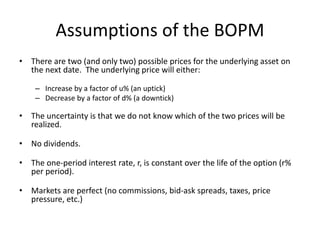

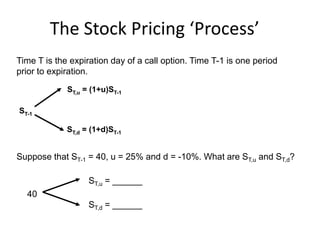

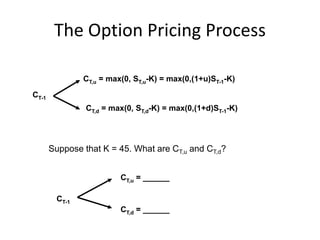

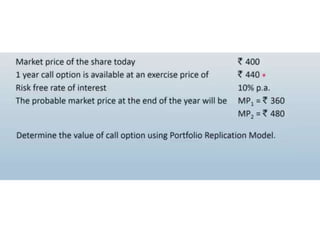

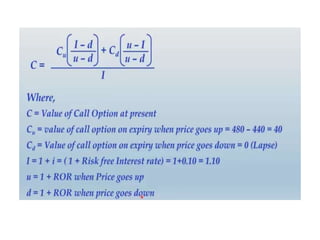

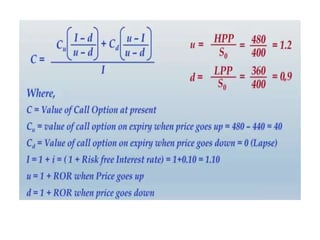

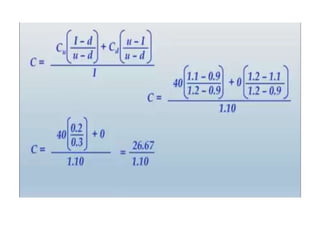

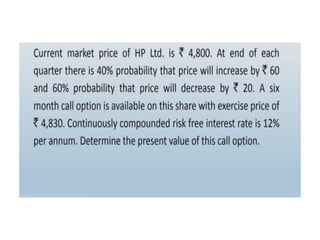

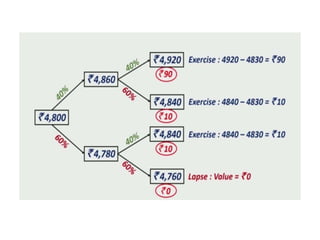

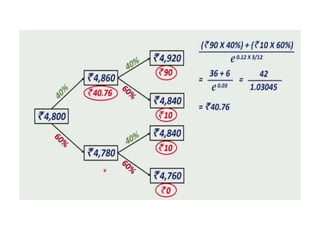

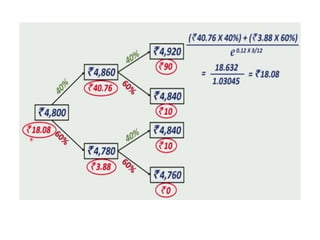

The document introduces the binomial option pricing model, which values options by allowing the underlying asset price to move up or down by a set percentage at each time period. It assumes two possible prices, constant interest rates over the life of the option, and perfect markets. The model is then demonstrated by calculating the possible up and down prices of a stock and related call option values at the next time period, given inputs like the current stock price, interest rates, and strike price.