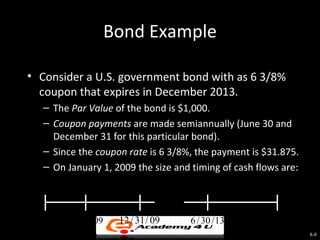

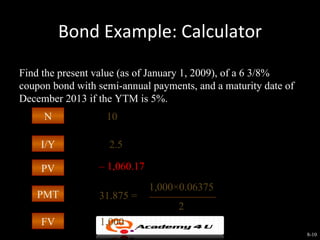

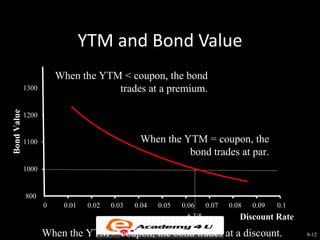

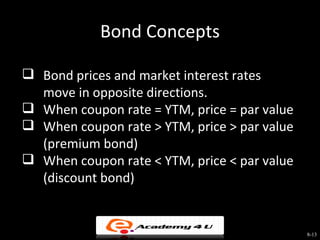

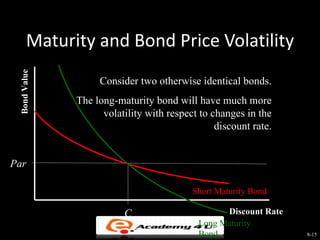

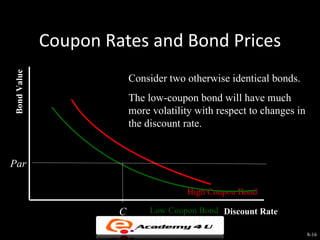

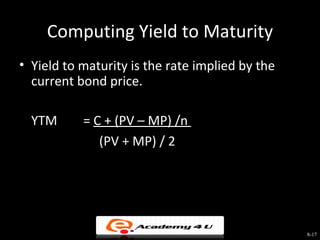

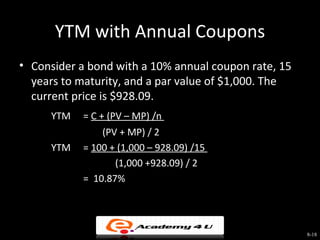

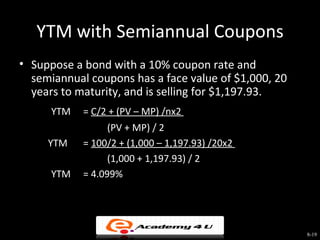

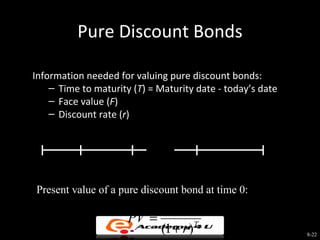

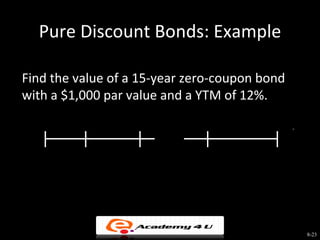

This document provides an overview of bond valuation and the bond market. It discusses key bond features and valuation concepts, including how bond prices are determined by expected future cash flows and interest rates. Government bonds such as Treasury securities are described as well as corporate bonds, which have greater default risk. Bond ratings are also covered, with higher rated bonds seen as less risky. The effects of inflation and the term structure of interest rates on bond yields are summarized.