Market Outlook - 2 November 2010

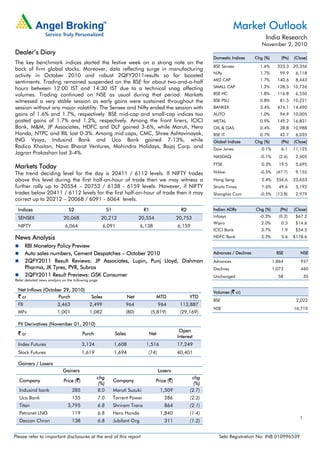

- 1. 1 Market Outlook India Research November 2, 2010 Please refer to important disclosures at the end of this report Sebi Registration No: INB 010996539 Dealer’s Diary The key benchmark indices started the festive week on a strong note on the back of firm global stocks. Moreover, data reflecting surge in manufacturing activity in October 2010 and robust 2QFY2011results so far boosted sentiments. Trading remained suspended on the BSE for about two-and-a-half hours between 12:00 IST and 14:30 IST due to a technical snag affecting volumes. Trading continued on NSE as usual during that period. Markets witnessed a very stable session as early gains were sustained throughout the session without any major volatility. The Sensex and Nifty ended the session with gains of 1.6% and 1.7%, respectively. BSE mid-cap and small-cap indices too posted gains of 1.7% and 1.2%, respectively. Among the front liners, ICICI Bank, M&M, JP Associates, HDFC and DLF gained 3-6%, while Maruti, Hero Honda, NTPC and RIL lost 0-3%. Among mid caps, CMC, Shree Ashtavinayak, ING Vysya, Indusind Bank and Uco Bank gained 7-13%, while Radico Khaitan, Nava Bharat Ventures, Mahindra Holidays, Bajaj Corp. and Jagran Prakashan lost 3-4%. Markets Today The trend deciding level for the day is 20411 / 6112 levels. If NIFTY trades above this level during the first half-an-hour of trade then we may witness a further rally up to 20554 – 20753 / 6138 - 6159 levels. However, if NIFTY trades below 20411 / 6112 levels for the first half-an-hour of trade then it may correct up to 20212 – 20068 / 6091 - 6064 levels. Indices S2 S1 R1 R2 SENSEX 20,068 20,212 20,554 20,753 NIFTY 6,064 6,091 6,138 6,159 News Analysis RBI Monetary Policy Preview Auto sales numbers, Cement Despatches – October 2010 2QFY2011 Result Reviews: JP Associates, Lupin, Punj Lloyd, Dishman Pharma, JK Tyres, PVR, Subros 2QFY2011 Result Previews: GSK Consumer Refer detailed news analysis on the following page Net Inflows (October 29, 2010) ` cr Purch Sales Net MTD YTD FII 3,463 2,499 964 964 113,887 MFs 1,001 1,082 (80) (5,819) (29,169) FII Derivatives (November 01, 2010) ` cr Purch Sales Net Open Interest Index Futures 3,124 1,608 1,516 17,249 Stock Futures 1,619 1,694 (74) 40,401 Gainers / Losers Gainers Losers Company Price (`) chg (%) Company Price (`) chg (%) Indusind bank 285 8.0 Maruti Suzuki 1,509 (2.7) Uco Bank 135 7.0 Torrent Power 286 (2.2) Titan 3,795 6.8 Shriram Trans 864 (2.1) Petronet LNG 119 6.8 Hero Honda 1,840 (1.4) Deccan Chron 138 6.8 Jubilant Org 311 (1.2) Domestic Indices Chg (%) (Pts) (Close) BSE Sensex 1.6% 323.3 20,356 Nifty 1.7% 99.9 6,118 MID CAP 1.7% 140.6 8,443 SMALL CAP 1.2% 128.5 10,726 BSE HC 1.8% 116.8 6,550 BSE PSU 0.8% 81.5 10,221 BANKEX 3.4% 474.1 14,490 AUTO 1.0% 94.9 10,005 METAL 0.9% 149.2 16,831 OIL & GAS 0.4% 38.8 10,988 BSE IT 0.7% 42.7 6,035 Global Indices Chg (%) (Pts) (Close) Dow Jones 0.1% 6.1 11,125 NASDAQ -0.1% (2.6) 2,505 FTSE 0.3% 19.5 5,695 Nikkei -0.5% (47.7) 9,155 Hang Seng 2.4% 556.6 23,653 Straits Times 1.6% 49.6 3,192 Shanghai Com -0.5% (13.8) 2,979 Indian ADRs Chg (%) (Pts) (Close) Infosys -0.3% (0.2) $67.2 Wipro 2.0% 0.3 $14.6 ICICI Bank 3.7% 1.9 $54.5 HDFC Bank 3.3% 5.6 $178.6 Advances / Declines BSE NSE Advances 1,864 937 Declines 1,073 460 Unchanged 58 35 Volumes (` cr) BSE 2,022 NSE 14,710

- 2. November 2, 2010 2 Market Outlook | India Research RBI Monetary Policy Preview RBI to continue to combat inflation: The growth momentum in the Indian economy continues to be strong. Real GDP growth was 8.8% during 1QFY2011, which was the highest quarterly growth recorded since 3QFY2008. Also, despite some moderation in recent months, IIP grew by 10.6% during April-August 2010, as compared to 5.9% during the same period in 2009. While credit growth has been hovering around the 20% mark targeted by the RBI, inflation continues to be stubbornly high at 8.6% yoy, well above the RBI's target of 6.0%. As of now, the trade-off seems more favourable on restraining inflation. Hence, we believe the RBI would find it prudent to continue the process of gradual domestic monetary tightening. Liquidity situation may prompt a hold on the CRR front: Since the previous mid-quarter monetary policy review by the RBI on September 16, 2010, liquidity in the system has completely dried up, as reflected in the bank’s average borrowings of ~`58,300cr from the RBI. The decline in liquidity has been primarily on account of continuous lagging of deposit growth as compared to credit growth and steady stream of big-ticket primary issuances. On October 29, 2010, banks borrowed ~`1,17,700cr from the RBI, which was the highest since October 10, 2008. As a result of the above developments, the 10-year benchmark G-sec yields have hardened from 7.98% as of September 16, 2010, to 8.13% as of October 29, 2010. Thus, the current liquidity situation may lead the RBI to delay any CRR hike in contemplation. Accordingly, we expect the RBI to hike repo and reverse repo rates by 25bp each to 6.25% and 5.25%, respectively. However, considering the current liquidity situation, we do not expect a CRR hike in the coming policy. Auto sales numbers – October 2010 Maruti Suzuki (Maruti) Maruti report yet another month of strong volumes. The company reported the highest- ever monthly sales during October 2010, growing at an impressive 10% mom. October volumes grew by 39.2% yoy to 118,908 units (85,415), led by 50.3% yoy growth in the domestic market at 107,555 units. Exports during the month declined by 18.1% yoy to 11,353 units. Maruti continues to maintain its growth momentum in the A2, A3 and C segments, posting 50.7%, 32% and 91.8% growth, respectively, in October 2010. Mahindra & Mahindra (M&M) M&M reported robust overall growth of 32% yoy in total sales to 58,776 units (44,442) in October 2010, aided by 34% yoy growth in the automotive segment. The four-wheeler pick-up segment grew substantially by 53% yoy as GIO and Maxximo sales continued to witness a strong traction. The UV segment grew by 21% yoy, led by Scorpio and Xylo. Logan sales continued to revive, growing at a strong rate of 169% yoy, albeit on a low base. Domestic tractor sales grew by 31% yoy. Management has indicated that the supply constraint on the UV and tractor fronts has eased out to a certain extent and expects the demand scenario to come down to a normalised level post the festival season.

- 3. November 2, 2010 3 Market Outlook | India Research Tata Motors (TML) TML reported 21.3% yoy growth in total volumes, with the passenger vehicles (PV) segment growing by 22.8% yoy, while the commercial vehicles (CV) segment growing by 20.3% yoy during the month. Growth in the PV segment was aided by a 20.7% yoy increase in the cars category, with the Indigo range leading the pack, growing by 69.3%. Nano volumes declined for the second straight month on an mom basis, down by 44.5% mom. The CV segment grew by 20.3% yoy on the back of growth in the medium and heavy commercial vehicles (M&HCV) segment and LCV segment. Exports continued to report strong performance, growing by 108.6% yoy. Hero Honda (HH) HH reported robust 42.7% growth in sales volume, selling 505,553 units (354,156), led by strong growth across segments. The new bikes–New Super Splendor and Splendor Pro– launched in September 2010 also helped the company to post the highest-ever monthly sales. TVS Motor (TVS) TVS continued to maintain impressive 38.2% yoy growth, led by robust growth in all the segments of the two and three-wheeler market. While motorcycle sales grew by 49.2% yoy to 84,233 units (56,465), the scooter segment registered 57.8% yoy growth to 44,659 units (28,301). Three-wheeler sales grew by 278.2% yoy at 3,449 units (912). Overall, exports reported strong 44.8% growth to 18,051 units (12,466). Cement companies post double digit despatch growth in October 2010 Cement manufacturers have reported healthy growth in cement despatches during October 2010. Grasim’s despatches grew by 21.3% to 3.42 million tonnes (mt). ACC’s despatches grew by robust 13.9% yoy and stood at 1.92mt, while Ambuja’s despatches stood at 1.75mt, up 19.7% yoy. We believe the impressive growth in despatches is due to strong pent-up demand arising from the infrastructure segment post the cessation of monsoons. Despatches growth also indicates that the price hikes carried out by cement manufacturers have been absorbed by the market. Going ahead, we believe cement manufacturers would increase their production to capitalise on the high prices. This move, if undertaken, would increase supply and put pressure on prices again. We continue to remain Neutral on ACC, Ambuja and UltraTech Cement as they are fairly priced. We maintain a Buy on India Cements (Target Price `139), Madras Cements (Target Price `141) and JK Lakshmi Cement (Target Price `92).

- 4. November 2, 2010 4 Market Outlook | India Research Result Reviews – 2QFY2011 Jaiprakash Associates JAL reported robust top-line growth of 62.6% yoy to `3,071cr (`1,889cr), significantly ahead of our estimates of 33.1% growth, aided by strong 73% and 43% growth in construction and cement revenue, respectively. However, EBIT margin of the cement segment played a spoil-sport and impacted overall OPM, which came in at 24.7% as against our estimate of 27.2%. Interest and depreciation costs were in line with our estimates. The bottom line declined by 16.3% to `115.5cr (`138cr) mainly due to higher tax provision for the quarter (61%). We expect JAL to become one of the fastest growing conglomerates and post top-line and bottom-line CAGR of 33.9% and 31.5%, respectively, over FY010-12. We have valued JAL’s cement business at 6.5x EV/EBITDA (`62.7/share) and construction division at FY2012E target EV/EBITDA multiple of 8.5x (`78.5/share). We have valued its power and real estate businesses on market cap basis (giving 20% holding company discount) contributing `81.8/share to our target price. Treasury shares (`11.1/share) have been valued at the current market price, whereas net debt is accounted for on a per share basis in our valuation at `65.1. We maintain Buy on the stock with an SOTP Target Price of `169, implying an upside of 35% from current levels. Lupin Lupin reported its 2QFY2011 results, which were ahead of our estimates. Net sales came in at `1,405cr (`1,115cr), up 26.0% yoy, driven by the US generic business. The US generic business grew by strong 53% yoy, while the US branded business grew by mere 10%. Further, the Japan market posted healthy growth of 22% to `157cr, while the India formulation market grew by 21% to `419cr. OPM for the quarter came in at 19.2% and was in line with our estimates. The company reported net profit of `219cr (`161cr), up 36.5% yoy, driven by top-line growth. The stock is trading at 24.0x FY2011E and 19.2x FY2012E earnings. We recommend Neutral on the stock. Punj Lloyd Punj Lloyd (Punj) posted top-line de-growth of 31% yoy to `1,988cr (`2,872cr). Operating margin for the quarter came in at 9.2% (7.4%), a jump of 180bp. The bottom line declined by 55% yoy to `23.9cr (`51.5cr). Punj’s order book stands at `25,470cr, with an order inflow of `4,313cr this quarter. We will be releasing a detailed note after the conference call. We maintain our positive view on the stock, and the stock is currently under review. Dishman Pharma Dishman Pharma (Dishman) reported its 2QFY2011 results, which were in line with our estimates. The company reported net sales of `213cr, flat yoy. CRAMS revenue came in at ` 160cr, which was flat yoy, while marketable molecule sales came in at `52, down 6%. Dishman reported OPM of 17.4% (20.4%), which was lower than our estimate. OPM contracted by 300bp yoy on the back of increased employee and SG&A expenses. The company recorded higher other operating income of `20cr (`6cr) on the back of forex gains. As a result, net profit came in at `28cr (`25cr), up 13.7% yoy. The stock is under review.

- 5. November 2, 2010 5 Market Outlook | India Research JK Tyre JK Tyre reported a turnover of Rs1,139cr (Rs941cr) for 2QFY2011, an increase of 20.9% yoy. Top-line growth was aided by volume growth of ~15% in tonnage terms. On the operating front, the company posted a 45.6% yoy decline in operating profit to Rs74cr (Rs137cr) for 2QFY2011. Operating margin dipped substantially by 800bp yoy, primarily due to a spurt in rubber prices leading to a substantial 1,187bp yoy increase in raw- material cost at 70.6% (58.7%) of sales in 2QFY2011. Net profit dipped by 66% to Rs20.2cr (Rs59.5cr) for the quarter, primarily on account of margin contraction. The drop in net profit growth was restricted due to a decline in interest expense, which was down 11.3% during the quarter. In view of the apparent structural shift that the tyre industry is going through, we retain our Buy rating on the stock; however, the Target Price is under review. PVR PVR posted strong set of consolidated numbers on both the revenue and the earnings front. While the top line grew by robust 49% yoy/32% qoq to `134cr (`90cr/`102cr) aided by better movie pipeline (I hate luv storys, Once upon a time in Mumbai, Aisha and Debangg), earnings grew by 39% yoy/77% qoq to `9cr (`6.4cr/`5.1cr), aided by significant margin expansion and a 5% yoy decrease in interest expense, despite high depreciation cost of `16.4cr (`6.3cr) and 53% yoy/60% qoq decrease in other income to `1.6cr. In terms of operating performance, PVR’s consolidated margins expanded by 705bp yoy/1,049bp qoq to 24.5% (17.5%/14.1%), aided by significant cost curtailment measures undertaken by the company. Film distributor’s expense (down 643bp yoy/ 563bp qoq), F&B expense (down 139bp yoy/128bp qoq), staff cost (down 225bp yoy/ 211bp qoq) and rental expense (down 408bp yoy/400bp qoq, on account of merger of Leisure World with itself) declined. However, the increase in movie distribution and other expenditure by 643bp yoy and 90bp yoy, respectively, restricted further margin expansion. The stock is currently under review. Subros Subros reported a mixed set of results, with strong top-line growth; however, the bottom line declined due to increased cost pressures. Net sales registered 27.5% growth to Rs278cr, primarily on the back of robust 30% growth in volumes. Average realisation however, registered a marginal decline of 2% yoy. On the operating front, EBITDA margins declined by a substantial 387bp to 6.7% (10.6% in 2QFY2010), largely on account of a 435bp yoy increase in raw-material costs. Raw-material cost during the quarter was negatively impacted by a ~10% yoy appreciation in Yen against the Rupee. As a result, the company’s bottom line declined by a substantial 27% yoy. However, we believe growth in the passenger vehicle segment augurs well for Subros and maintain our Buy rating. The Target Price in under review. Result Previews – 2QFY2011 GSKCHL GSK Consumer is slated to announce its 3QCY2010 numbers. For the quarter, we expect GSK Consumer to post modest growth of 18% yoy in its top line to ` 584cr, driven by growth in its core brands and new product launches. The bottom line is expected to register growth of 20.7% yoy to `72, aided by top-line growth and margin expansion of 24bp to 20.4%. We upgrade from Reduce to Accumulate on the stock, as we roll over to CY2012E with a Target Price of `2,118.

- 6. November 2, 2010 6 Market Outlook | India Research Economic and Political News No diesel dual pricing, new subsidy mechanism in works: Deora High inflation affecting export competitiveness: RBI RBI hints at rate hike; says taming inflation priority SEZ exports up 56% in April-September Corporate News Shoppers Stop to open 4-5 Hypercity stores in FY2012 Coal India H1 production at 185.7mt, slips 9% from the target Tulip Telecom bags Rs38cr orders from Punjab JSW Energy to set up 660MW power plant Source: Economic Times, Business Standard, Business Line, Financial Express, Mint Events for the day 3I Infotech Results Berger Paints Results Electrosteel Cast Results Essel Propack Results Future Capital Results Glaxosmithkl Cons Results Jai Corp Results Neyveli Lignite Results Oracle Fin Results Orbit Corp Results Sabero Organics Results Satra Prop Results Spicejet Results Zodiac Ventures Results

- 7. November 2, 2010 7 Market Outlook | India Research Research Team Tel: 022-4040 3800 E-mail: research@angeltrade.com Website: www.angeltrade.com DISCLAIMER This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and risks of such an investment. Angel Broking Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this document are those of the analyst, and the company may or may not subscribe to all the views expressed within. Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's fundamentals. The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel Broking Limited endeavours to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so. This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced, redistributed or passed on, directly or indirectly. Angel Broking Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking or other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in the past. Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in connection with the use of this information. Note: Please refer to the important ‘Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Limited and its affiliates may have investment positions in the stocks recommended in this report. Angel Broking Ltd: BSE Sebi Regn No : INB 010996539 / CDSL Regn No: IN - DP - CDSL - 234 - 2004 / PMS Regn Code: PM/INP000001546 Angel Capital & Debt Market Ltd: INB 231279838 / NSE FNO: INF 231279838 / NSE Member code -12798 Angel Commodities Broking (P) Ltd: MCX Member ID: 12685 / FMC Regn No: MCX / TCM / CORP / 0037 NCDEX : Member ID 00220 / FMC Regn No: NCDEX / TCM / CORP / 0302 Address: Acme Plaza, ‘A’ Wing, 3rd Floor, M.V. Road, Opp. Sangam Cinema, Andheri (E), Mumbai - 400 059. Tel : (022) 3952 4568 / 4040 3800