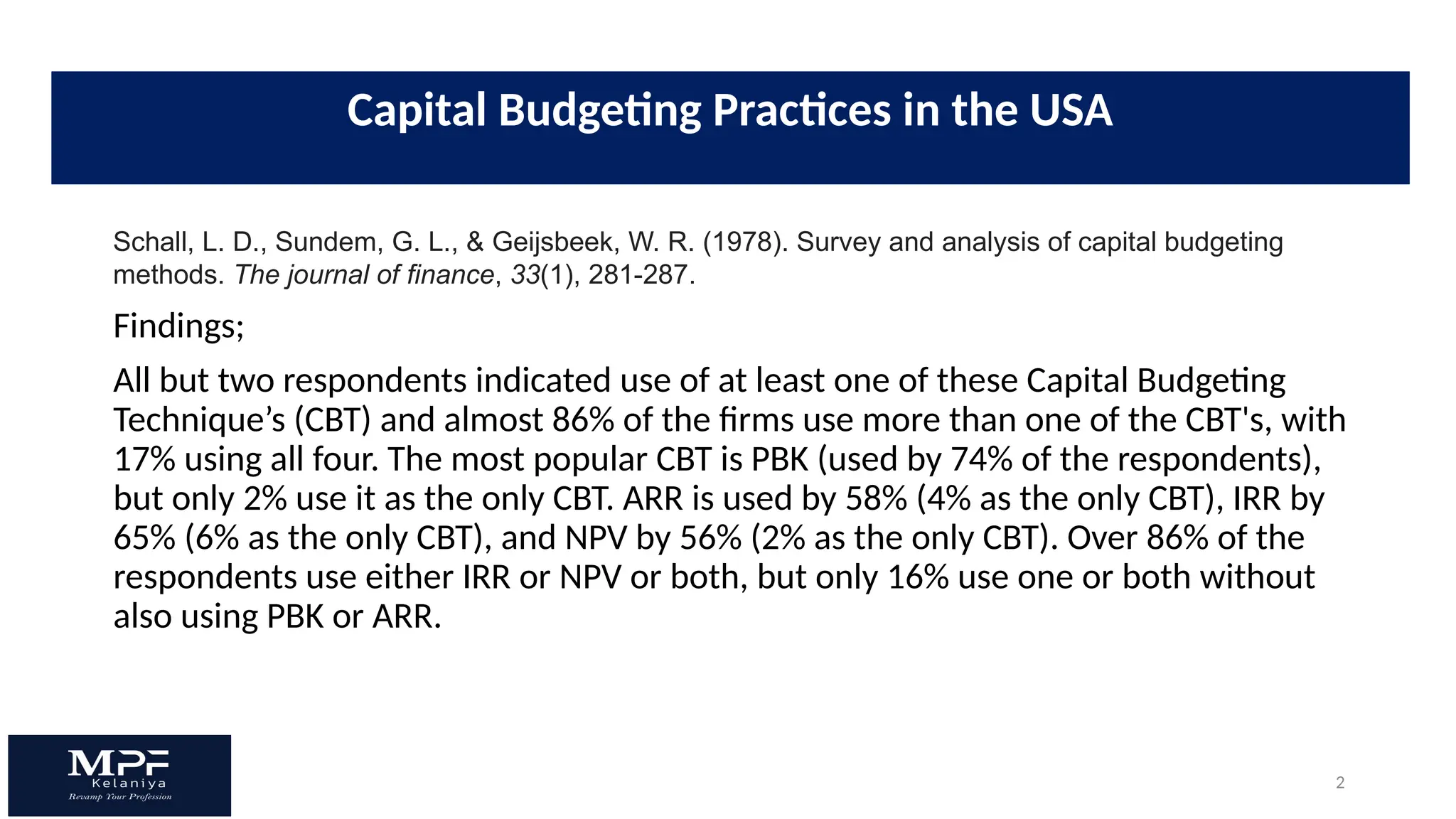

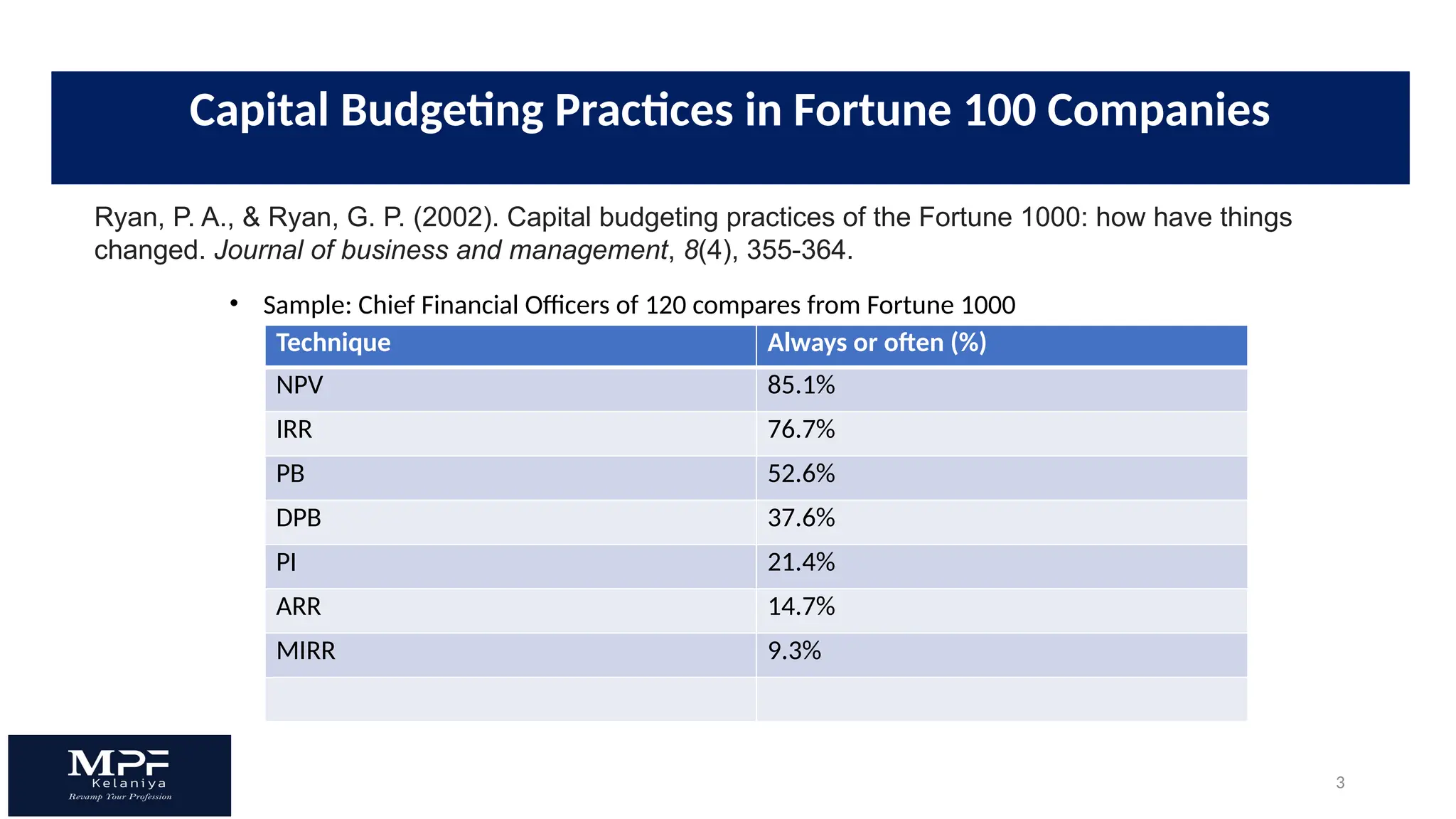

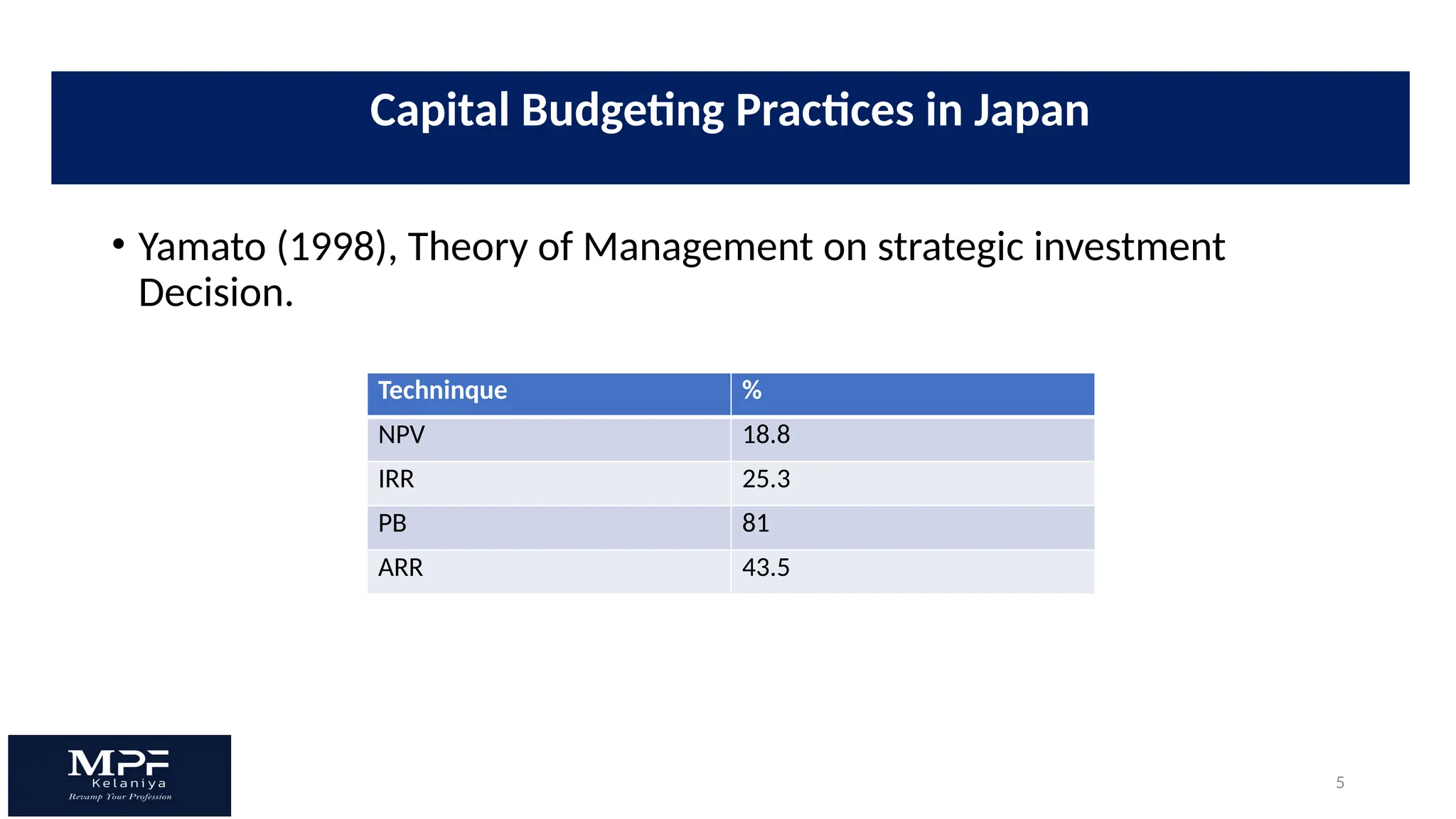

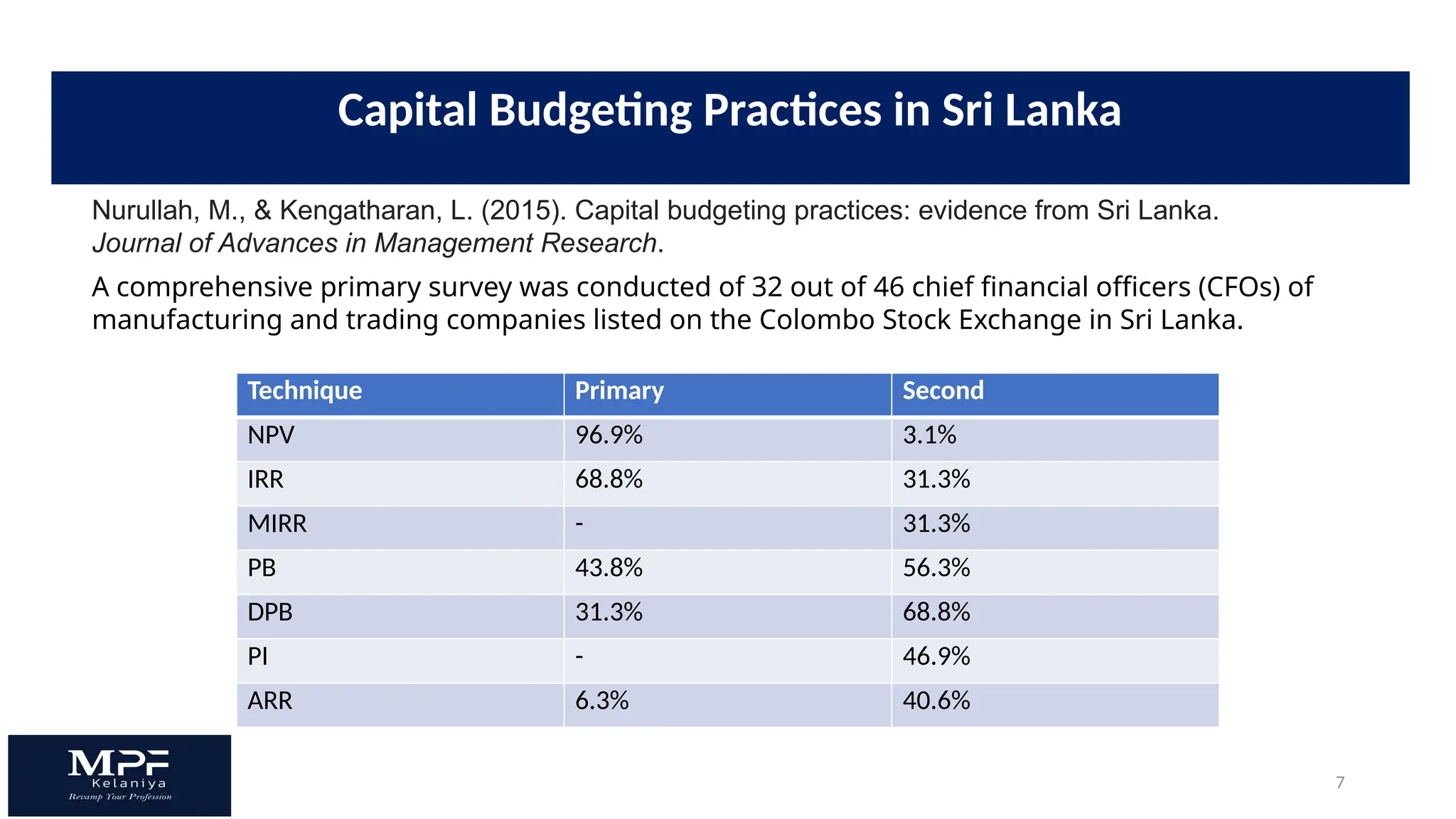

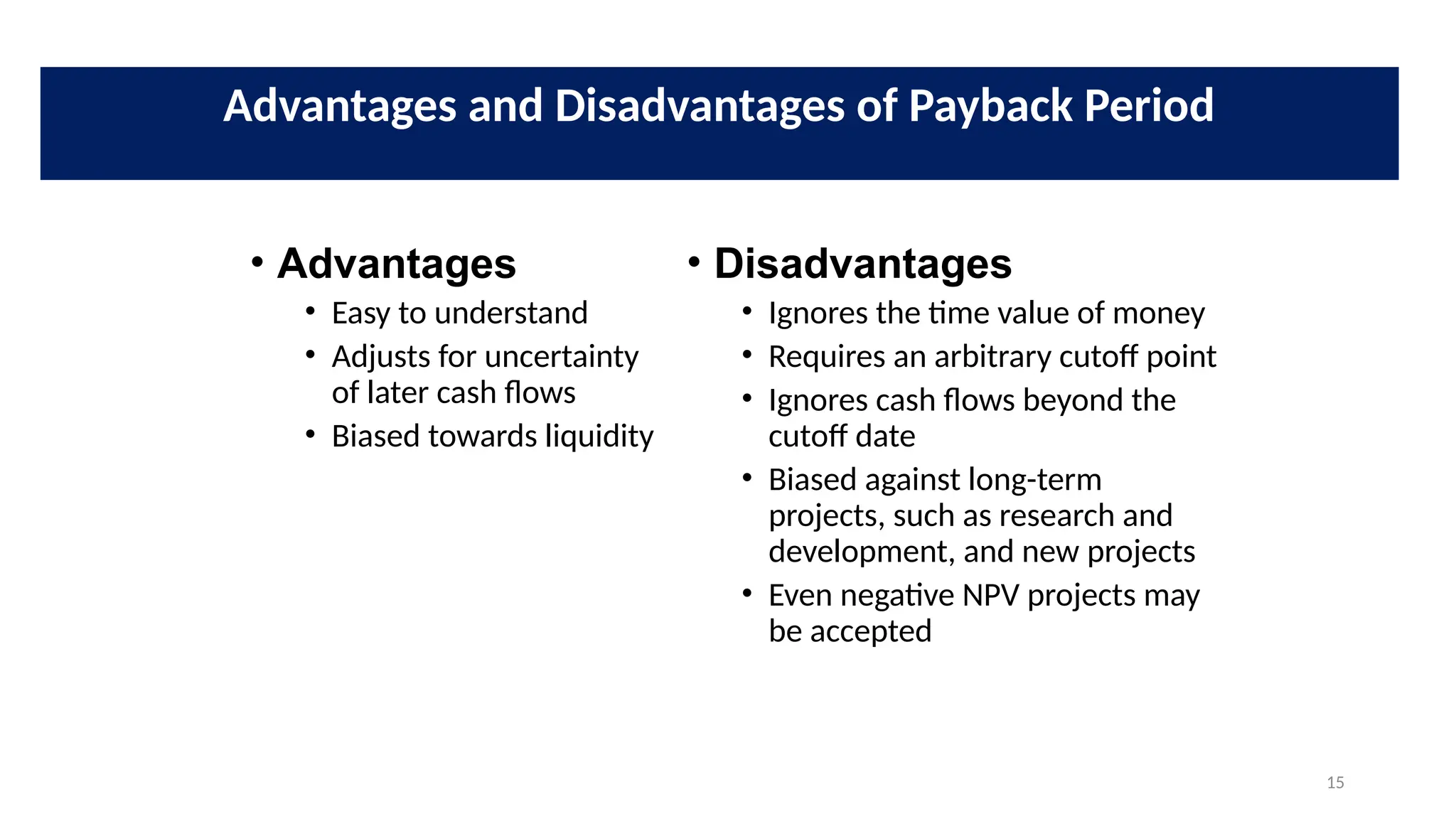

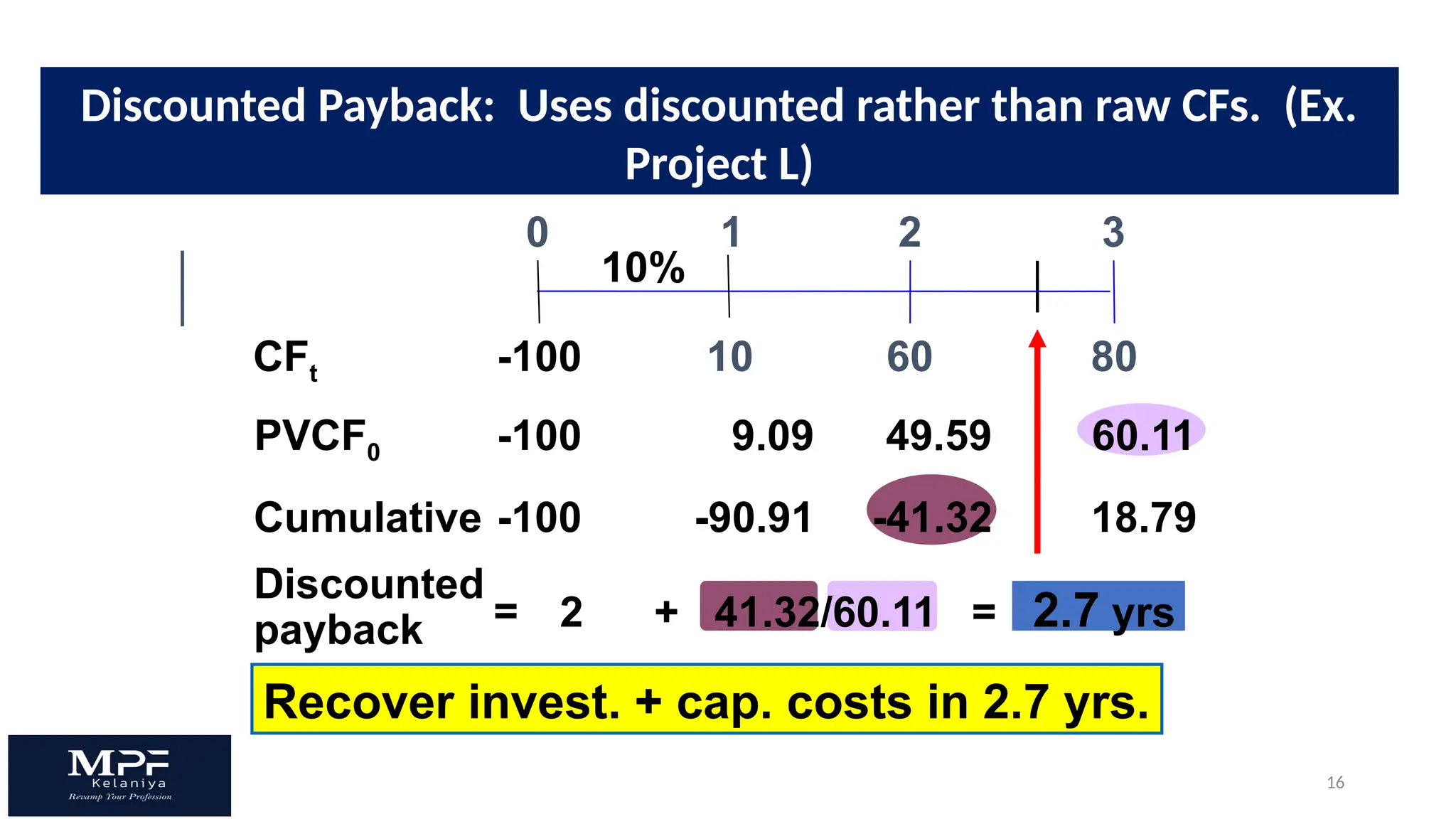

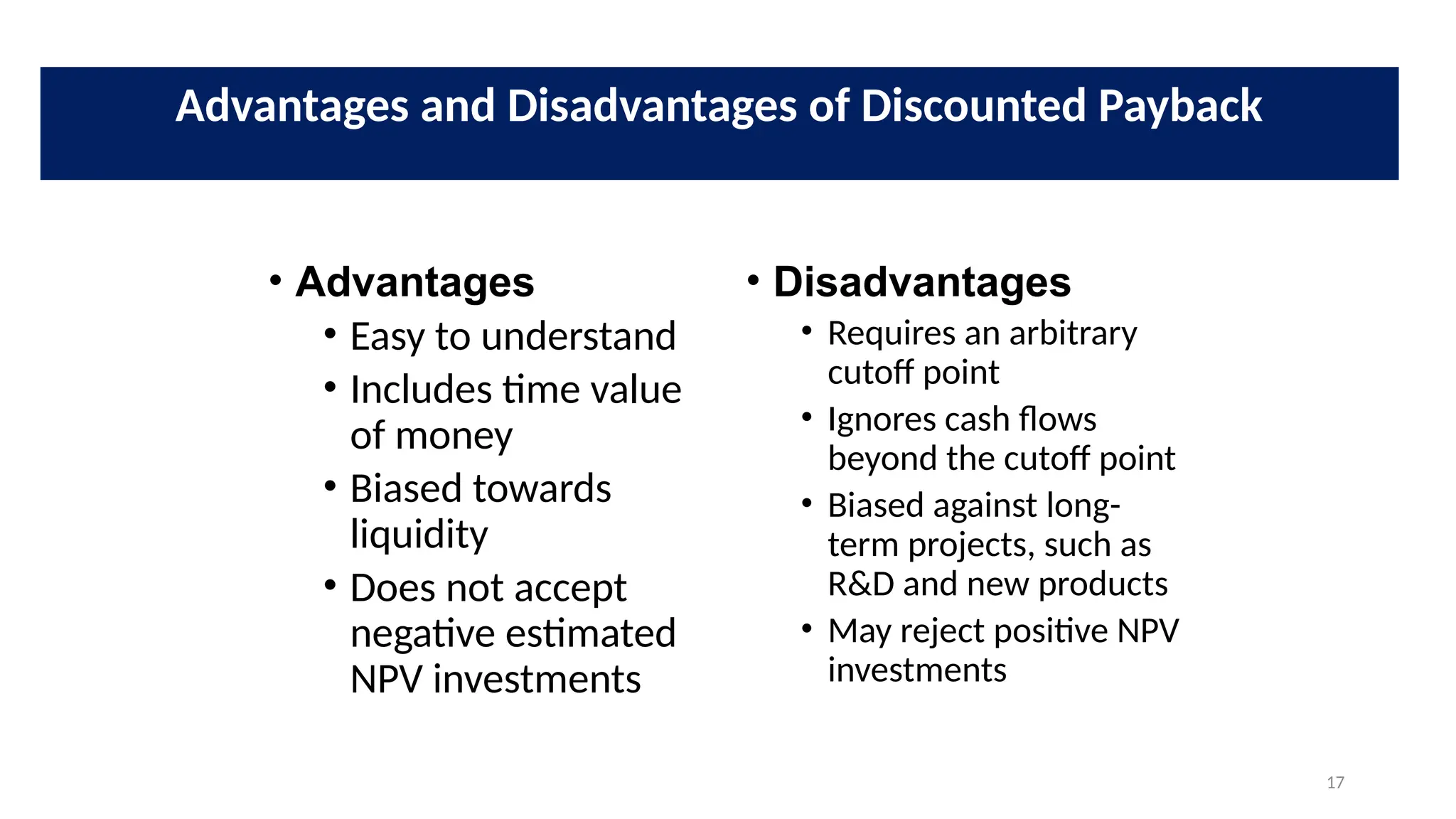

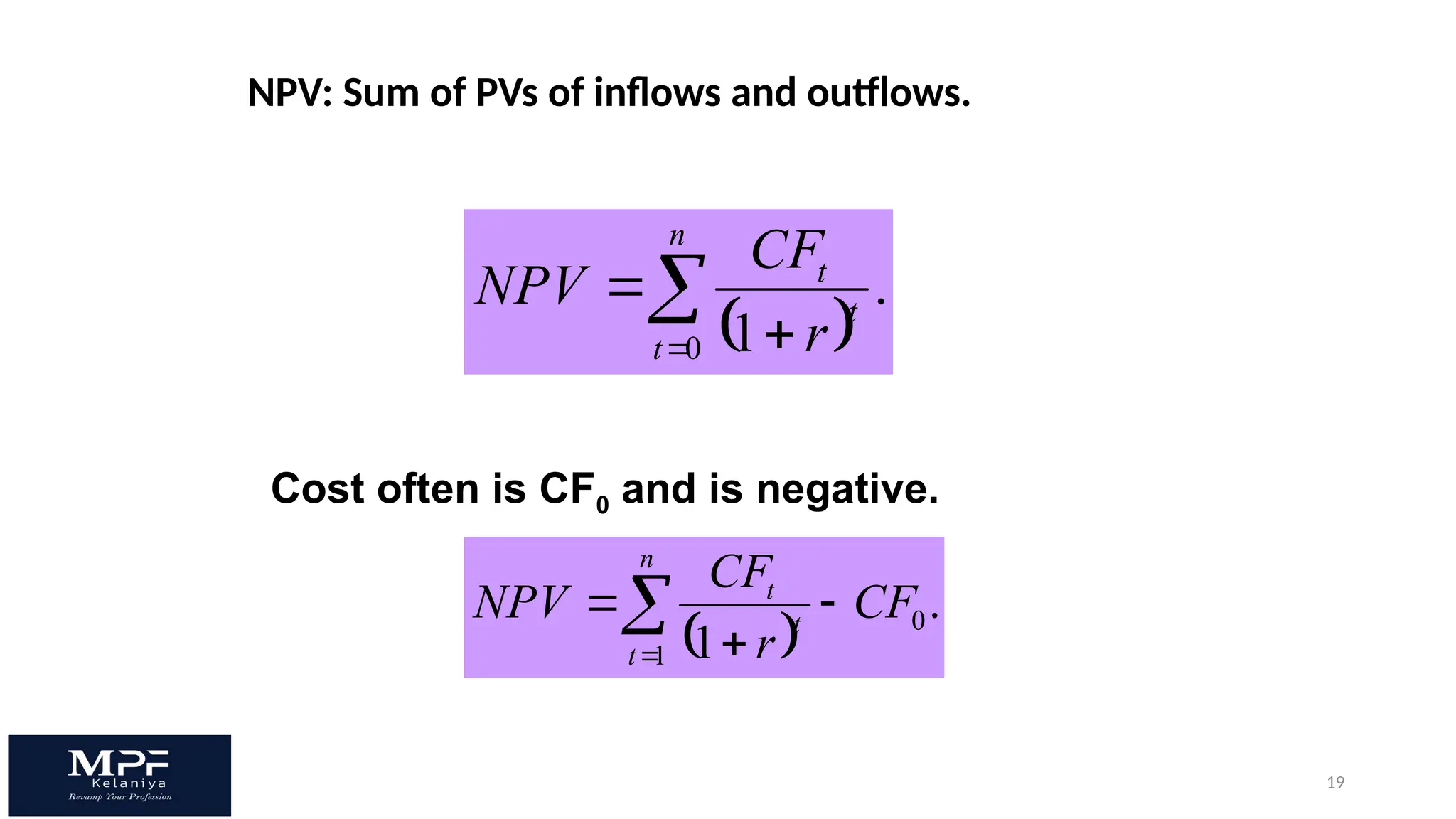

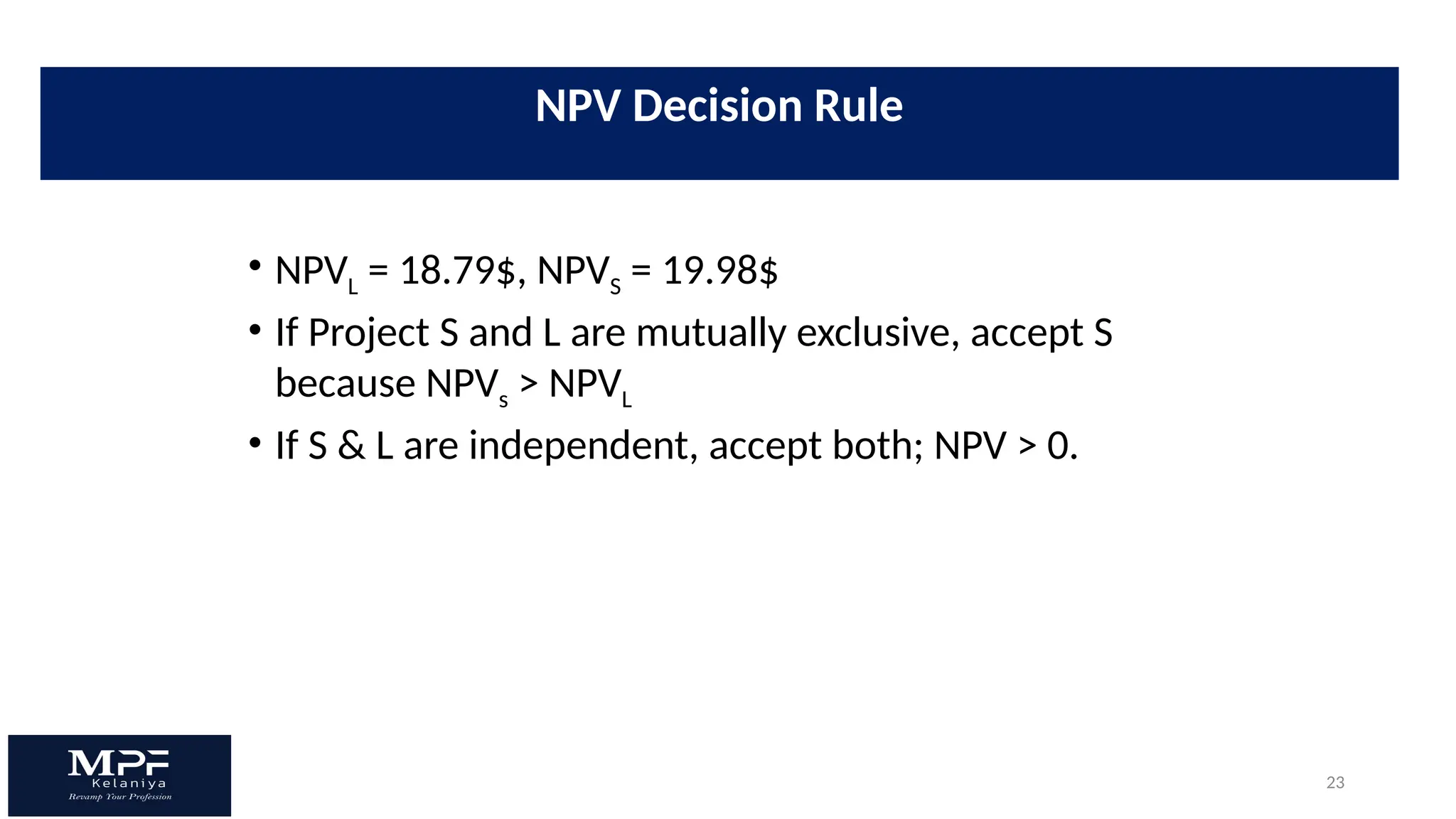

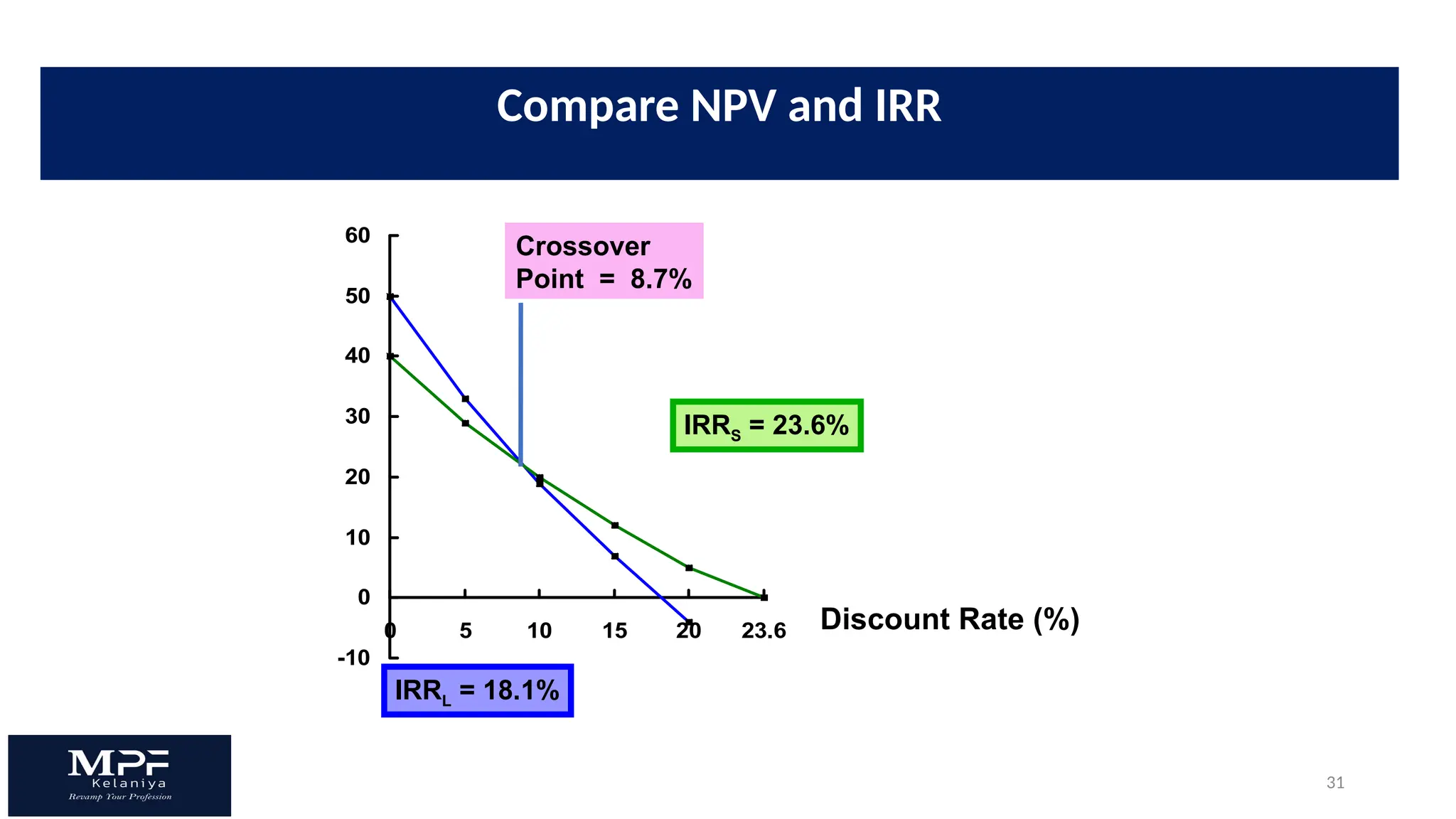

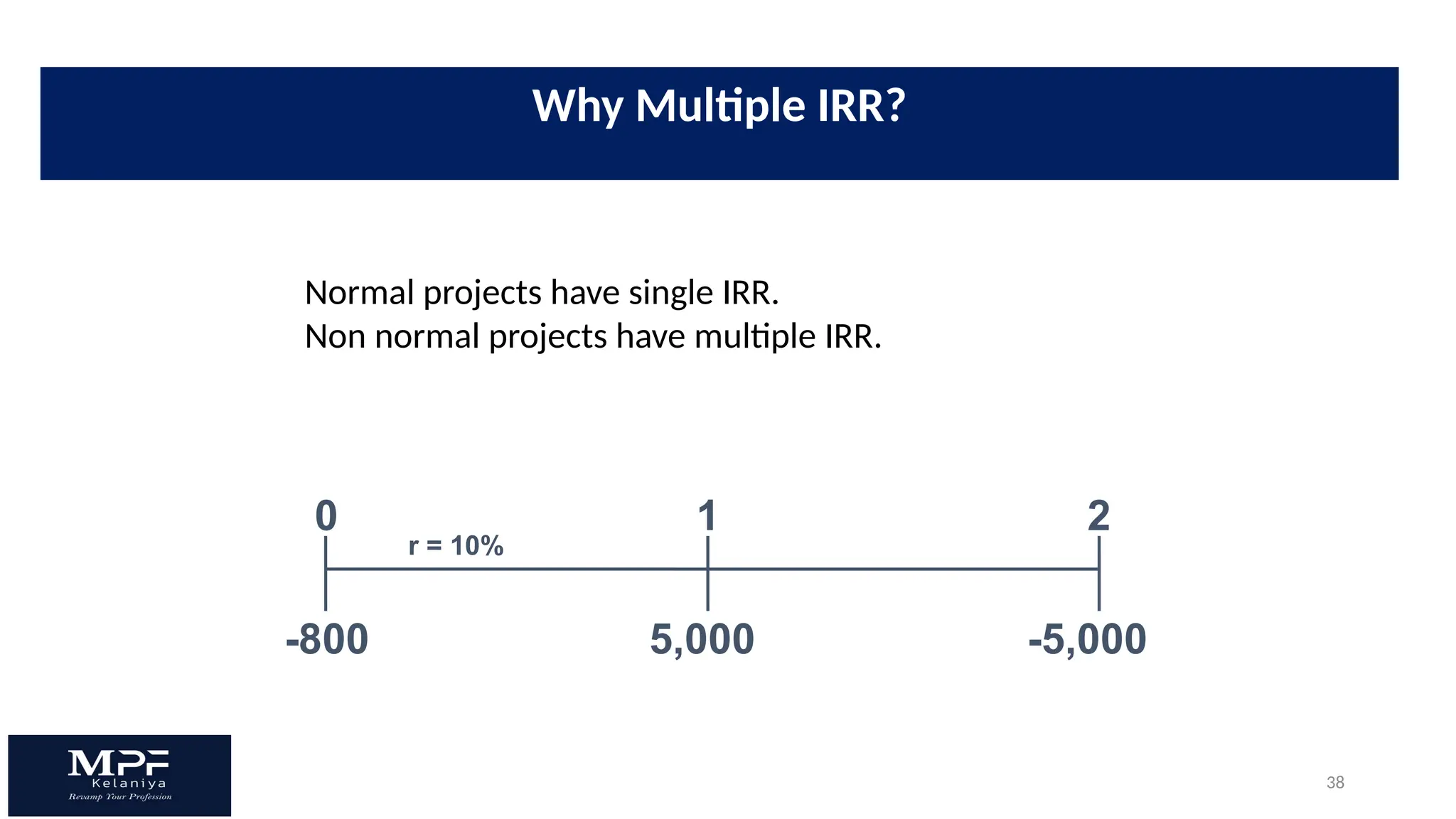

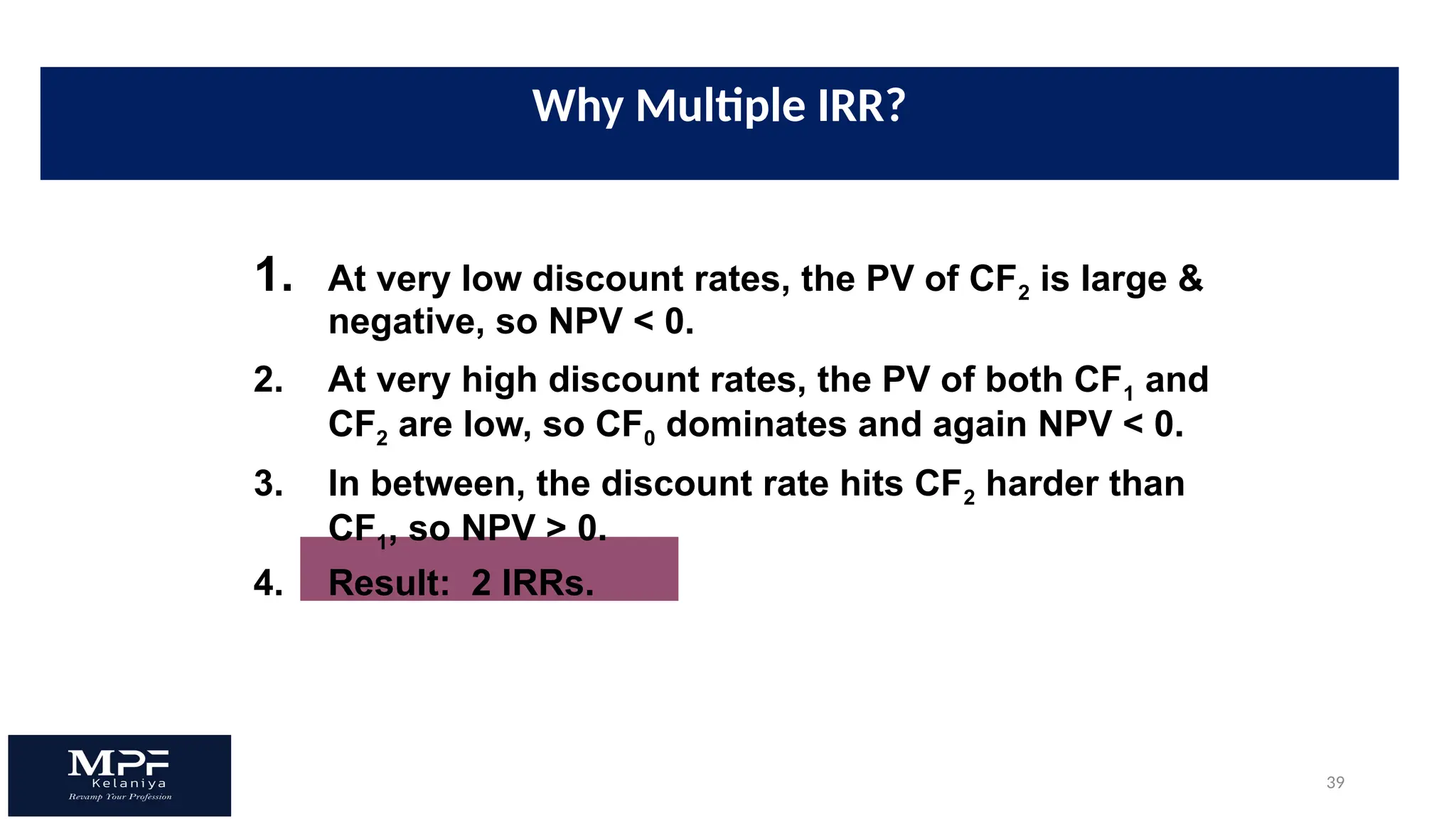

The document discusses capital budgeting practices in different countries, highlighting the usage of various techniques such as NPV, IRR, and ARR among firms. A majority of respondents utilize multiple techniques, with NPV and IRR being the most favored in corporate finance decision-making. It also details the advantages and disadvantages of different capital budgeting methods and emphasizes the importance of sound investment evaluation criteria.