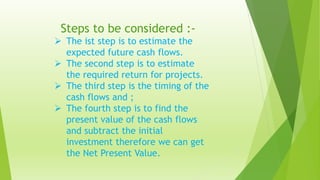

Net present value (NPV) is used to analyze the profitability of investments by discounting future cash flows to their present value and comparing them to the initial investment amount. A positive NPV means the investment increases firm value and is acceptable, while a negative NPV means it decreases firm value and is unacceptable. To calculate NPV, an analyst estimates future cash flows, the required return, the timing of cash flows, and discounts the cash flows to find their present value minus the initial investment. NPV considers the time value of money and all cash inflows to determine if an investment maximizes firm value and owner welfare. However, NPV is limited by the accuracy of estimating future cash flows and discount rates, does not