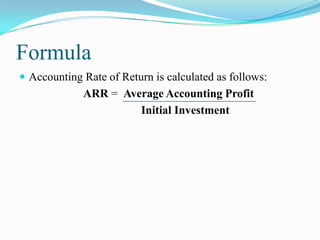

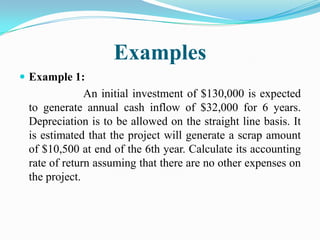

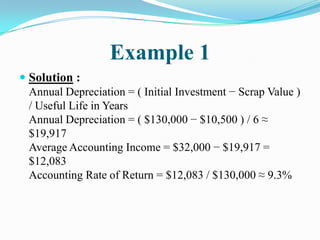

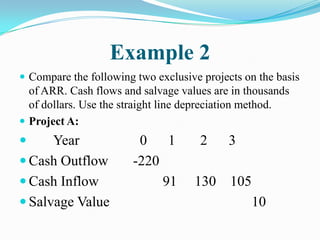

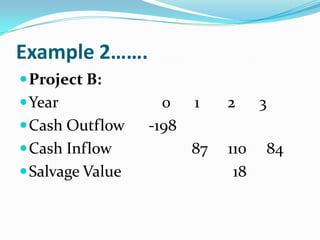

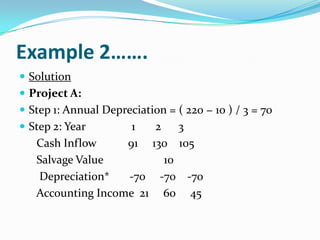

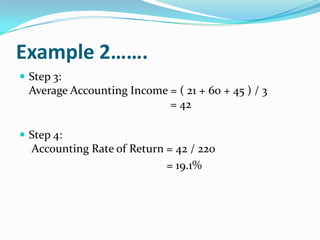

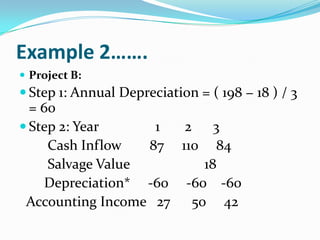

This document defines accounting rate of return (ARR) as the ratio of estimated accounting profit to average investment of a project. It ignores the time value of money. ARR is calculated by dividing average accounting profit by initial investment. Average accounting profit is the mean of annual profits over the project life. Initial investment may be replaced by average investment due to declining book value over time. Projects are accepted if their ARR is not less than the required rate of return. Examples show calculating ARR for projects with given cash flows. ARR is an easy method but ignores the time value of money and can be calculated inconsistently using accounting versus cash flows.