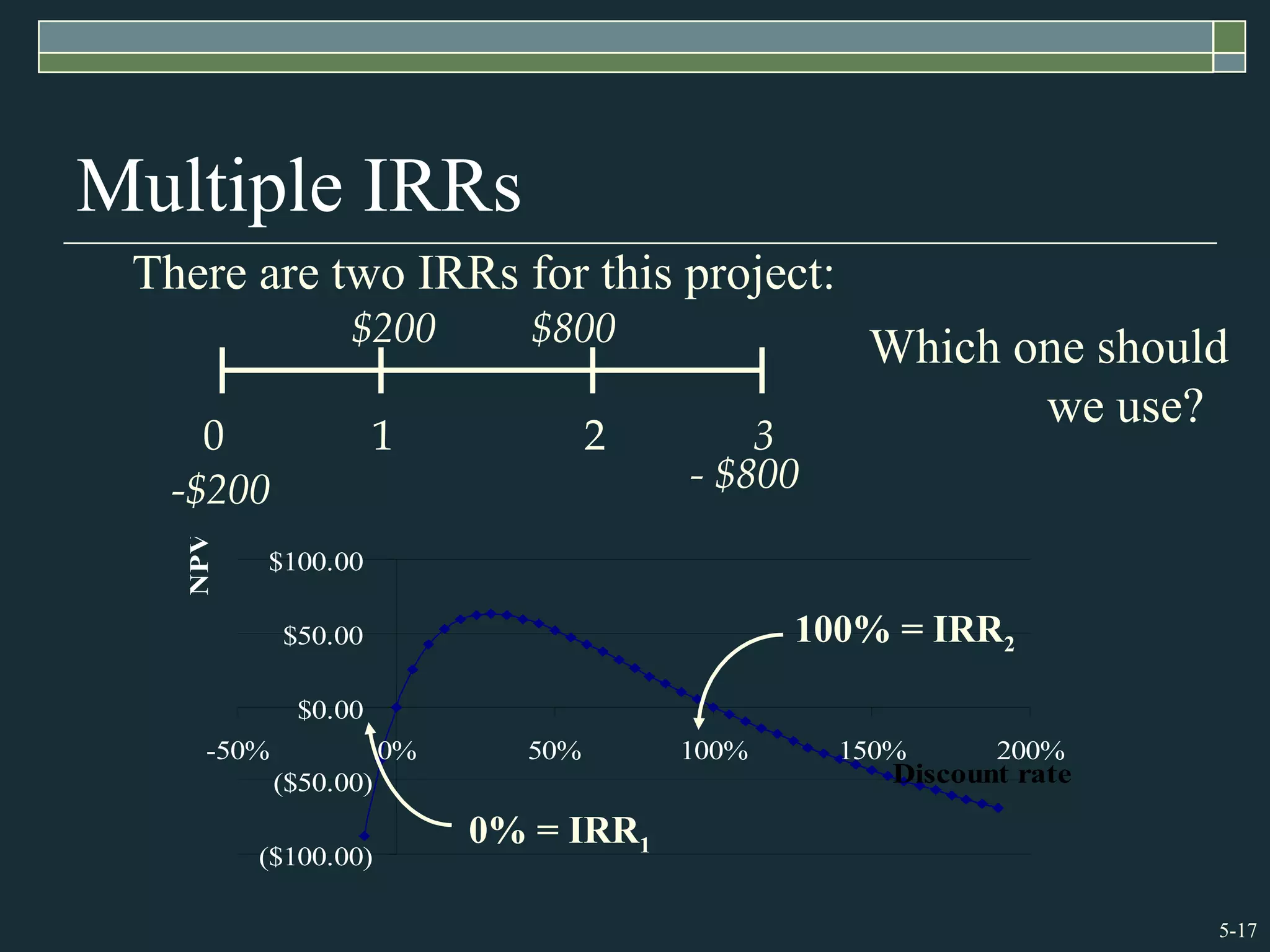

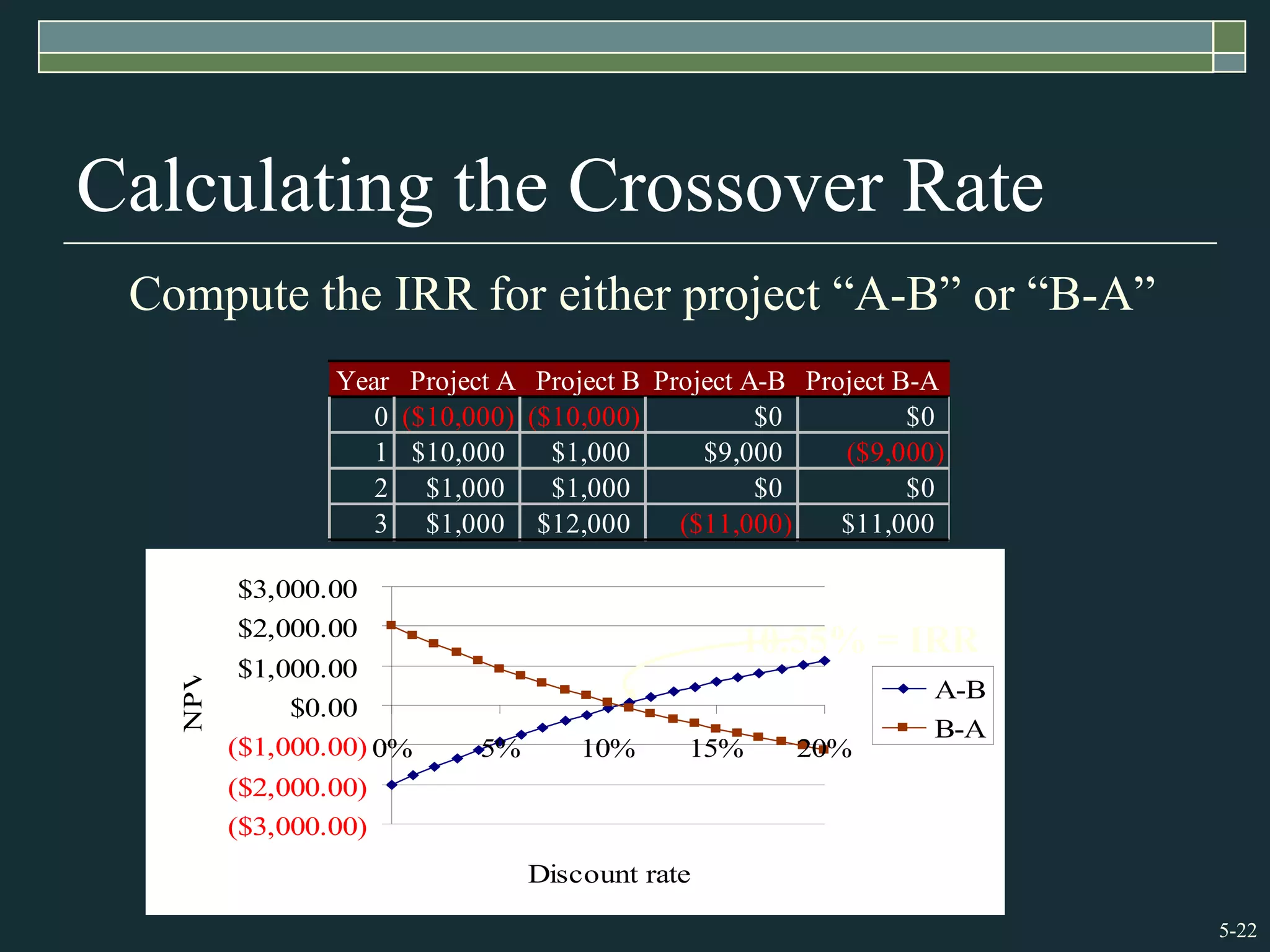

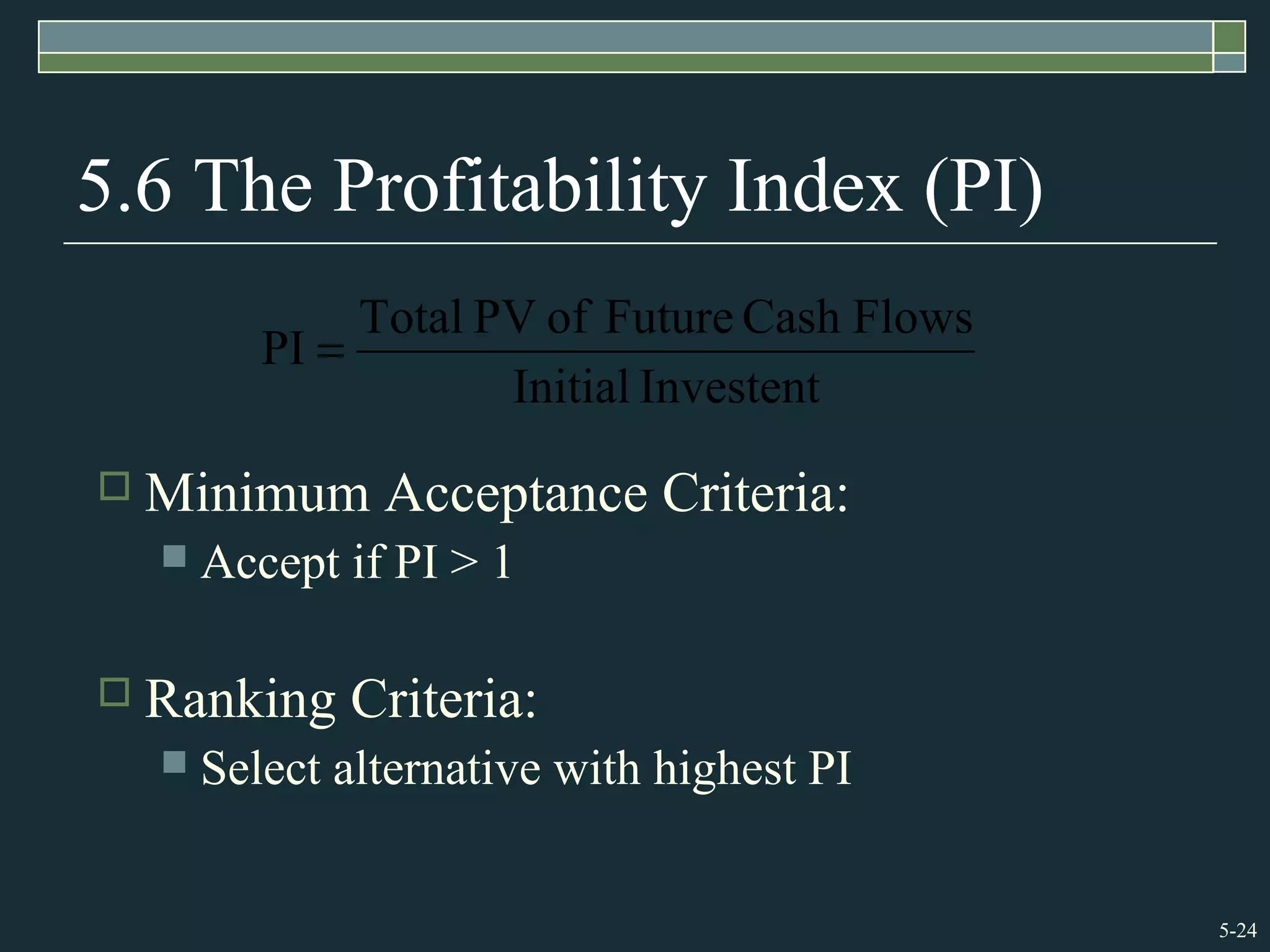

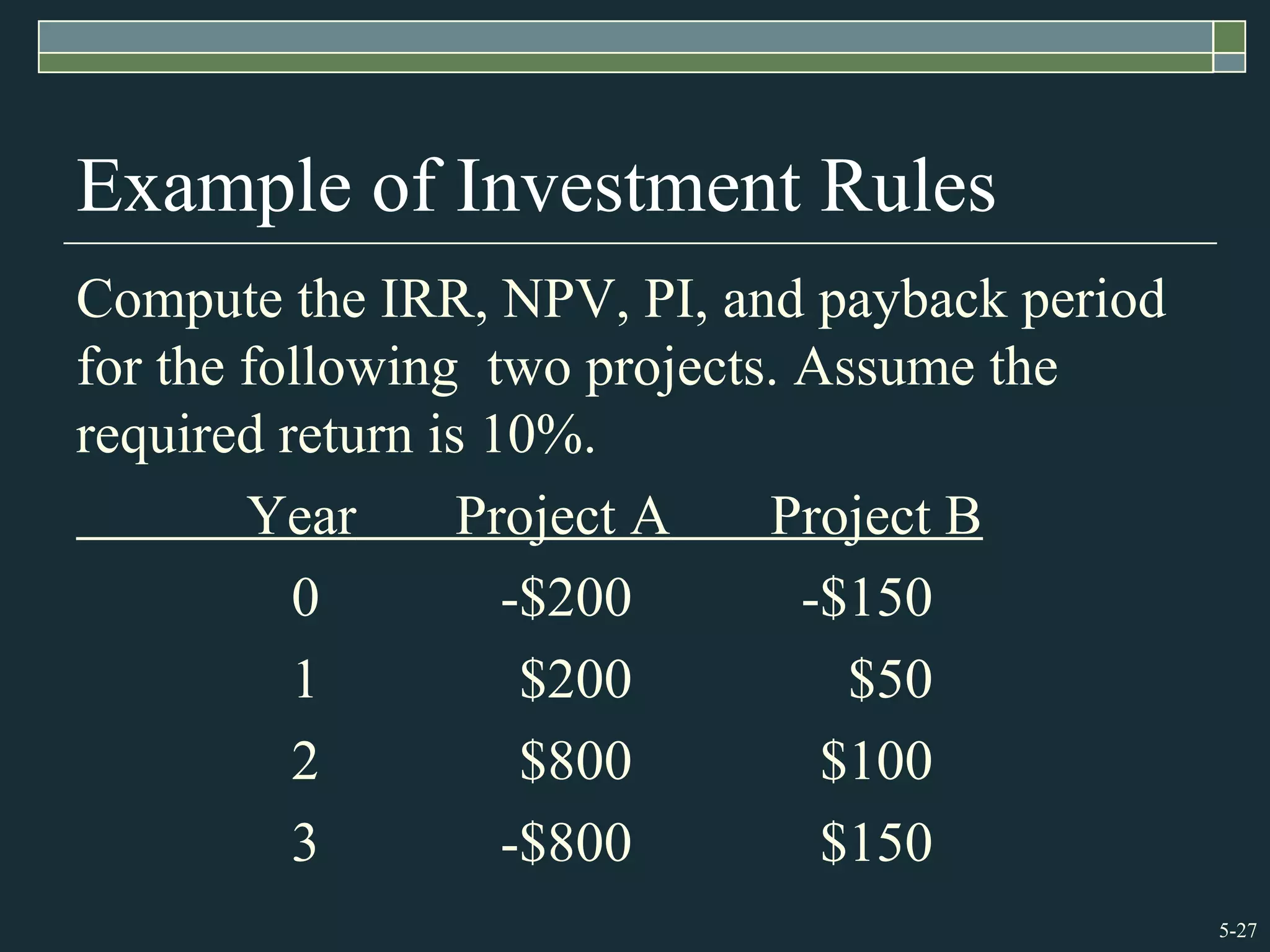

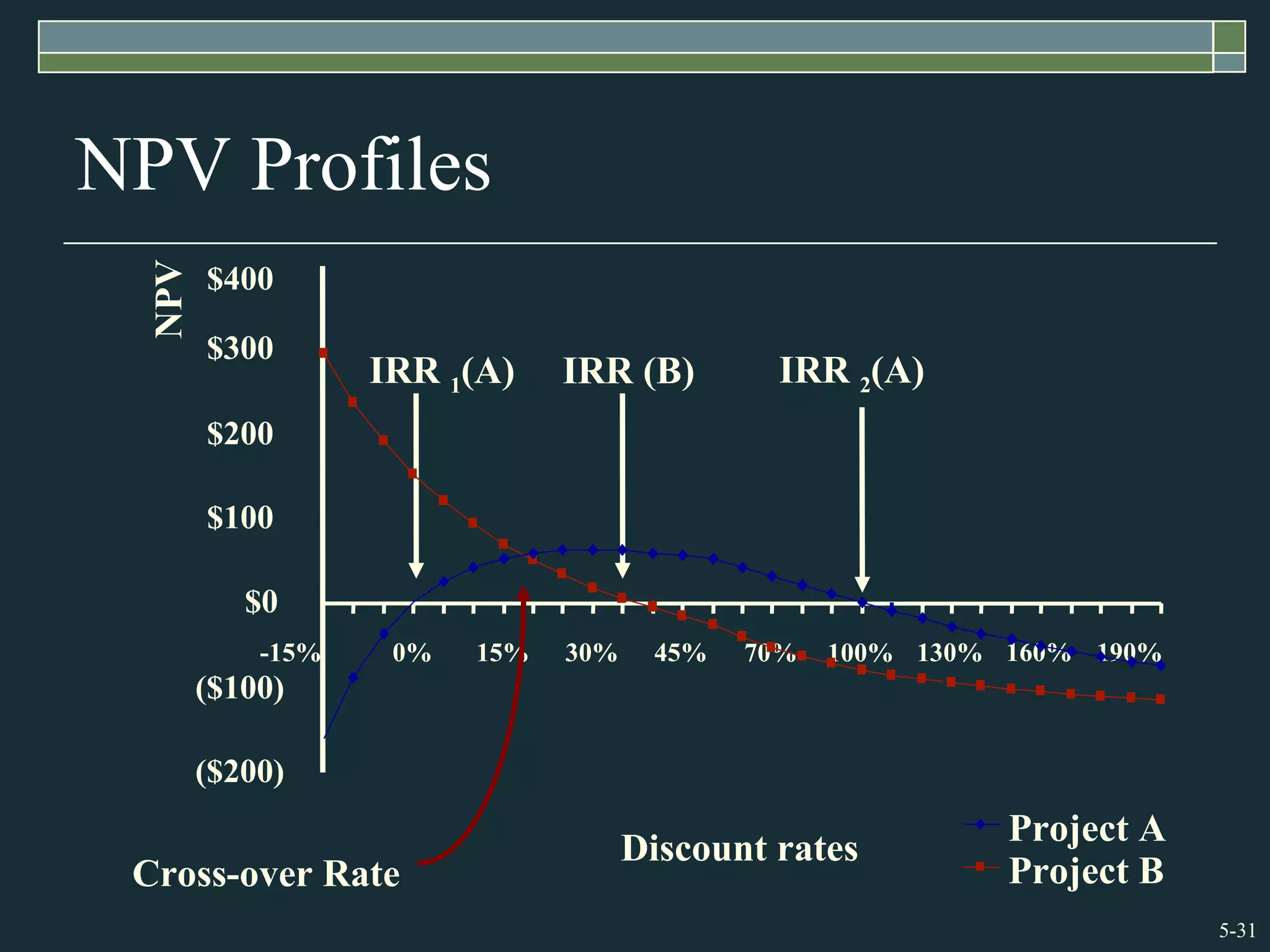

This chapter discusses various capital budgeting techniques for evaluating investment projects. It recommends using net present value (NPV) as the best approach, as NPV accounts for the timing of cash flows and uses the required rate of return to discount future cash flows. The chapter covers payback period and internal rate of return (IRR) but notes limitations of both, such as payback ignoring the time value of money and IRR potentially yielding incorrect decisions for projects with non-standard cash flows. It also discusses profitability index and compares the strengths and weaknesses of different capital budgeting methods.