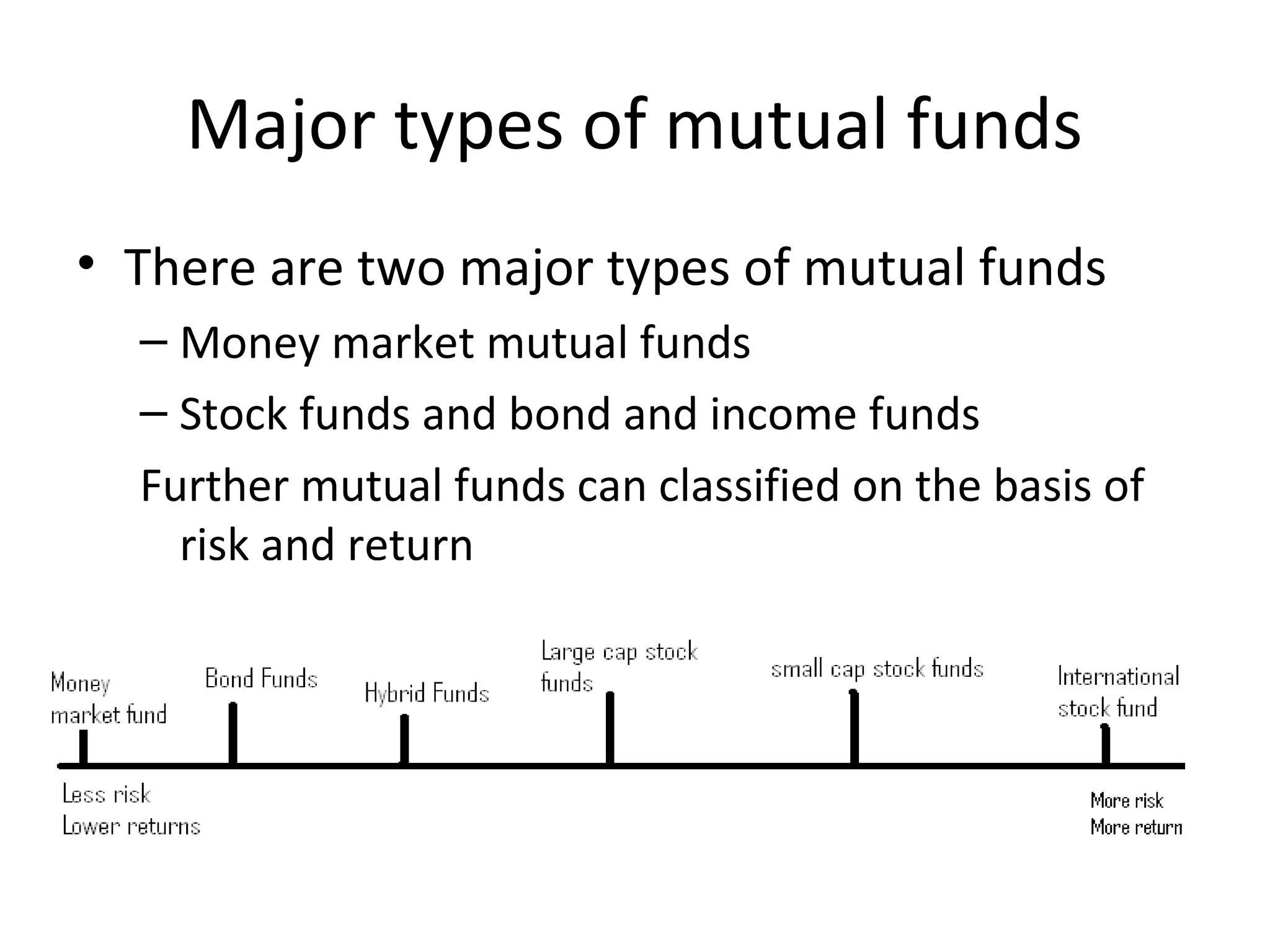

There are six main types of mutual funds: money market funds, bond funds, hybrid funds, equity funds, sector funds, and index funds. Money market funds invest in low-risk, low-return money market securities. Bond funds invest in fixed income securities like government or corporate bonds. Hybrid funds invest in both bonds and equities. Equity funds invest solely in common stocks, with the goal of capital growth or income. Sector funds focus on specific industries. Index funds aim to match the performance of a market index at low cost. Mutual funds report returns as total returns including dividends and capital gains over time periods like one, five, or ten years. Regulations require mutual funds to appoint independent trustees and comply with