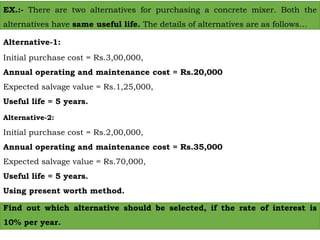

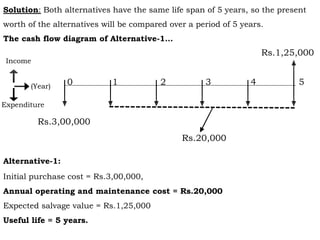

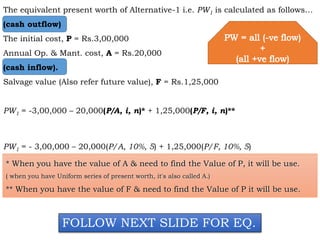

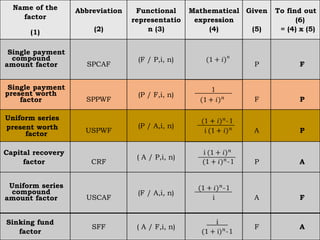

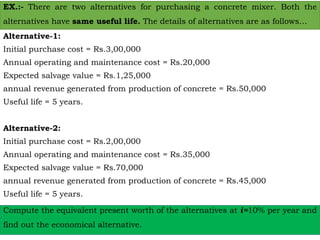

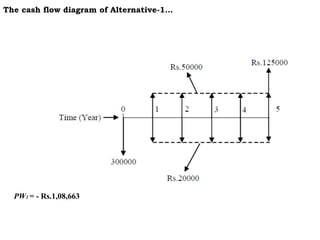

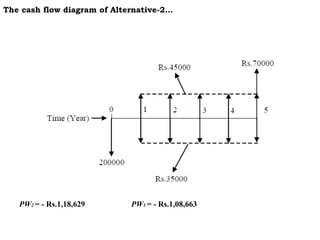

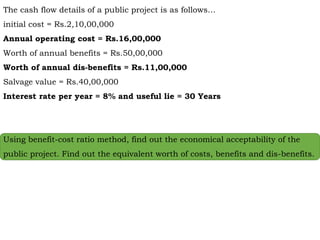

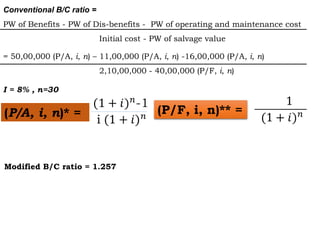

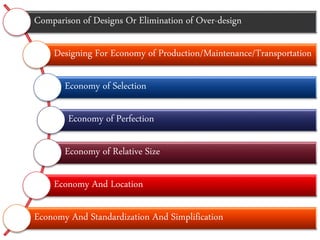

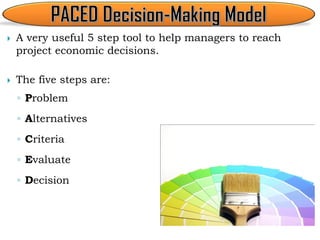

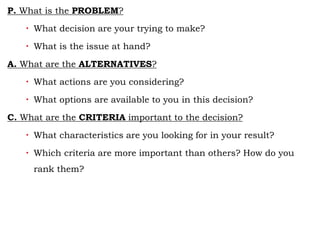

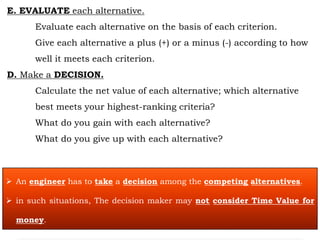

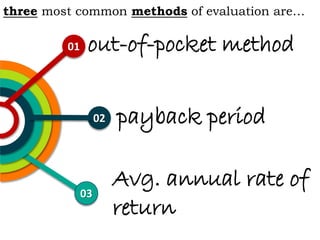

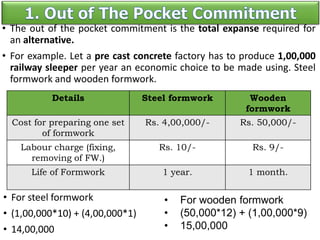

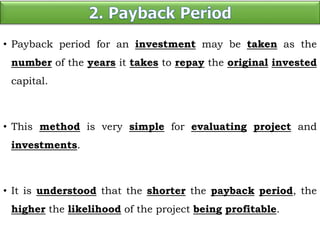

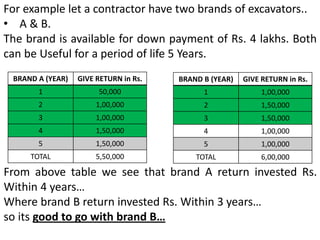

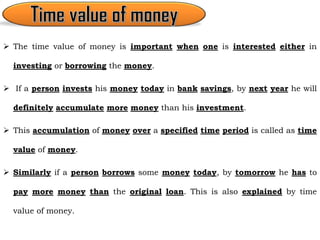

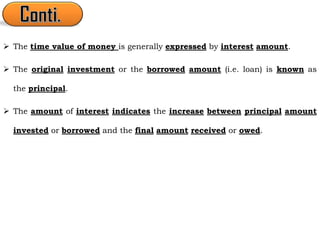

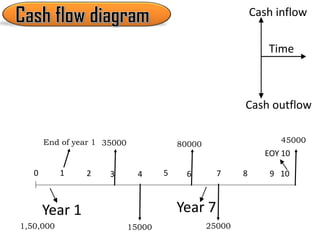

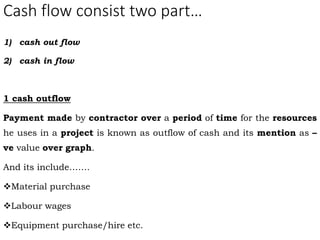

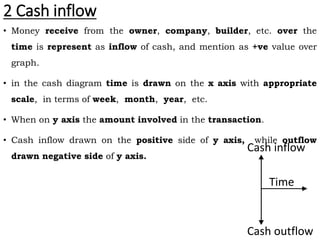

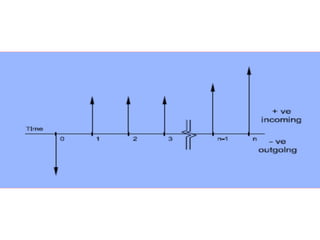

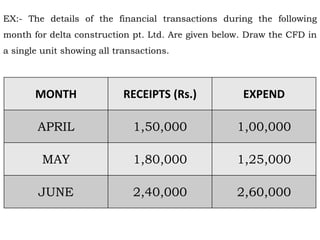

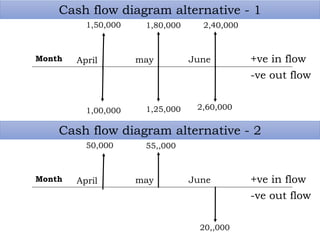

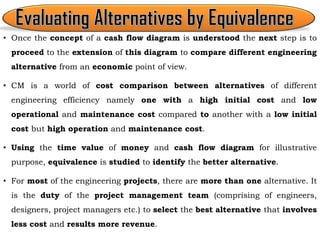

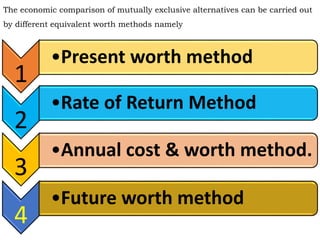

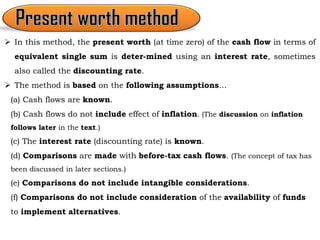

This document discusses the integration of engineering and economic principles for effective decision-making in construction projects, emphasizing the importance of evaluating alternatives based on economic efficiency and life cycle costs. It presents a systematic five-step tool for decision-making, which includes identifying problems, alternatives, criteria, evaluation, and final decision-making, alongside methods for economic evaluation such as the payback period and net present worth. The role of cash flow diagrams in representing cash transactions over time is also highlighted, underscoring the need for both economic and non-economic considerations in selecting the best project alternatives.

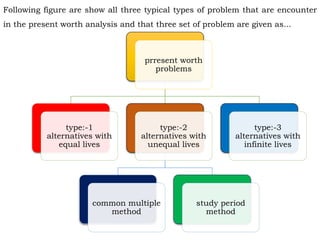

![TYPE:-1 alternatives with equal lives

As the name suggest, in such problem the compacting alternatives have

equal life span. [The useful lives (life span) of alternatives are equal]

for evaluating the alternatives, the present worth of both the compacting

alternatives are found out.

the alternatives with the maximum present worth is the most economical

alternative.

for cost dominated cash flow diagrams, the alternative with the lowest

present cost is chosen.

in case of cash flow diagram involving both cost and revenue, the net or

difference of present worth of revenue and cost are found.

this is referred to as net present worth or net present value (NPV).

the method of comparison of (NPV) is quite popular for evolution of

alternative.](https://image.slidesharecdn.com/mod3constructioneconomics2-210226041739/85/MOD-3-CONSTRUCTION-ECONOMICS-UPDATED-43-320.jpg)