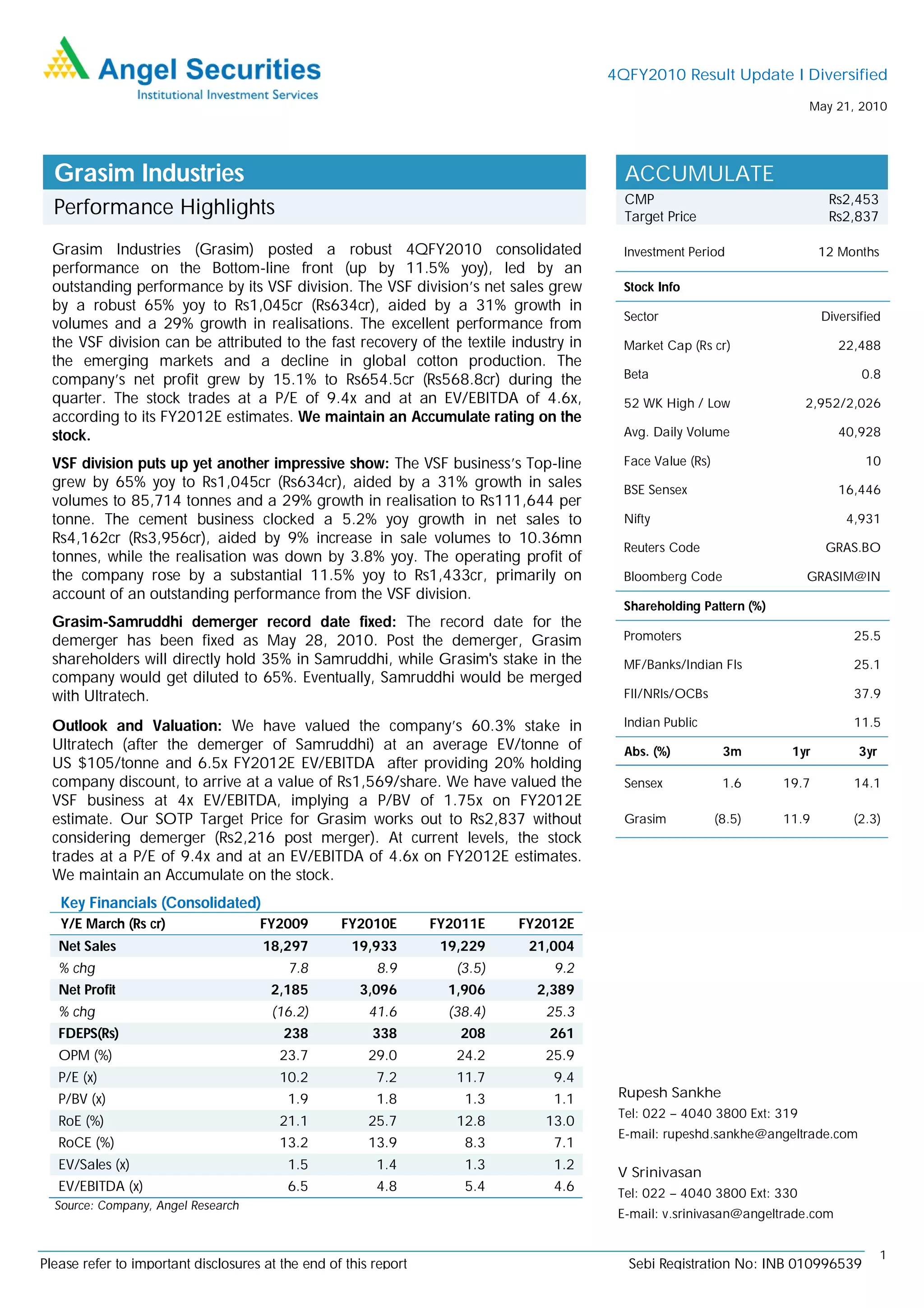

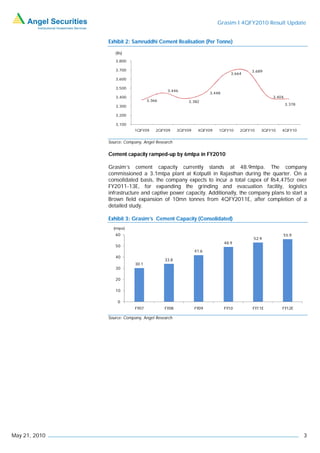

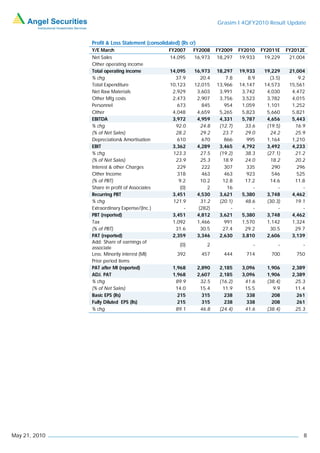

Grasim Industries reported a robust 11.5% year-over-year increase in net profit for the fourth quarter of fiscal year 2010, led by an outstanding 65% sales growth in its viscose staple fiber division. The company's overall sales were up 10.8% to Rs. 5,475 crore for the quarter. The cement business also performed well, with a 5.2% sales increase. Going forward, the company plans additional capacity expansions across its businesses to continue its growth trajectory.