The document discusses capital budgeting methods, focusing on the net present value (NPV) method. It provides details on calculating NPV, including the formulas and acceptance rules. The key points are:

1) Capital budgeting is the process of evaluating long-term investments and NPV is a discounted cash flow method used.

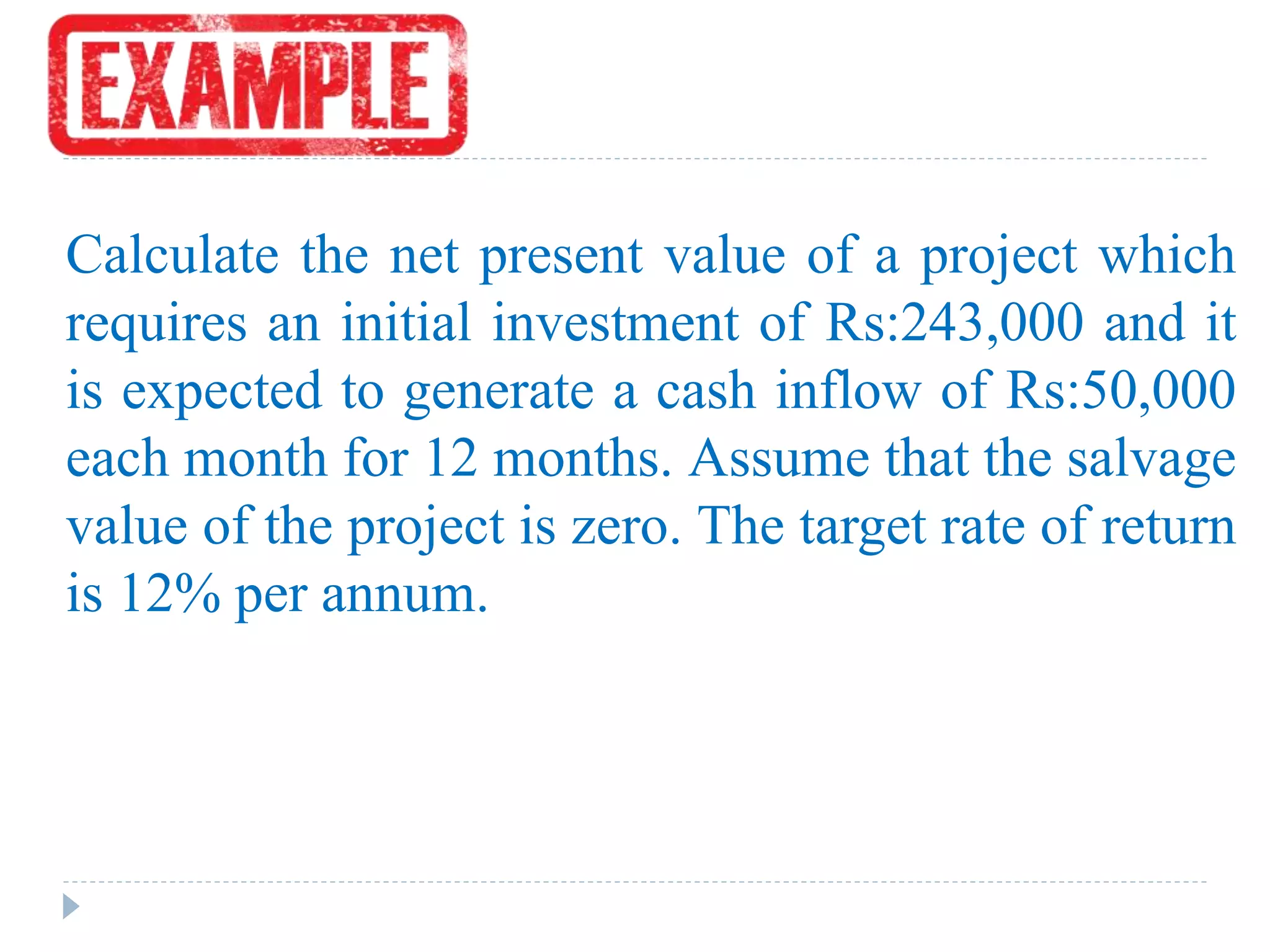

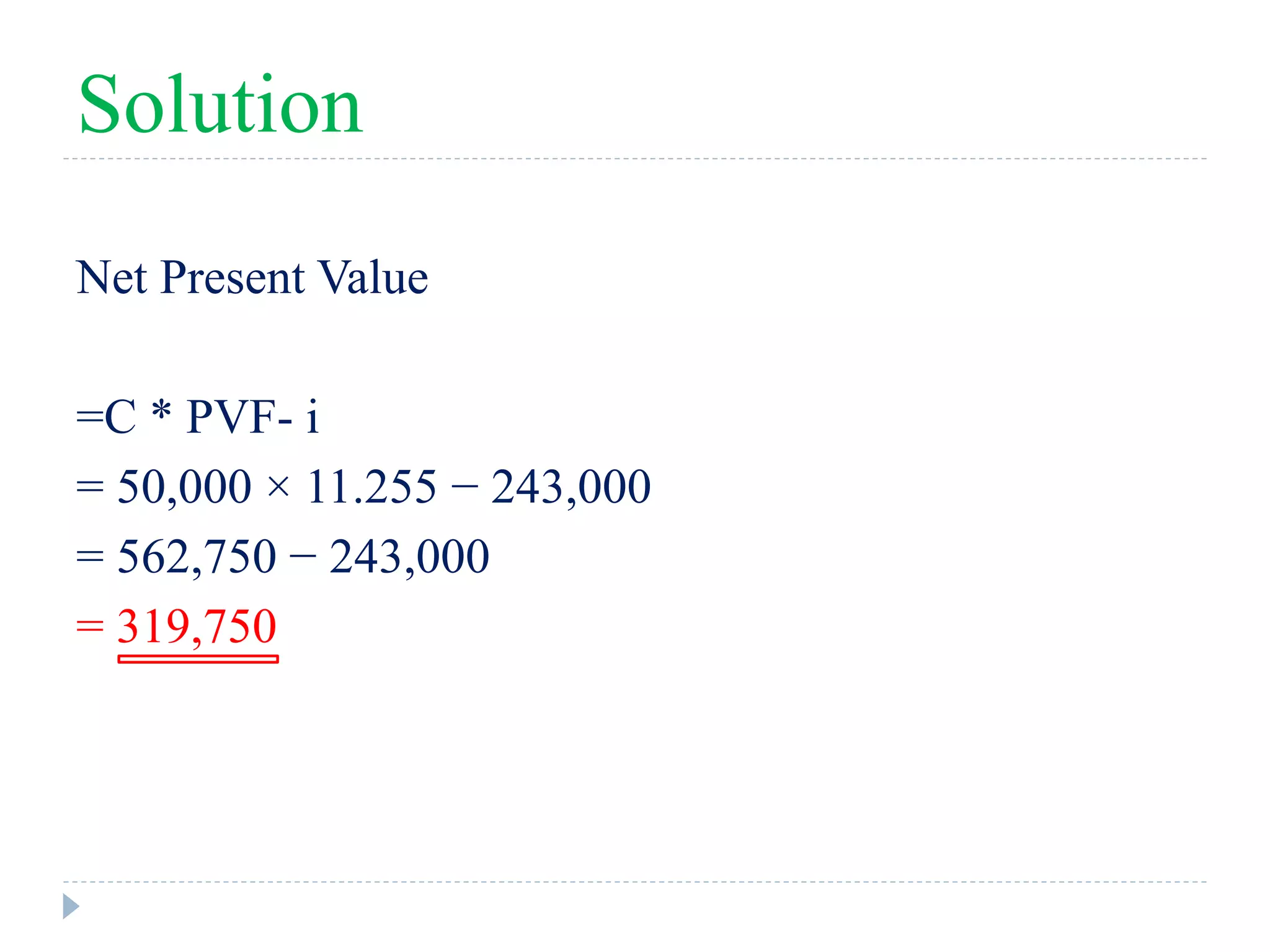

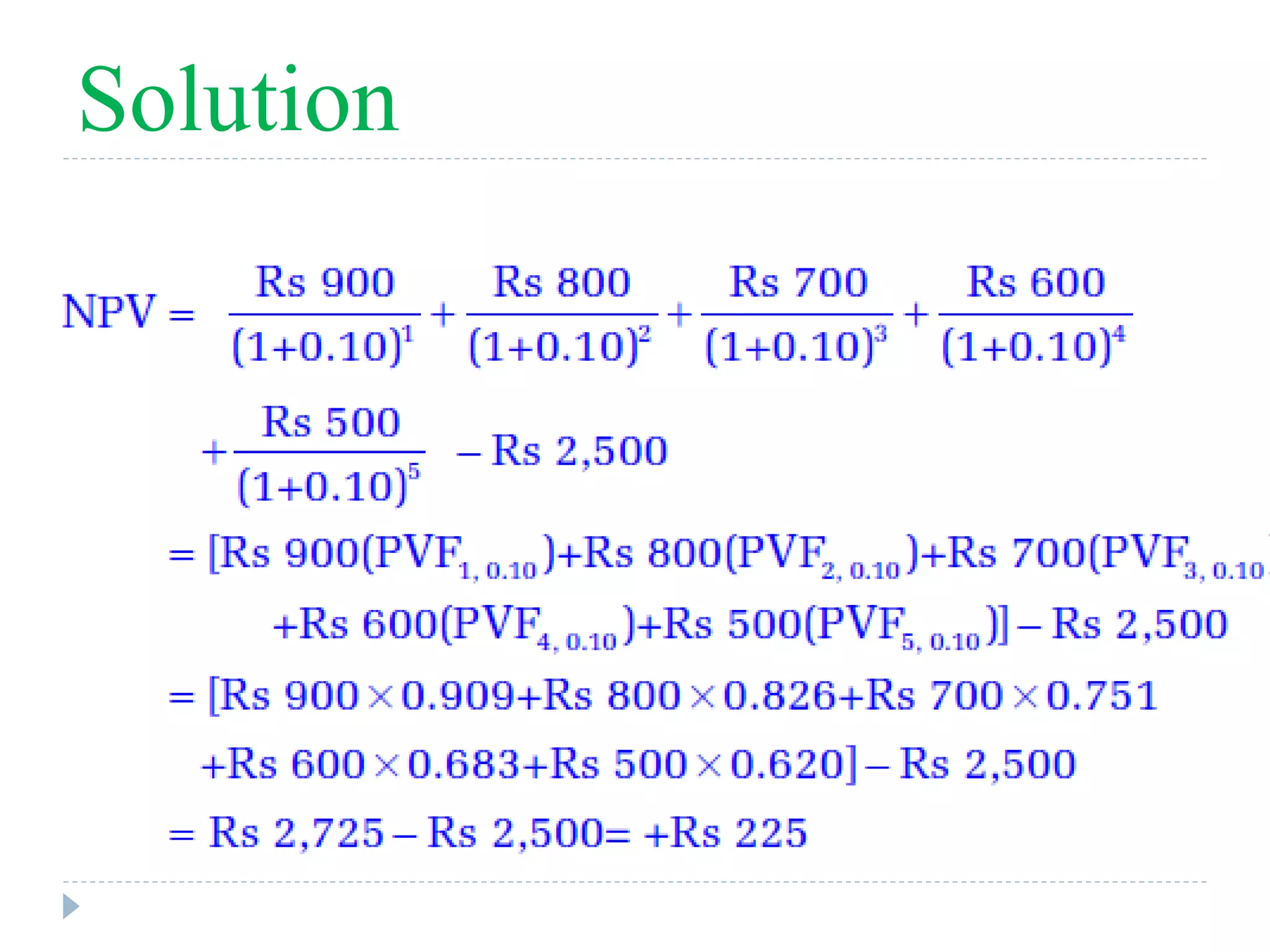

2) With NPV, future cash flows of a project are discounted to give their present value, and the project's NPV is calculated as the present value of cash inflows minus the initial investment.

3) A project should be accepted if it has a positive NPV, as that means it is expected to increase shareholder value.