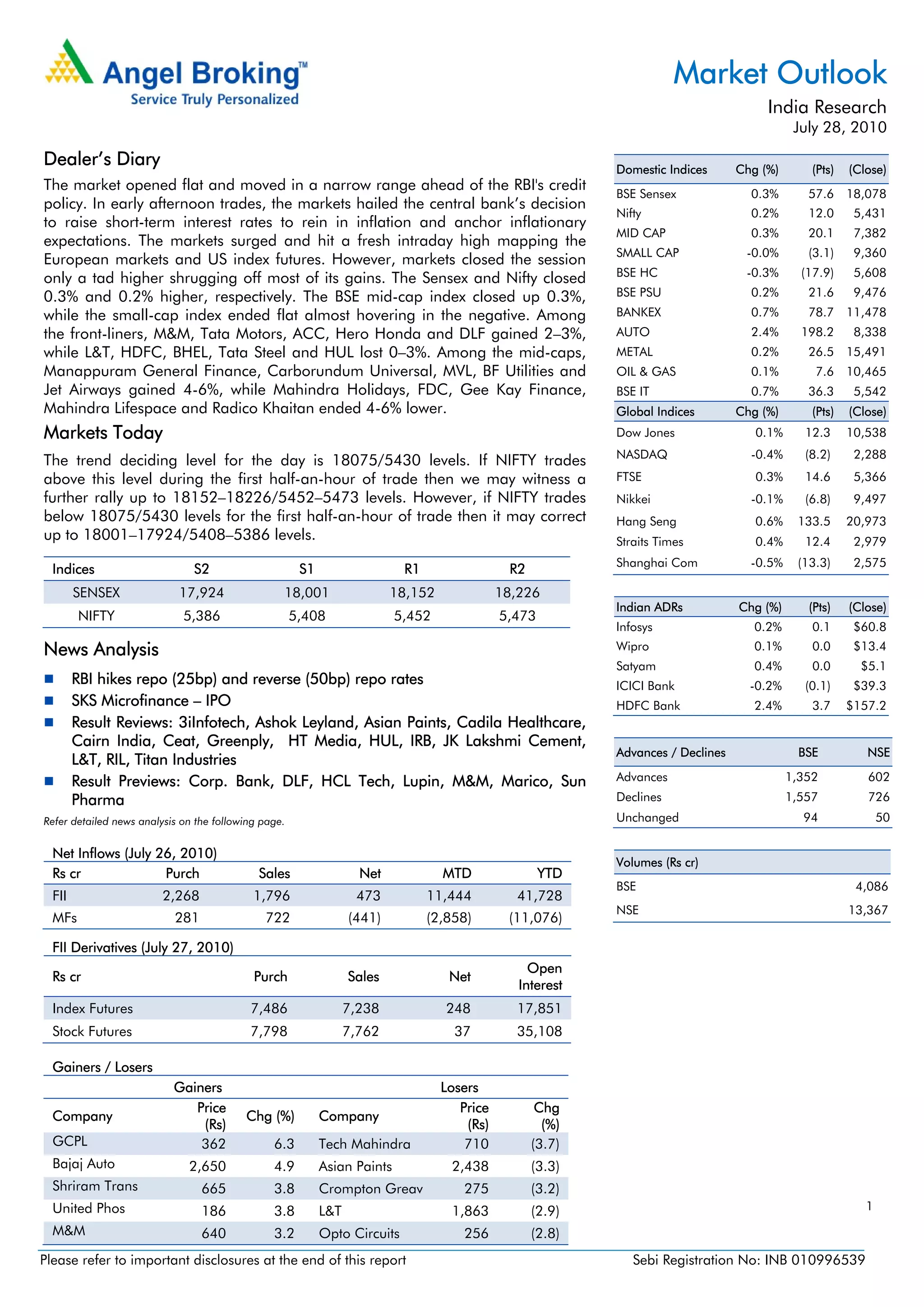

The markets opened flat ahead of the RBI's credit policy announcement and moved in a narrow range. The markets rallied after the RBI raised interest rates to control inflation. However, the markets gave up most gains and closed only slightly higher. The RBI raised repo and reverse repo rates by 25bps and 50bps respectively. SKS Microfinance filed for an IPO to capitalize on the growing microfinance sector in India. Several companies such as 3iInfotech, Ashok Leyland, Asian Paints, and Cairn India reported higher revenues compared to the prior year in their first quarter financial results.