Market Outlook, 1 Apr

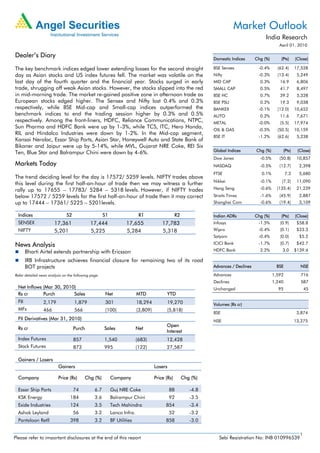

- 1. Market Outlook India Research April 01, 2010 Dealer’s Diary Domestic Indices Chg (%) (Pts) (Close) The key benchmark indices edged lower extending losses for the second straight BSE Sensex -0.4% (62.4) 17,528 day as Asian stocks and US index futures fell. The market was volatile on the Nifty -0.3% (13.4) 5,249 last day of the fourth quarter and the financial year. Stocks surged in early MID CAP 0.3% 16.9 6,806 trade, shrugging off weak Asian stocks. However, the stocks slipped into the red SMALL CAP 0.5% 41.7 8,497 in mid-morning trade. The market re-gained positive zone in afternoon trade as BSE HC 0.7% 39.2 5,328 European stocks edged higher. The Sensex and Nifty lost 0.4% and 0.3% BSE PSU 0.2% 19.3 9,038 respectively, while BSE Mid-cap and Small-cap indices outperformed the BANKEX -0.1% (12.0) 10,652 benchmark indices to end the trading session higher by 0.3% and 0.5% AUTO 0.2% 11.6 7,671 respectively. Among the front-liners, HDFC, Reliance Communications, NTPC, METAL -0.0% (5.5) 17,974 Sun Pharma and HDFC Bank were up by 1-3%, while TCS, ITC, Hero Honda, OIL & GAS -0.5% (50.5) 10,159 RIL and Hindalco Industries were down by 1-2%. In the Mid-cap segment, BSE IT -1.2% (62.6) 5,238 Kansai Nerolac, Essar Ship Ports, Asian Star, Honeywell Auto and State Bank of Bikaner and Jaipur were up by 5-14%, while MVL, Gujarat NRE Coke, REI Six Global Indices Chg (%) (Pts) (Close) Ten, Blue Star and Balrampur Chini were down by 4-6%. Dow Jones -0.5% (50.8) 10,857 Markets Today NASDAQ -0.5% (12.7) 2,398 FTSE 0.1% 7.3 5,680 The trend deciding level for the day is 17572/ 5259 levels. NIFTY trades above Nikkei -0.1% (7.2) 11,090 this level during the first half-an-hour of trade then we may witness a further rally up to 17655 – 17783/ 5284 – 5318 levels. However, if NIFTY trades Hang Seng -0.6% (135.4) 21,239 below 17572 / 5259 levels for the first half-an-hour of trade then it may correct Straits Times -1.6% (45.9) 2,887 up to 17444 – 17361/ 5225 – 5201levels. Shanghai Com -0.6% (19.4) 3,109 Indices S2 S1 R1 R2 Indian ADRs Chg (%) (Pts) (Close) SENSEX 17,361 17,444 17,655 17,783 Infosys -1.5% (0.9) $58.8 NIFTY 5,201 5,225 5,284 5,318 Wipro -0.4% (0.1) $23.3 Satyam -0.4% (0.0) $5.2 News Analysis ICICI Bank -1.7% (0.7) $42.7 Bharti Airtel extends partnership with Ericsson HDFC Bank 2.2% 3.0 $139.4 IRB Infrastructure achieves financial closure for remaining two of its road BOT projects Advances / Declines BSE NSE Refer detailed news analysis on the following page. Advances 1,592 716 Declines 1,240 587 Net Inflows (Mar 30, 2010) Unchanged 95 45 Rs cr Purch Sales Net MTD YTD FII 2,179 1,879 301 18,294 19,270 Volumes (Rs cr) MFs 466 566 (100) (3,809) (5,818) BSE 3,874 FII Derivatives (Mar 31, 2010) NSE 13,275 Open Rs cr Purch Sales Net Interest Index Futures 857 1,540 (683) 12,428 Stock Futures 873 995 (122) 27,587 Gainers / Losers Gainers Losers Company Price (Rs) Chg (%) Company Price (Rs) Chg (%) Essar Ship Ports 74 6.7 Guj NRE Coke 88 -4.8 KSK Energy 184 3.6 Balrampur Chini 92 -3.5 Exide Industries 124 3.5 Tech Mahindra 854 -3.4 Ashok Leyland 56 3.2 Lanco Infra. 52 -3.2 Pantaloon Retll 398 3.2 BF Utilities 858 -3.0 1 Please refer to important disclosures at the end of this report Sebi Registration No: INB 010996539

- 2. Market Outlook | India Research Bharti Airtel extends partnership with Ericsson Bharti Airtel and Ericsson further strengthened their strategic partnership with a US$1.3bn network expansion contract. Airtel users will enjoy an enhanced voice quality and faster data access with the strengthening of this partnership. The expansion covers introduction of some of the latest technologies within the wireless world. The agreement will enable Airtel to put in place a converged network and expanded coverage in rural India. Ericsson will expand and upgrade Airtels network in 15 of India’s 22 telecom circles. As part of this contract, Ericsson will supply its industry leading portfolio of energy efficient 2G /2.5G radio base stations, circuit and packet core, microwave transmission and Intelligent Network to Bharti Airtel. In addition, it will also ensure that Bharti Airtel’s core and transport network is ready for 3G rollout thereby reducing time to market and enable the fast rollout of 3G services at a later date. We maintain Buy on the stock with a Target Price of Rs406. IRB Infrastructure achieves financial closure for remaining two of its road BOT projects IRB Infrastructure (IRB) is a leader in the Road BOT segment with a portfolio of 16 projects and a total project capitalization amounting close to Rs10,000cr. Of the 16 projects, 10 are fully operational two are under construction and four have been secured in the recent past. In one of the latest development, IRB has achieved financial closure for remaining two of its four recently bagged projects – IRB Talegaon-Amravati Toll way and IRB Goa Toll Road, by tying up the debt component of Rs475cr and Rs300cr respectively. With this development, there are no Road BOT projects in IRB’s portfolio which are pending financial closure. This development needs to be seen in the backdrop of the NHAI’s latest amendment to Road project bidding norms, wherein a developer will not be allowed to bid for road BOT projects if it has three or more projects which have not achieved financial closure. This makes IRB eligible to bid for newer projects going ahead. We have valued IRB on an SOTP basis. The portfolio of road BOT projects has been valued on an FCFE basis (Rs149/share), whereas the Construction arm has been valued on an 8x EV/EBITDA basis (Rs117/share). The Land parcel adjoining the Mumbai-Pune expressway and its investments in Sindhdurg Airport project have been valued at 1x P/BV (Rs8/share). We recommend an Accumulate on IRB with a Target Price of Rs274 April 01, 2010 2

- 3. Market Outlook | India Research Economic and Political News February exports surge 34.8% to US$16bn RBI may raise key rates to check inflation: Citi Govt. to mobilize 49% equity from mkt. for Kannur airport Apparel exports dip 14% in January Corporate News L&T bags order worth Rs1,017cr in Buildings and Factories segment Tata Motors converts US$345mn bonds to shares Compact Disc India promoter hikes stake to 24.7% KSK Energy commences Power Generation project in Rajasthan Source: Economic Times, Business Standard, Business Line, Financial Express, Mint April 01, 2010 3

- 4. Market Outlook | India Research Research Team Tel: 022-4040 3800 E-mail: research@angeltrade.com Website: www.angeltrade.com DISCLAIMER This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment decision. Nothing in this document should be construed as an investment or financial advice. Each recipient of this document should make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and risks of such an investment. Angel Securities Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this document are those of the analyst, and the company may or may not subscribe to all the views expressed within. Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's fundamentals. The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources believed to be true, and is for general guidance only. Angel Securities Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel Securities Limited endeavours to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so. This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced, redistributed or passed on, directly or indirectly. Angel Securities Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking or other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in the past. Neither Angel Securities Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in connection with the use of this information. Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Address: Acme Plaza, ‘A’ Wing, 3rd Floor, M.V. Road, Opp. Sangam Cinema, Andheri (E), Mumbai - 400 059. Tel : (022) 3952 4568 / 4040 3800 Angel Broking Ltd: BSE Sebi Regn No : INB 010996539 / CDSL Regn No: IN - DP - CDSL - 234 - 2004 / PMS Regn Code: PM/INP000001546 Angel Securities Ltd:BSE: INB010994639/INF010994639 NSE: INB230994635/INF230994635 Membership numbers: BSE 028/NSE:09946 Angel Capital & Debt Market Ltd: INB 231279838 / NSE FNO: INF 231279838 / NSE Member code -12798 Angel Commodities Broking (P) Ltd: MCX Member ID: 12685 / FMC Regn No: MCX / TCM / CORP / 0037 NCDEX : Member ID 00220 / FMC Regn No: NCDEX / TCM / CORP / 0302 April 01, 2010 4