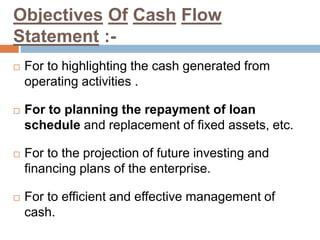

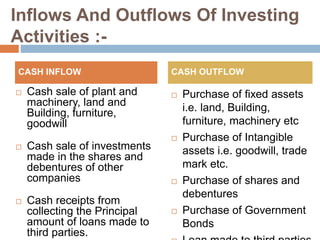

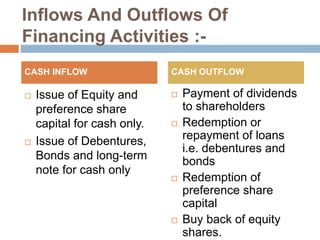

The document defines a cash flow statement as a summary of cash receipts and payments for a period of time that explains changes in a firm's cash position. It has three sections - operating, investing, and financing activities - that show cash inflows and outflows. Operating activities relate to core business operations, investing activities involve long-term asset acquisition and disposal, and financing activities pertain to raising and repaying financial capital. The cash flow statement provides information on a firm's liquidity, cash generation, and ability to meet debt obligations.