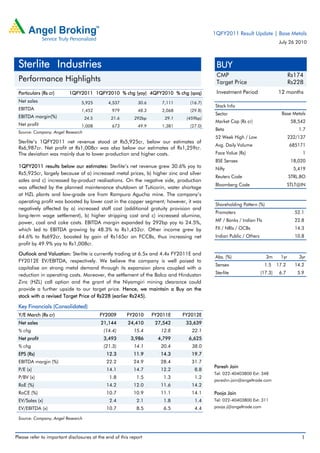

Sterlite Industries reported lower than expected results for the first quarter of fiscal year 2011. Net revenue grew 30.6% year-over-year to Rs5,925 crore, below Angel Research estimates, due to lower production from planned maintenance shutdowns and resource issues. EBITDA grew 48.3% to Rs1,452 crore but margins expanded less than expected. Net profit increased 49.9% to Rs1,008 crore, also below estimates. Segment performance was mixed, with copper improving but aluminum declining due to cost pressures. The results were impacted by higher costs and lower production than anticipated.