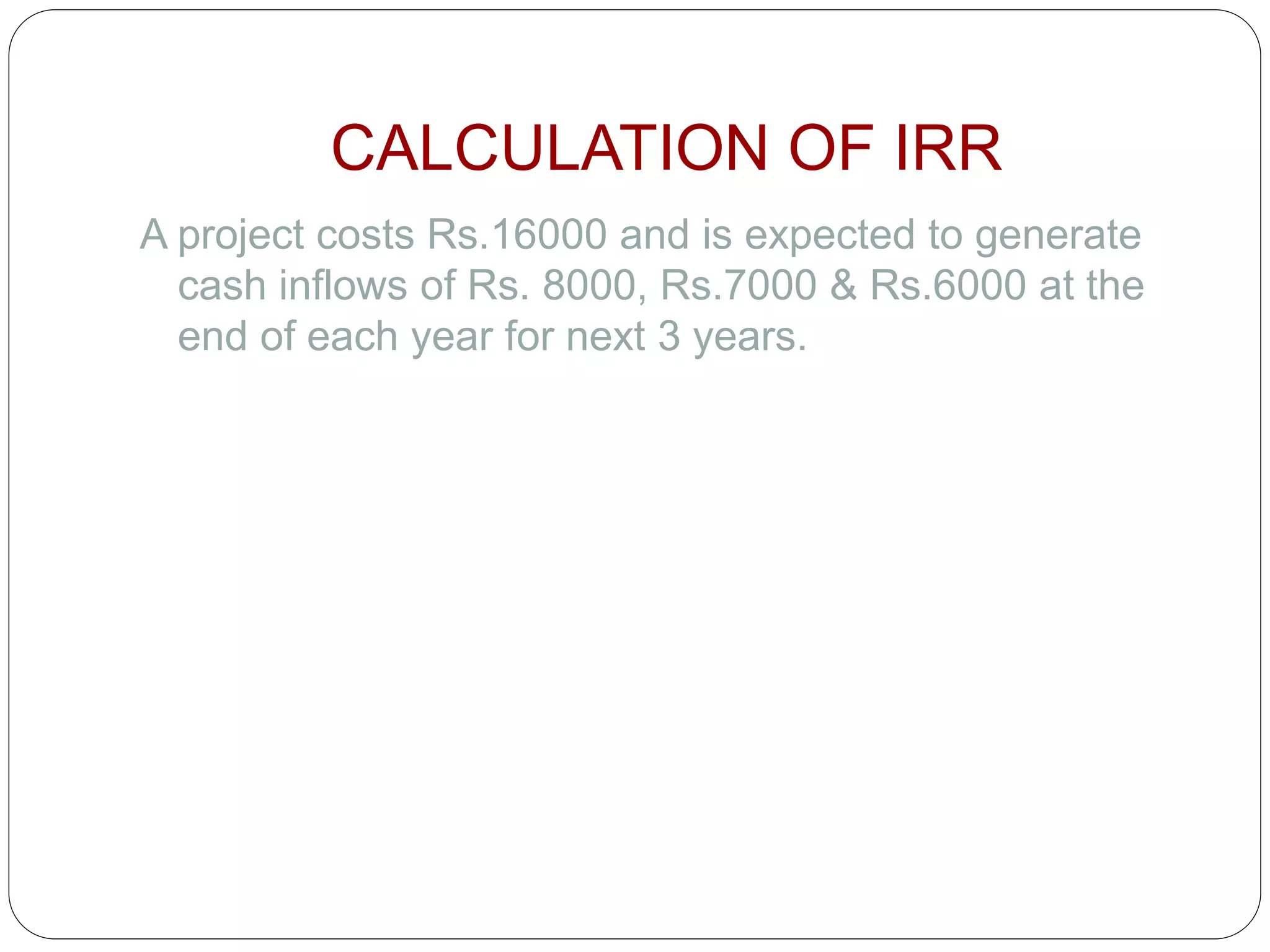

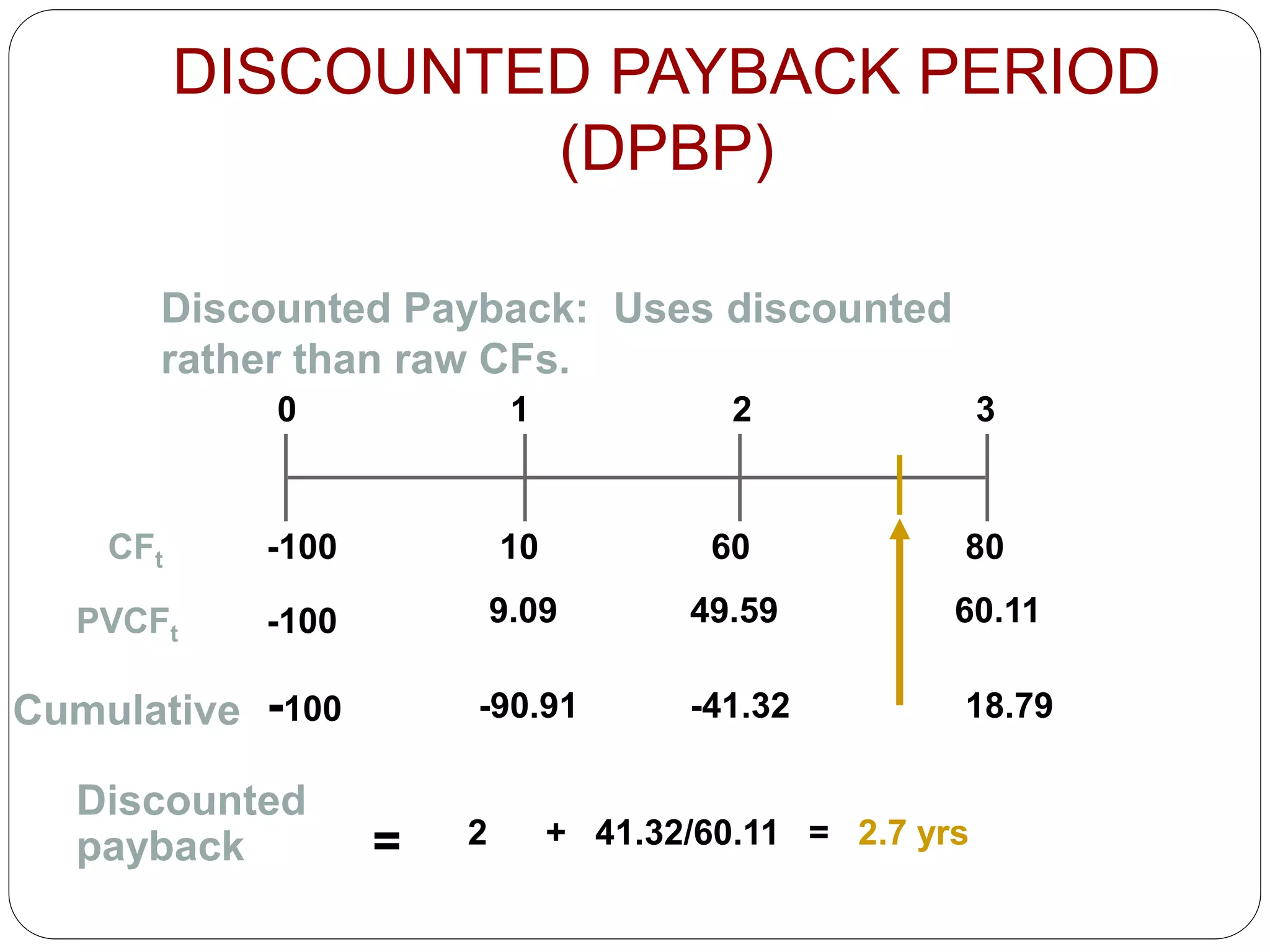

Assume that Project X costs Rs 2,500 now and is

expected to generate year-end cash inflows of Rs

900, Rs 800, Rs 700, Rs 600 and Rs 500 in years 1

through 5. The opportunity cost of the capital may be

assumed to be 10 per cent.

2 3 4 5

1, 0.10 2, 0.10 3, 0.10

4, 0.10 5, 0.

Rs 900 Rs 800 Rs 700 Rs 600 Rs 500

NPV Rs 2,500

(1+0.10) (1+0.10) (1+0.10) (1+0.10) (1+0.10)

NPV [Rs 900(PVF ) + Rs 800(PVF ) + Rs 700(PVF )

+ Rs 600(PVF ) + Rs 500(PVF

10)] Rs 2,500

NPV [Rs 900 0.909 + Rs 800 0.826 + Rs 700 0.751 + Rs 600 0.683

+ Rs 500 0.620] Rs 2,500

NPV Rs 2,725 Rs 2,500 = + Rs 225

](https://image.slidesharecdn.com/capitalbudgetingdecisions-230613063702-508dafeb/75/CAPITAL-BUDGETING-DECISIONS-ppt-11-2048.jpg)