- The Indian markets opened higher but saw volatility and sharp sell-offs, closing with modest gains of 0.7% for both the Sensex and Nifty. Mid-cap and small-cap indices underperformed.

- For the day, the markets may see further gains if the Nifty trades above 5,295/17,651 in the first half hour, but may correct otherwise.

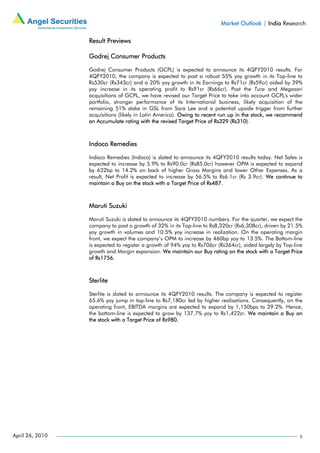

- News highlights include ABG Shipyard winning an order worth Rs. 385 crore and reviews of results from companies such as AREVA T&D, HDFC Bank, ICICI Bank, and Wipro.