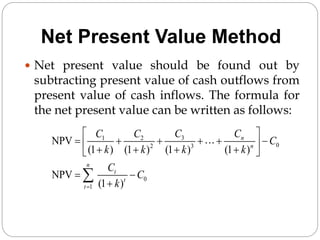

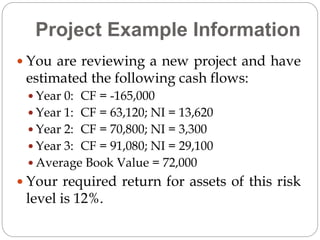

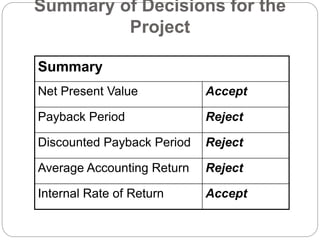

This document discusses capital budgeting and investment decision making. It defines capital budgeting as the analysis of potential additions to fixed assets that are important long-term decisions for a firm's future. There are three types of capital budgeting projects: independent projects whose cash flows are unrelated; mutually exclusive projects where accepting one precludes the other; and contingent projects where one is dependent on another. The document outlines capital budgeting processes and techniques for evaluating projects, including net present value, internal rate of return, profitability index, payback period, and accounting rate of return. It provides an example project and calculations for each technique to determine whether to accept or reject the project.