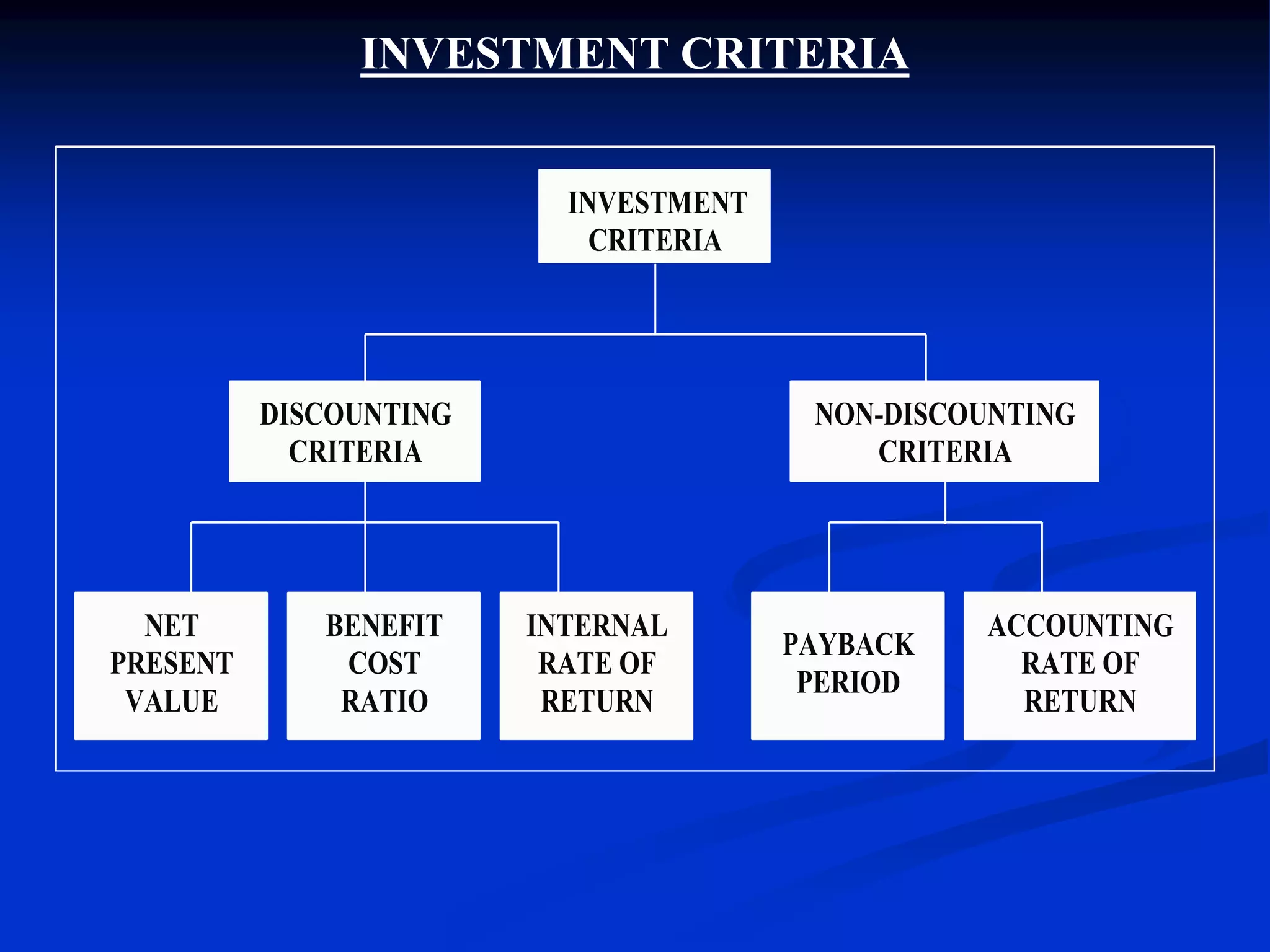

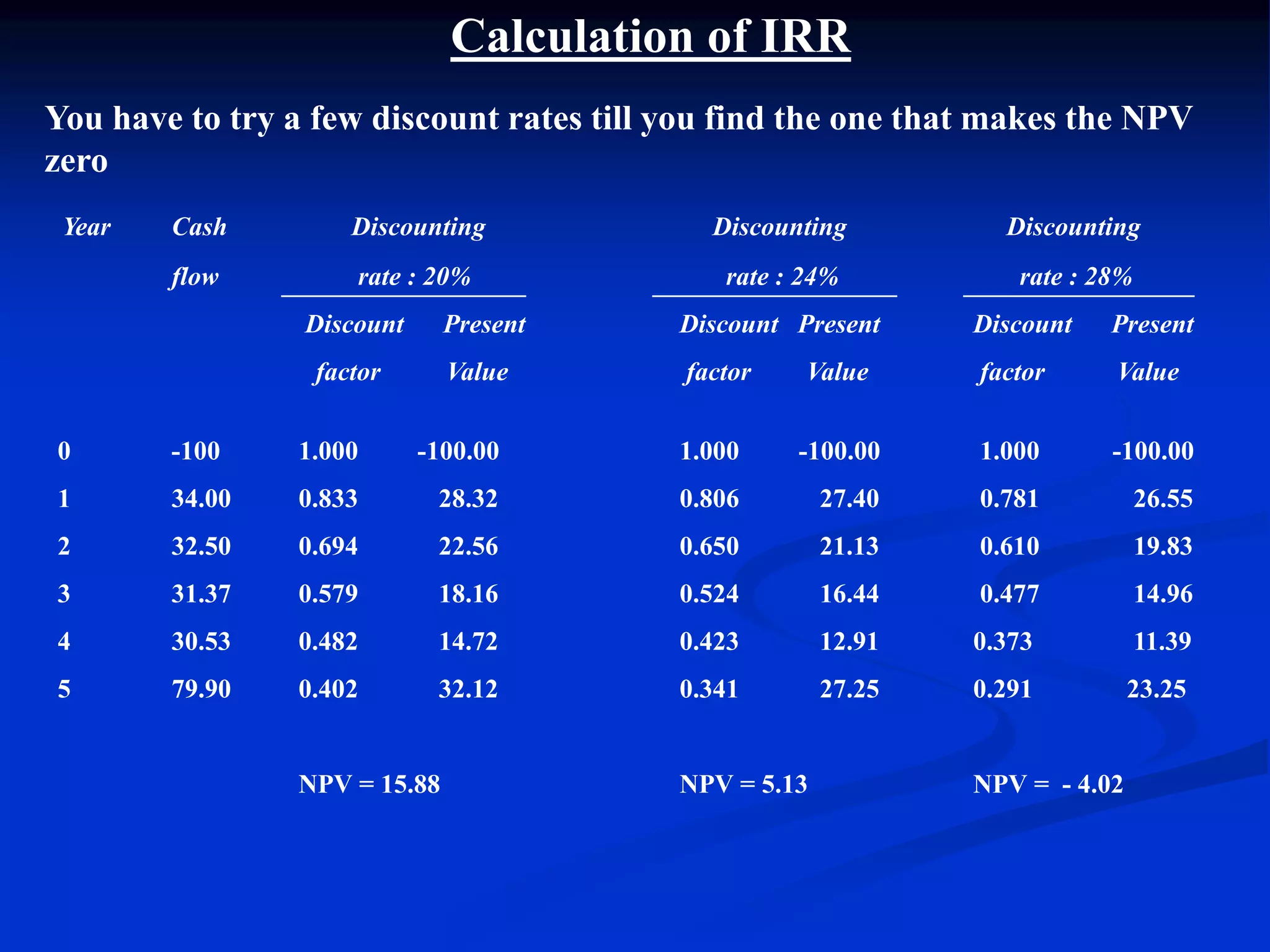

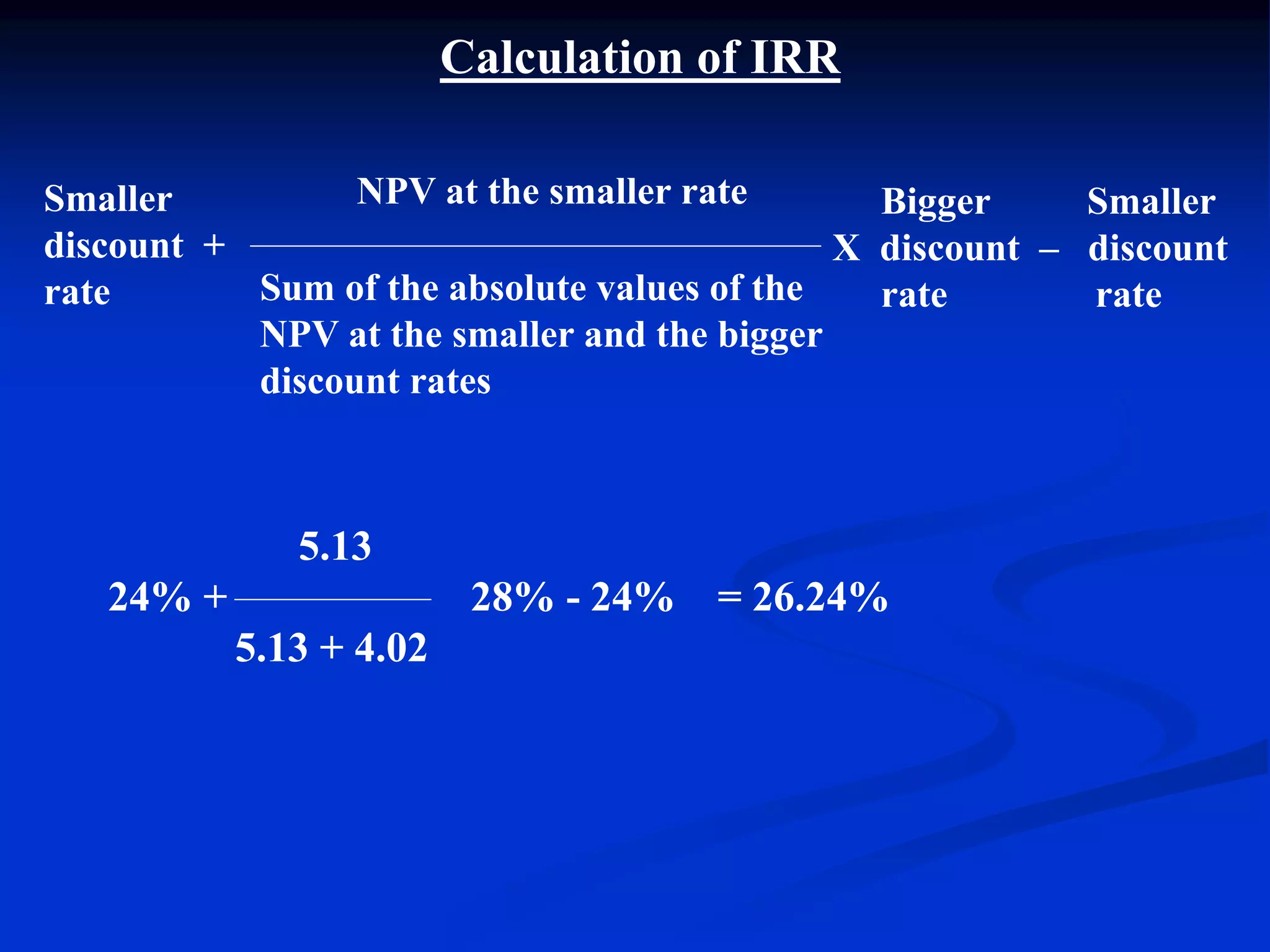

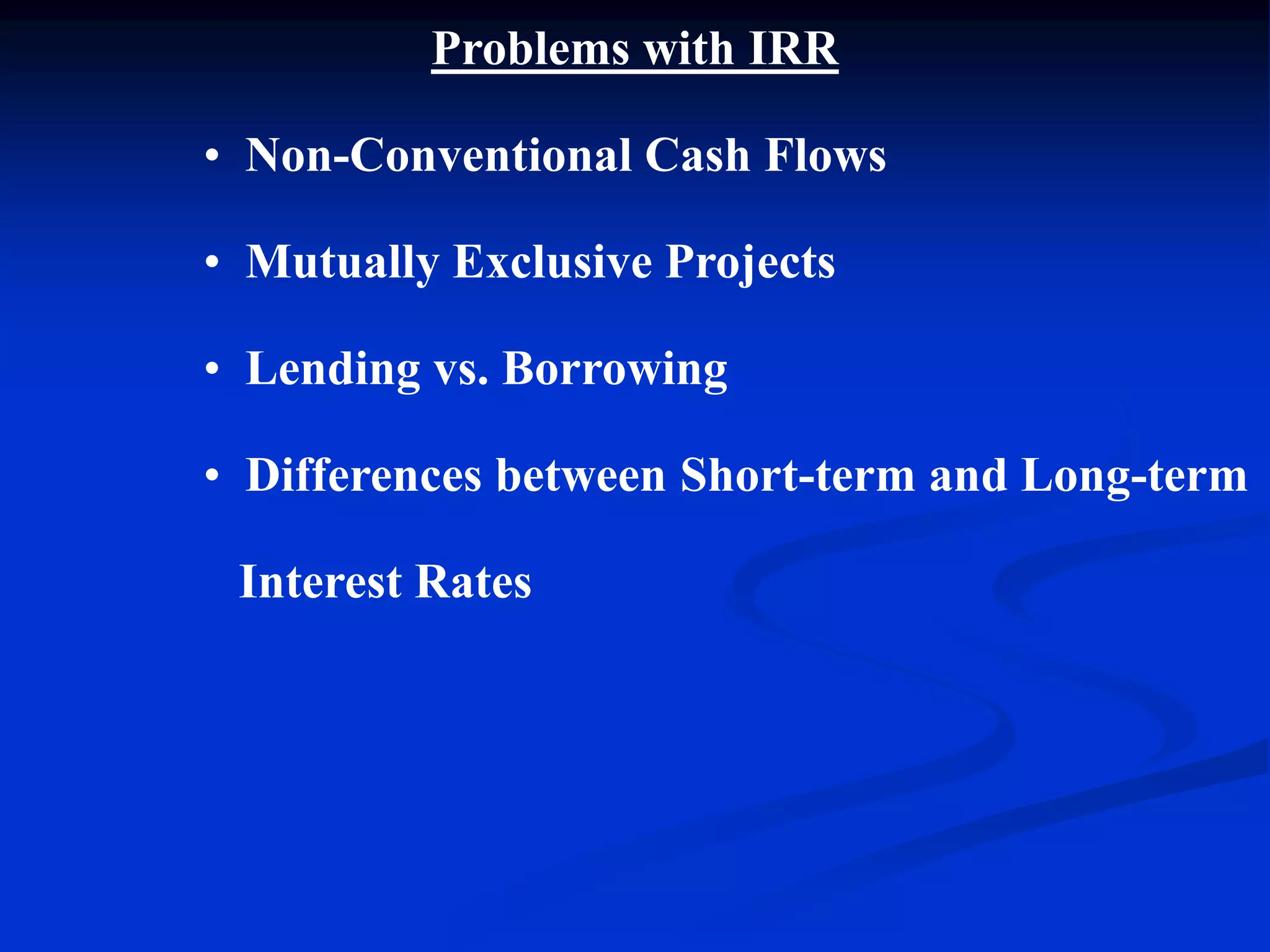

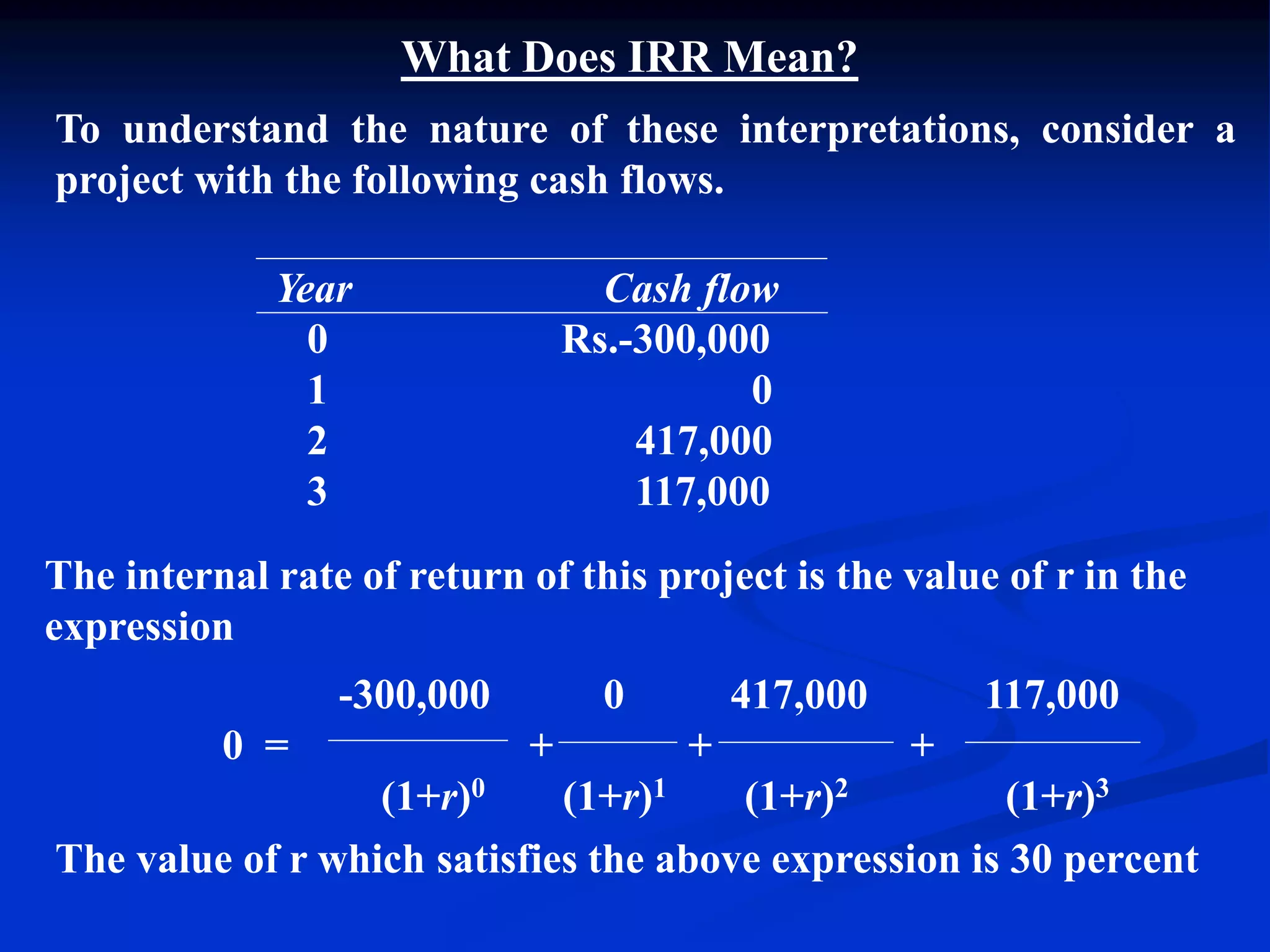

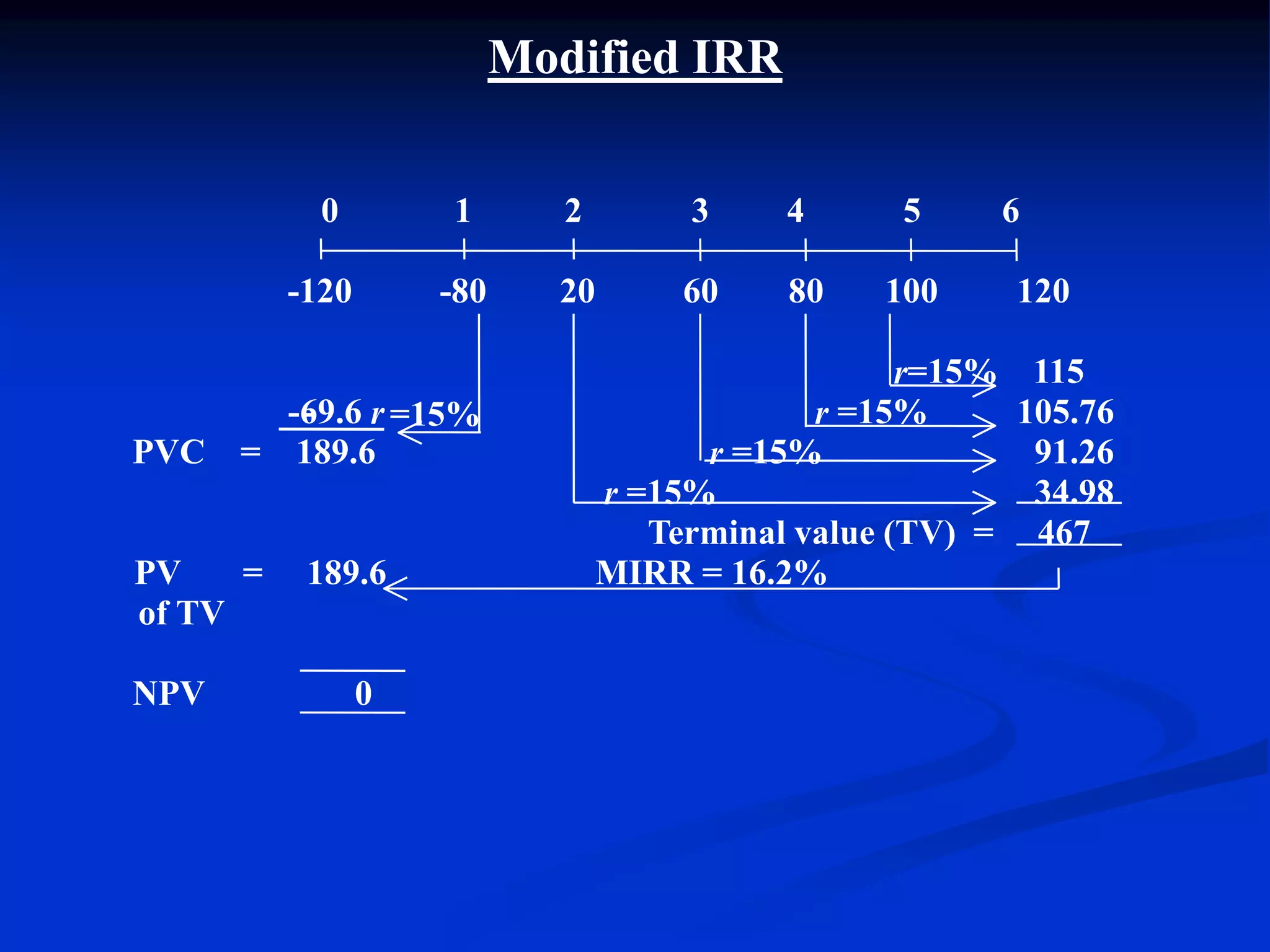

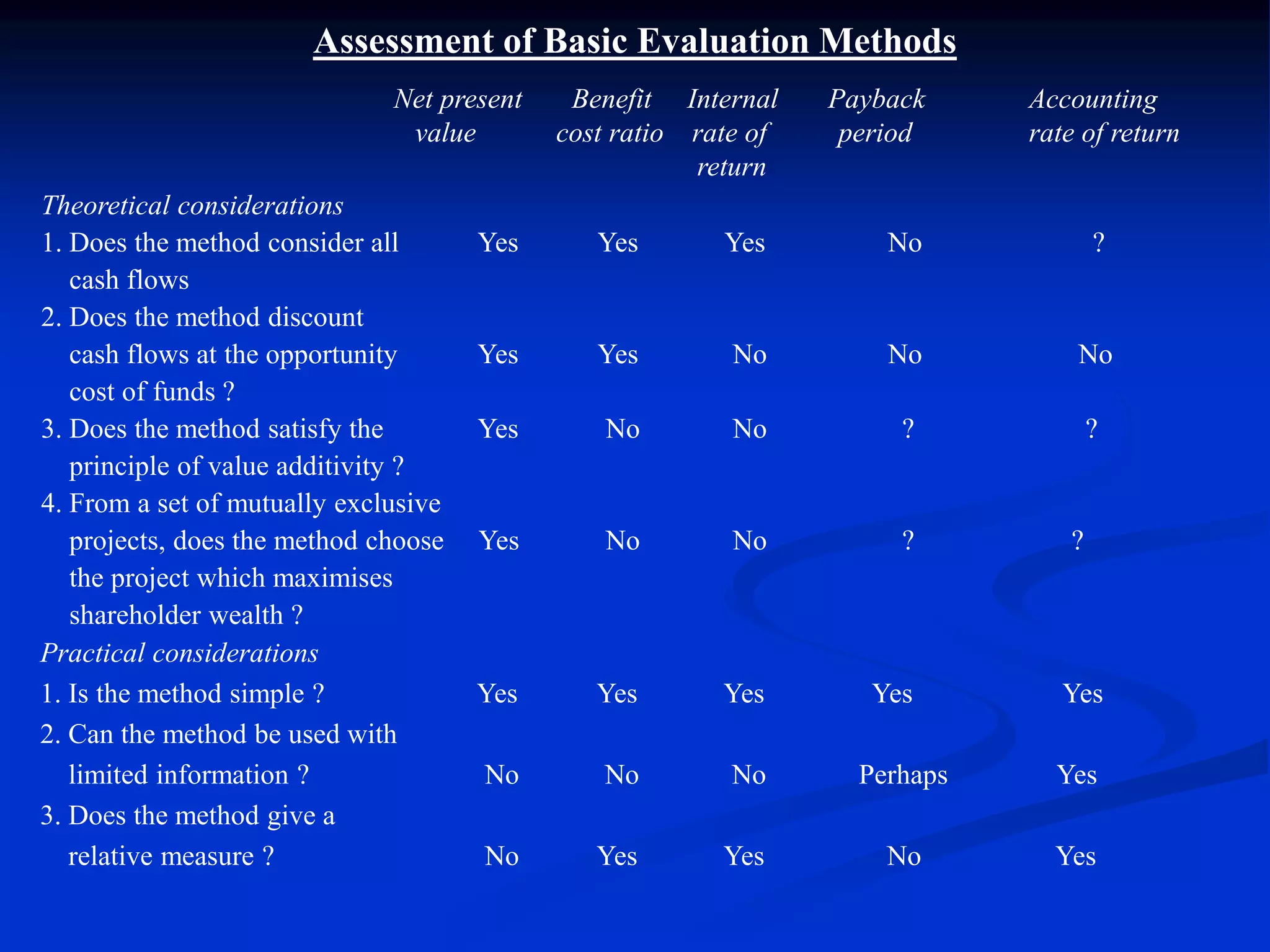

This document discusses various investment criteria used to evaluate capital budgeting projects. It covers net present value, benefit-cost ratio, internal rate of return, payback period, and accounting rate of return. Formulas are provided for calculating each method along with their pros and cons. The key steps in investment evaluation are estimating costs and benefits, assessing risk, calculating the cost of capital, and using these criteria to determine if a project is worthwhile.