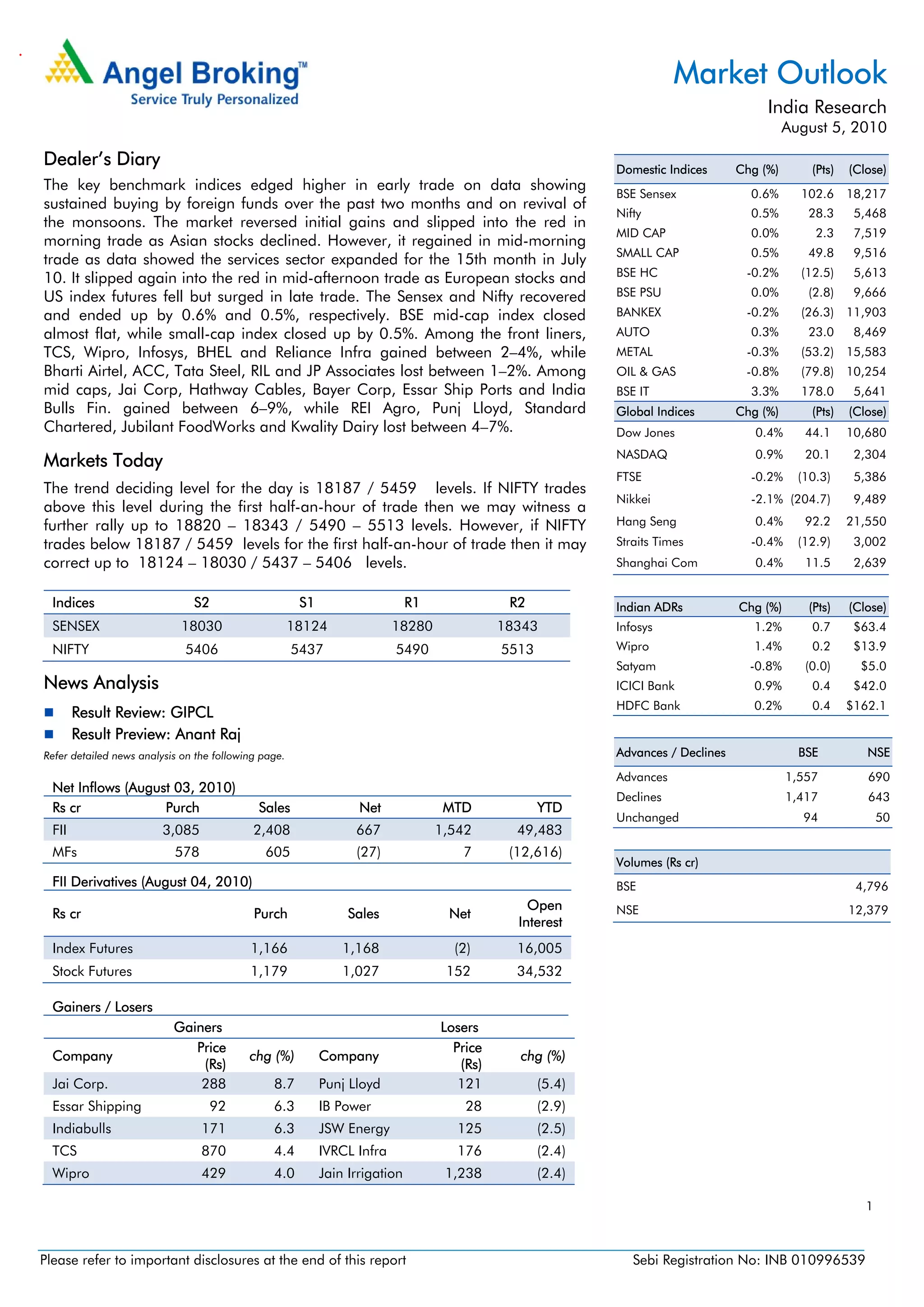

- The key Indian indices edged higher at the beginning of trading due to sustained foreign buying and monsoon revival, but later slipped into negative territory as Asian stocks declined. However, they regained some ground as services sector growth continued.

- TCS, Wipro and Infosys gained 2-4%, while Bharti Airtel, ACC and Tata Steel lost 1-2%. Mid-caps like Jai Corp and Hathway Cables rose 6-9%, while REI Agro and Punj Lloyd fell 4-7%.

- The report provides outlook for the day's trading and lists various companies releasing earnings results.