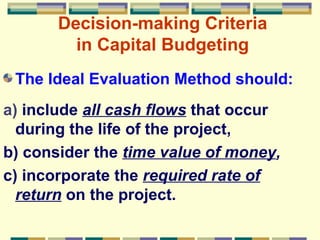

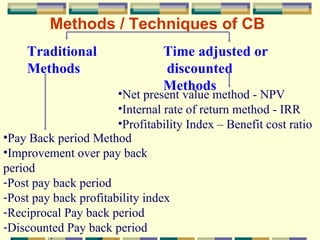

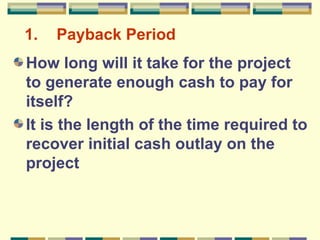

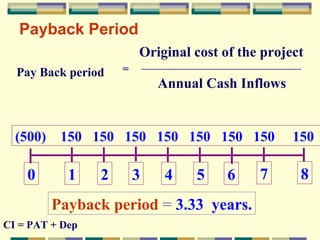

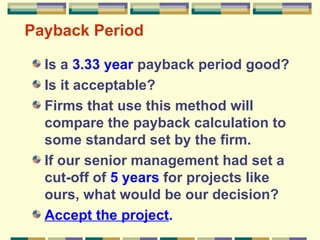

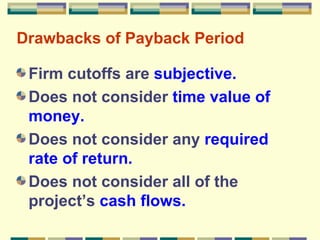

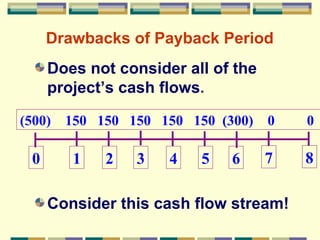

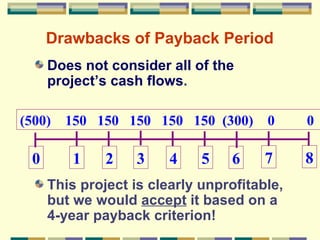

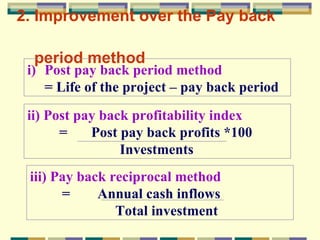

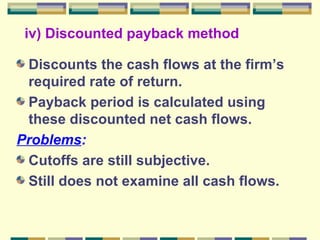

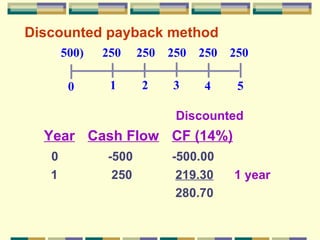

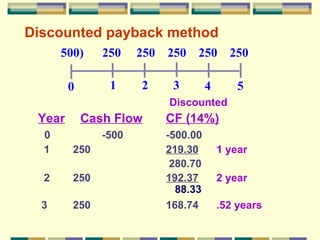

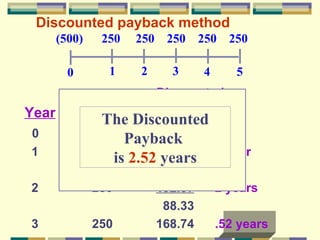

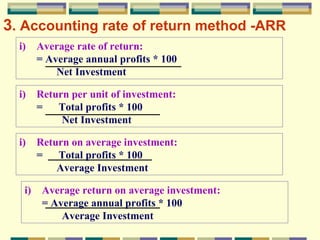

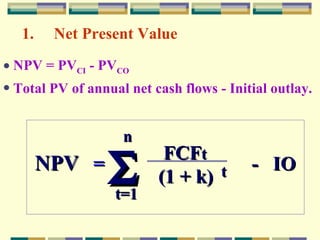

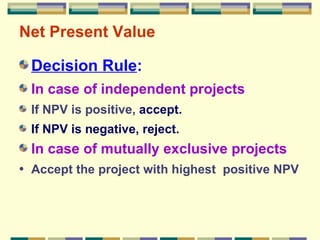

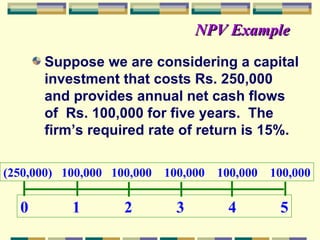

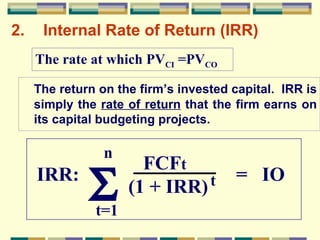

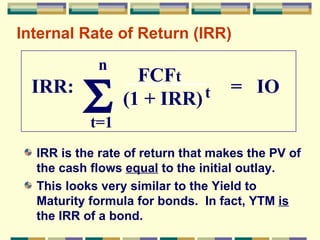

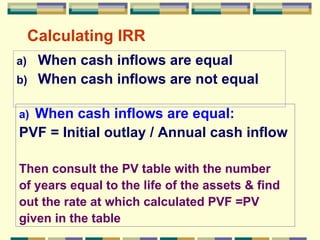

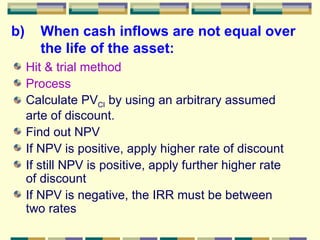

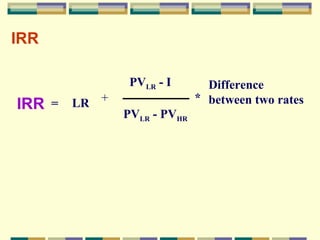

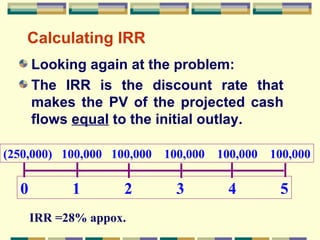

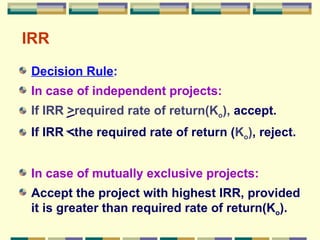

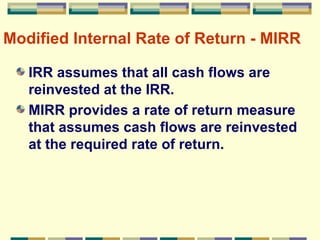

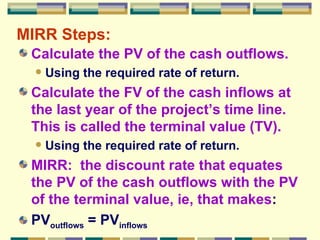

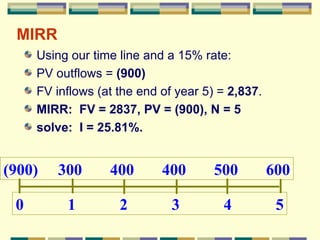

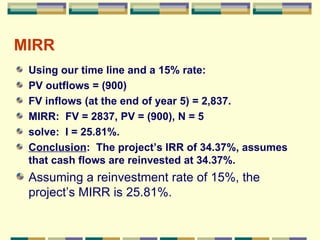

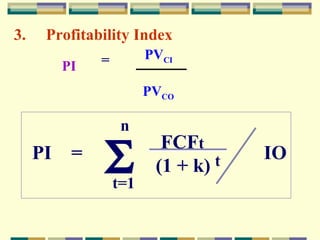

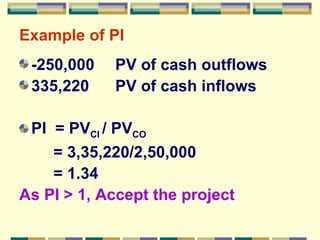

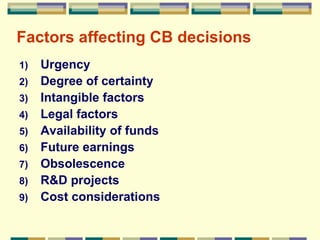

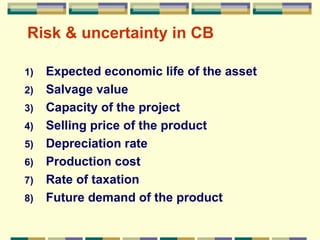

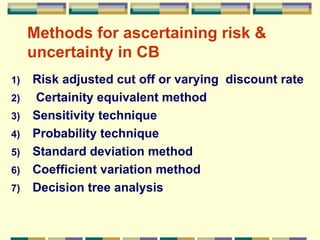

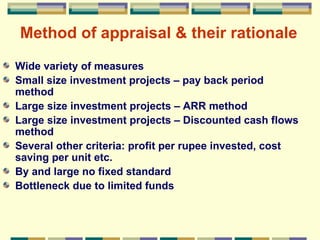

The document discusses various capital budgeting techniques used to evaluate long-term investment projects. It describes traditional methods like payback period and accounting rate of return, as well as discounted cash flow methods like net present value, internal rate of return, and profitability index. These time-adjusted methods account for the time value of money and required rate of return when analyzing projects. The document also discusses factors that introduce risk and uncertainty into capital budgeting decisions.