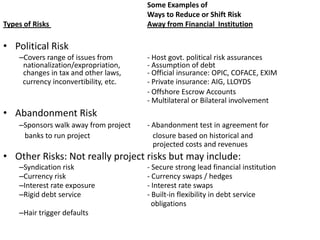

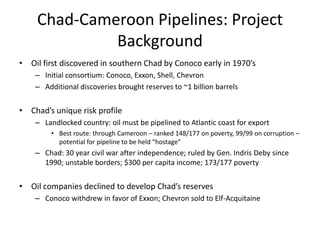

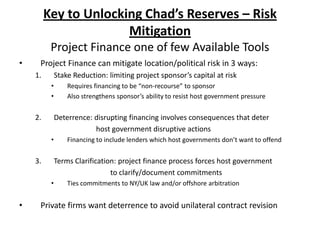

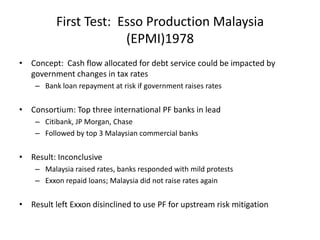

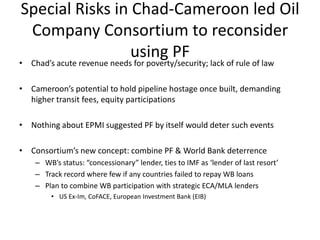

This document discusses project financing and political risk mitigation for the Chad-Cameroon oil pipeline project. It describes how project financing was used to reduce risks for sponsors by limiting their capital at risk and providing deterrence against host government disruption through consequences for disrupting financing. It also discusses how the project financing process forced host governments to clarify and document their commitments. The project combined project financing with World Bank participation to further increase deterrence given the World Bank's status as a concessionary lender with ties to the IMF.