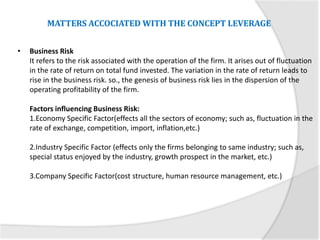

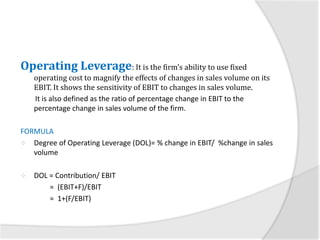

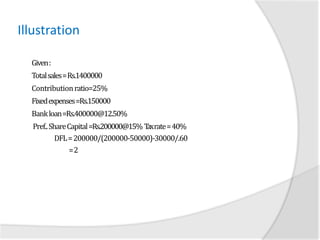

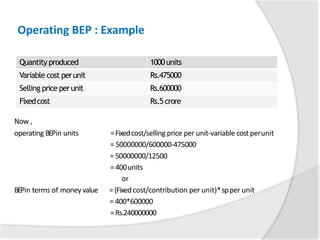

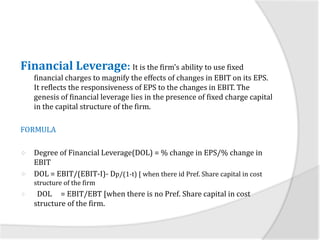

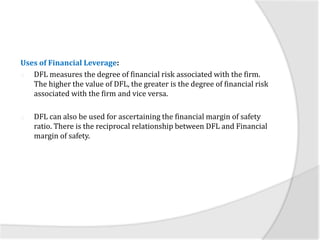

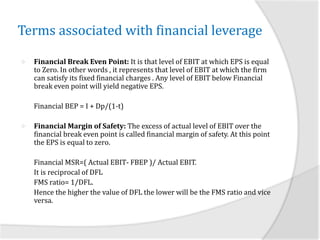

Leverage refers to using fixed costs to magnify returns. There are three types of leverage: operating, financial, and combined. Operating leverage is the sensitivity of earnings to sales changes. Financial leverage is the sensitivity of earnings per share to earnings changes. Combined leverage shows the responsiveness of EPS to sales changes. Calculating the degrees of each leverage type provides measures of risk. Operating leverage is measured by the percentage change in EBIT divided by the percentage change in sales. Financial leverage is measured by the percentage change in EPS divided by the percentage change in EBIT. Combined leverage is the product of operating and financial leverage.

![Combined Leverage: The product of Operating Leverage and

Financial Leverage is called Combined Leverage. It shows the

responsiveness of EPS to the changes in sales volume of the firm.

FORMULA

DTL= DOL*DFL

DTL= % change in EPS/% change in sales volume.

DTL = [1+(I+F)/ EBT]

Use

It measures the total risk associated with the firm i.e; it provides a

risk profile of the firm.](https://image.slidesharecdn.com/leverage-190125062632/85/Leverage-17-320.jpg)