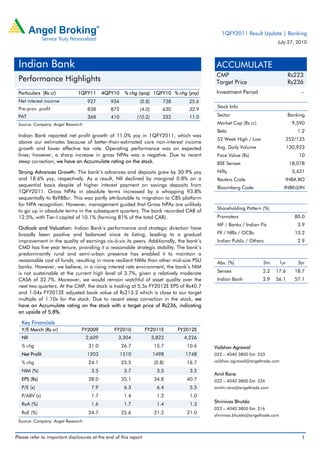

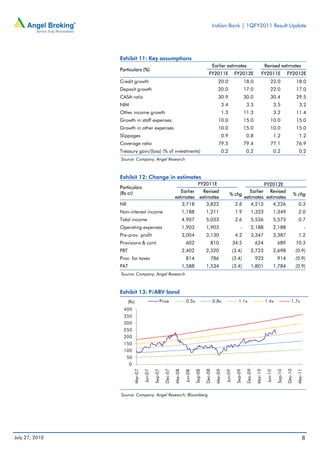

1) Indian Bank reported an 11% increase in net profit for 1QFY2011 compared to the previous year, which was above estimates. However, gross NPAs sharply increased.

2) Advances and deposits grew by 31% and 19% respectively year-over-year. Net interest income declined slightly sequentially despite higher interest payments on savings deposits.

3) Going forward, the bank's net interest margins may decline in a rising interest rate environment given its moderate CASA ratio of 33%, and asset quality will need to be monitored in the next two quarters.