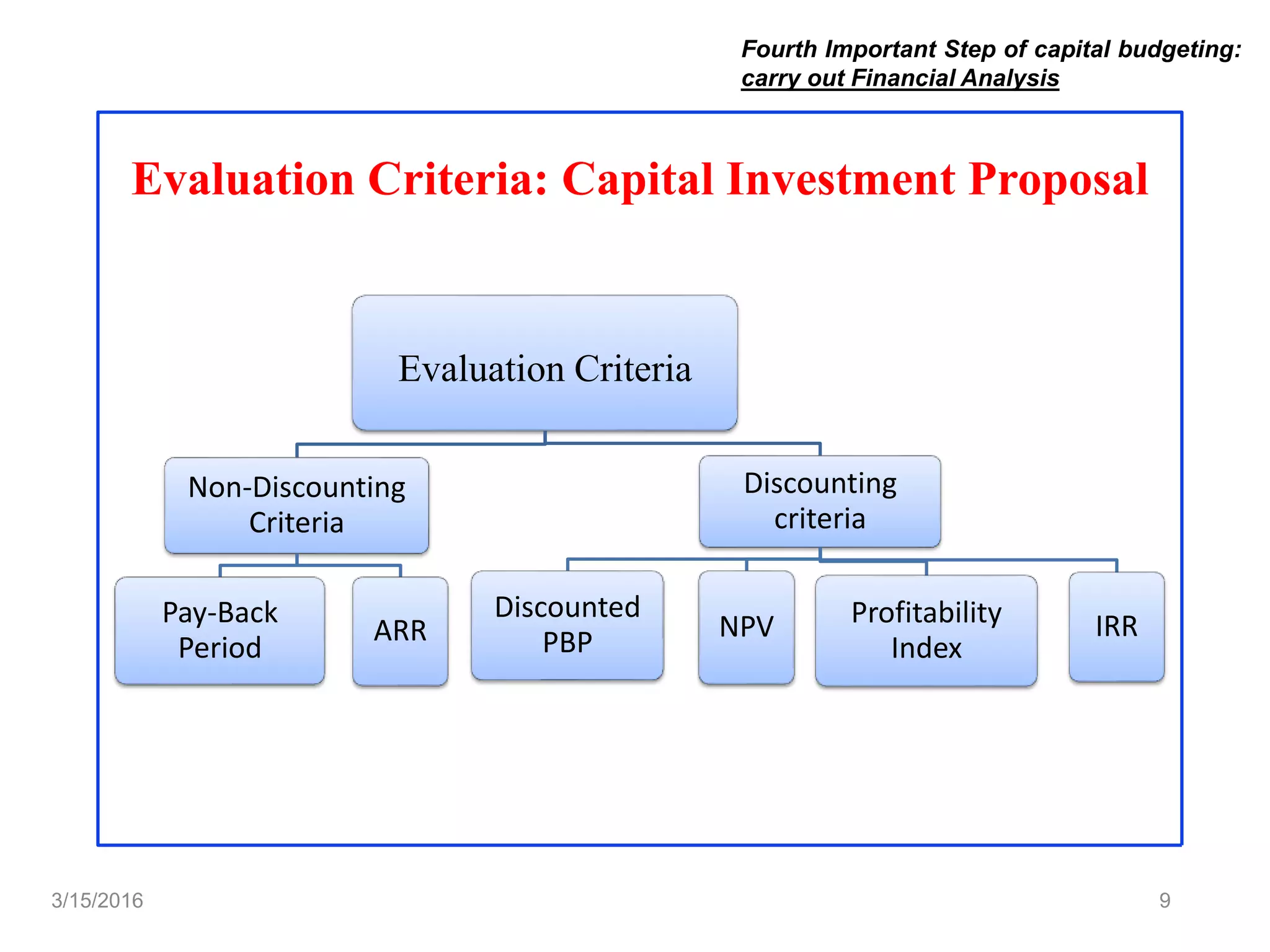

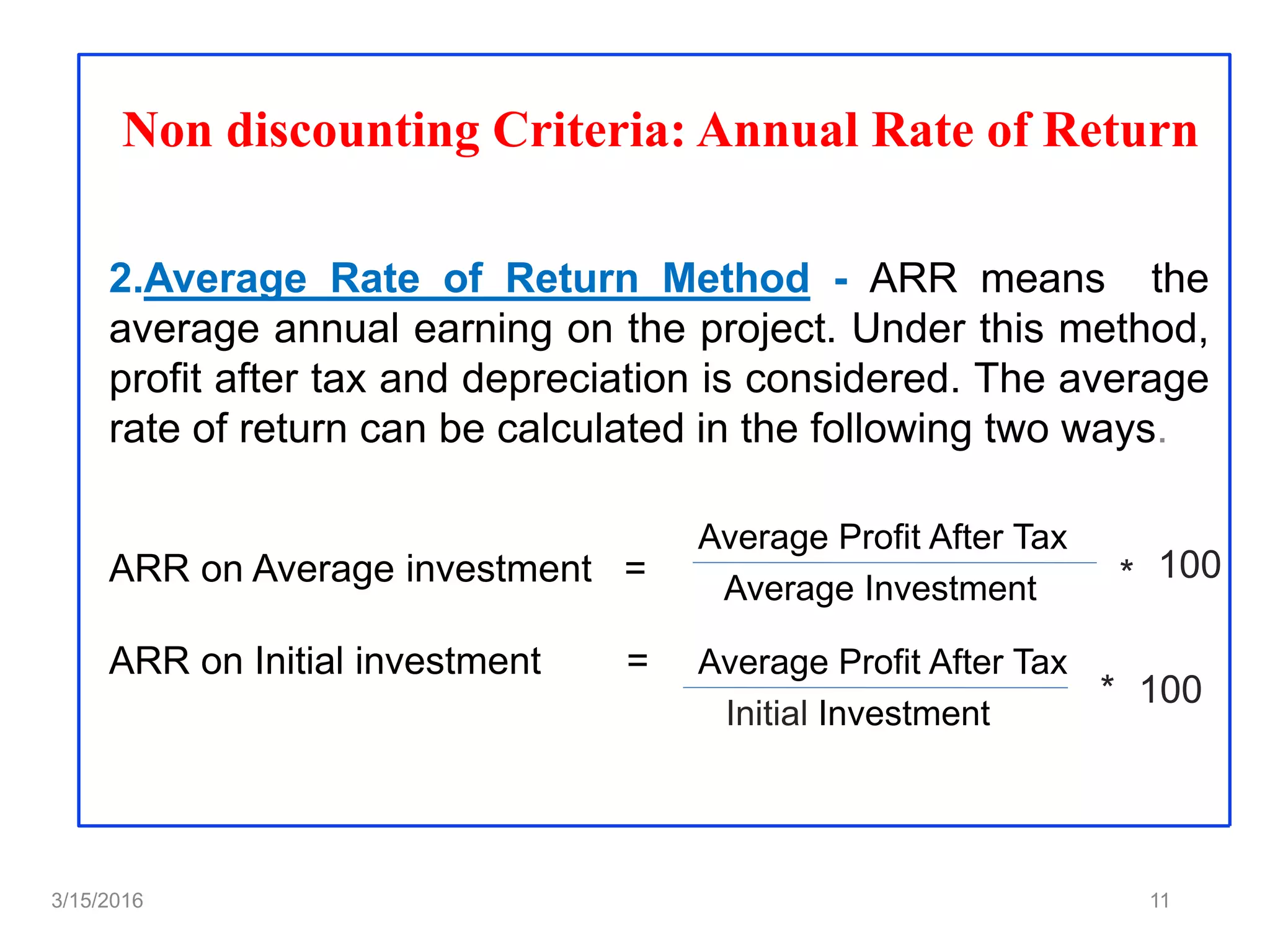

This document discusses capital budgeting and provides examples of how to evaluate capital investment projects. It defines capital budgeting as the process of analyzing projects and deciding which ones to include in the capital budget. It then outlines eight key steps in capital budgeting, including project categorization, evaluation criteria, and financial analysis. Examples are provided to calculate metrics like net present value, internal rate of return, payback period, and profitability index for a sample capital project. The document concludes that while net present value is generally the best method, companies often consider multiple evaluation criteria to make capital budgeting decisions.