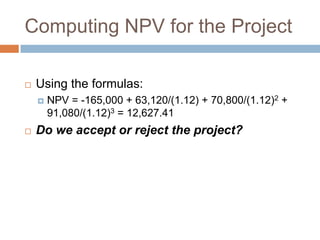

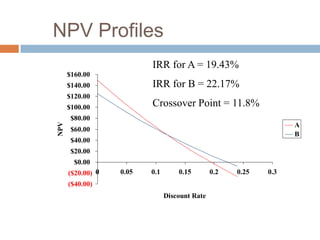

The document discusses net present value (NPV), outlining its calculation and significance in investment decision-making, where a positive NPV indicates value creation. It compares NPV to other measures like payback period, discounted payback period, internal rate of return (IRR), and profitability index, and highlights the decision rules for project acceptance. Additionally, it notes the preference for NPV over IRR in cases of conflicting results, especially for mutually exclusive projects.