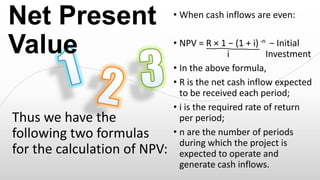

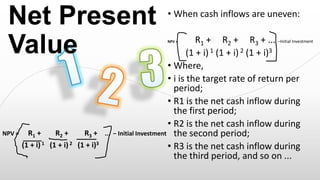

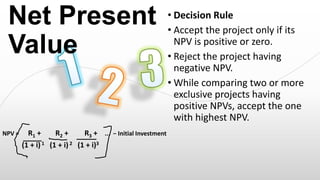

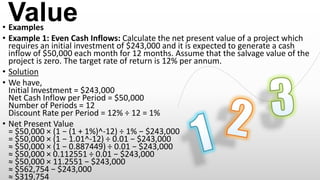

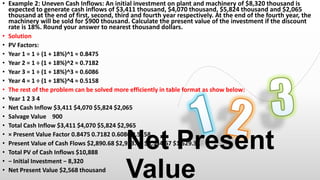

The document discusses net present value (NPV) as a key metric in capital budgeting, outlining its calculation involving the present value of net cash inflows and the initial investment. It provides formulas for NPV calculations for both even and uneven cash inflows while emphasizing the importance of a target rate of return. Advantages of NPV include its consideration of the time value of money, whereas its primary disadvantage is reliance on estimated future cash flows.