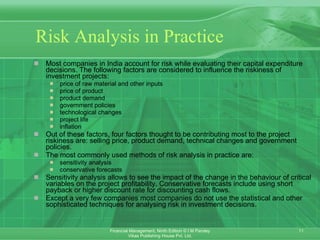

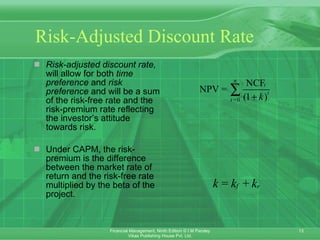

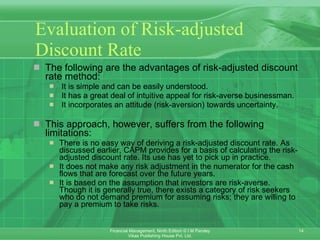

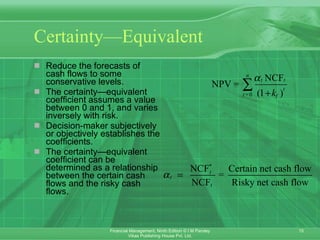

- The document discusses various techniques for analyzing risk in capital budgeting decisions such as payback period, certainty equivalent, risk-adjusted discount rate, sensitivity analysis, scenario analysis, and simulation analysis.

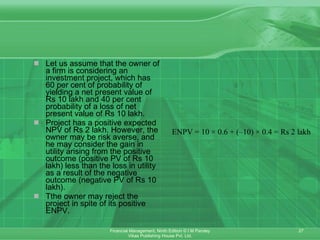

- It also covers using decision trees for sequential investment decisions and incorporating utility theory to explicitly include a decision-maker's risk preferences in the capital budgeting analysis.