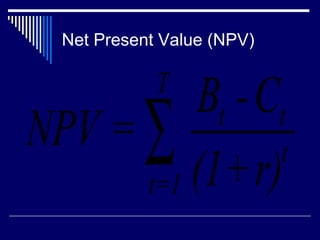

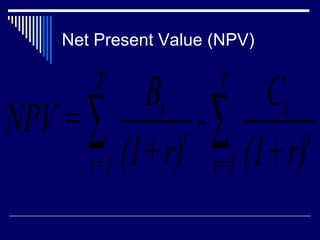

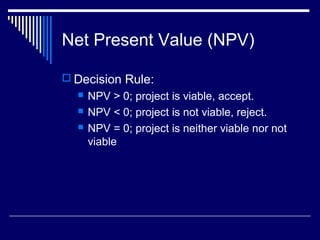

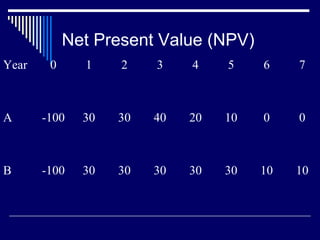

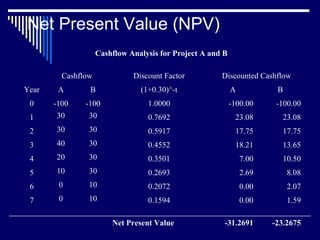

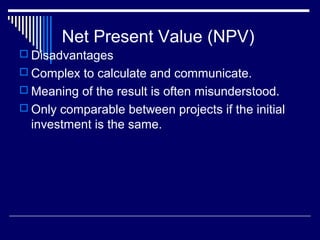

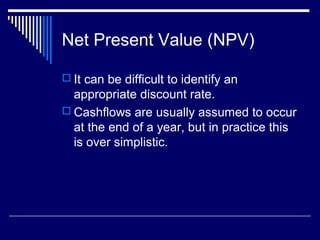

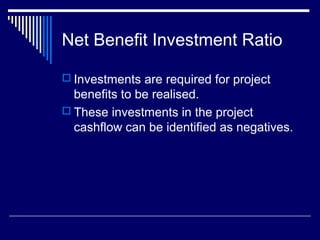

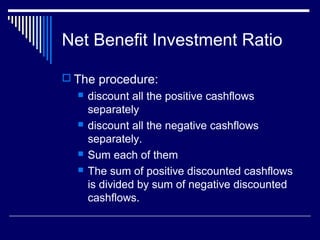

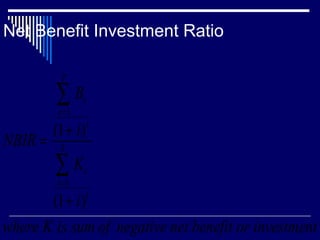

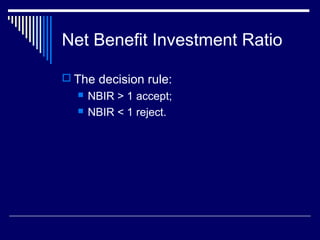

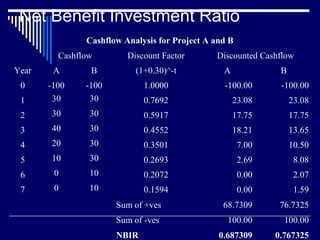

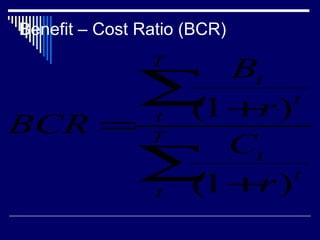

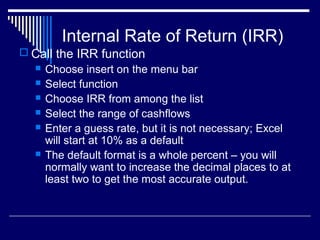

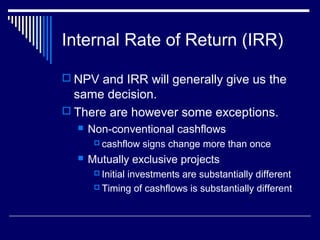

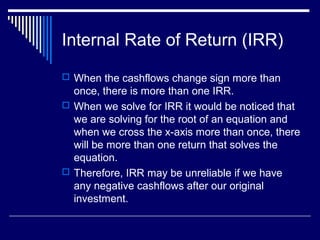

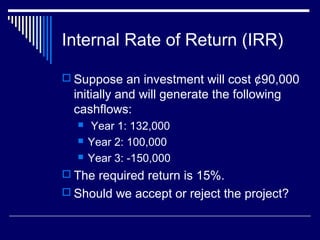

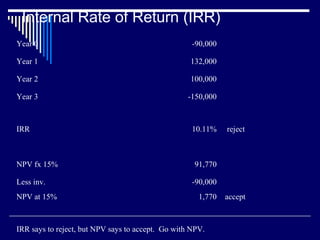

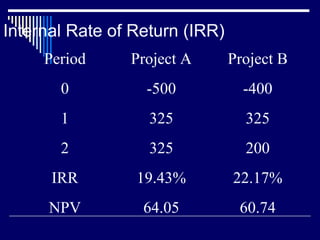

The document discusses several discounted measures used to evaluate project worth: net present value (NPV), net benefit investment ratio (NBIR), benefit-cost ratio (BCR), and internal rate of return (IRR). It provides the formulas and decision rules for each measure. It notes that while NPV, NBIR, BCR, and IRR are commonly used, IRR can be unreliable in situations with non-conventional cash flows or mutually exclusive projects, and that NPV should be used to resolve conflicts between decision rules.