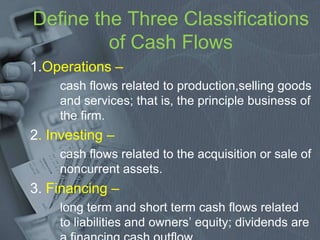

The document discusses cash flow statements, which show how changes in balance sheet accounts affect cash. It defines cash flow statements as having three classifications: operations, investing, and financing. It provides examples of cash flows that fall under each classification and discusses key components and preparation methods of the statement of cash flows. The document also covers issues in cash flow analysis, such as time horizons, biases, and the time value of money.