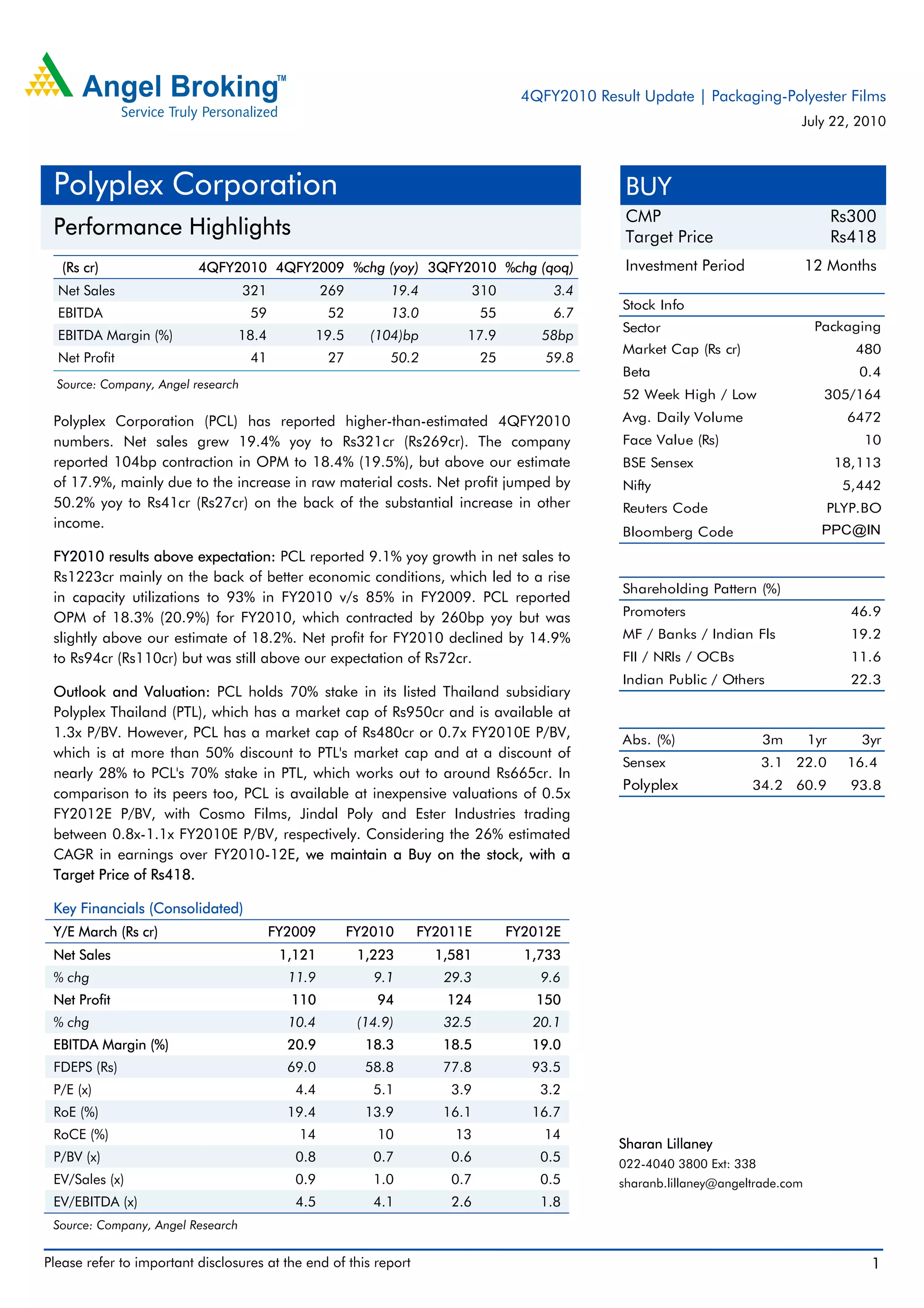

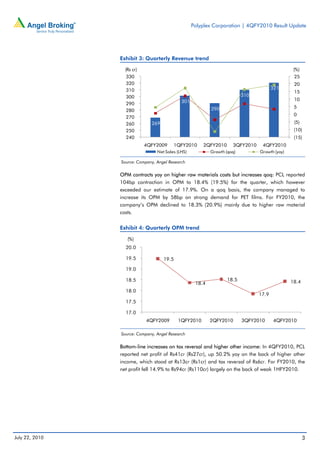

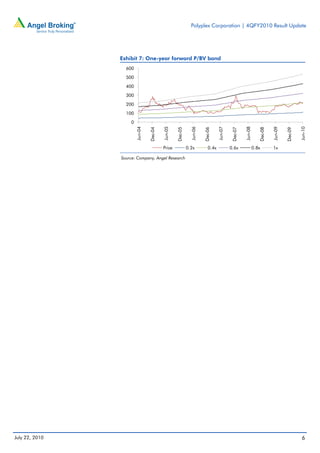

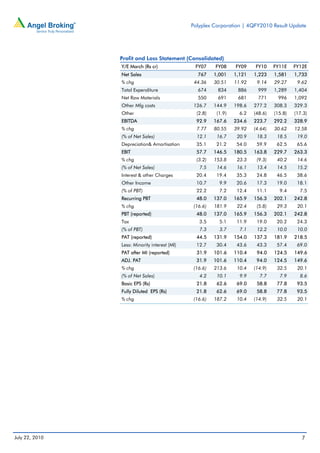

Polyplex Corporation reported higher-than-estimated quarterly and annual results. Net sales grew 19.4% year-over-year for the quarter and 9.1% for the full year. Quarterly net profit jumped 50.2% year-over-year due to a substantial increase in other income. For the full year, net profit declined 14.9% but was above estimates. The company trades at a discount to its peers and its Thailand subsidiary, despite an estimated 26% earnings CAGR over the next two years. The analyst maintains a "Buy" rating with a target price of Rs418.