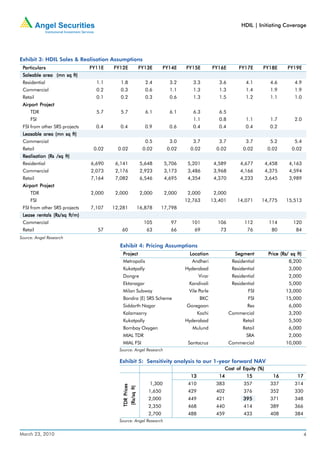

HDIL is initiating coverage with a buy recommendation and target price of Rs356 per share. HDIL's Mumbai International Airport redevelopment project is on track to generate significant revenue. The company is also set to benefit from strong land development rights (TDR) prices in Mumbai, which have recovered in recent years. At the current price of Rs284 per share, HDIL is trading at a 28% discount to the analyst's 1-year forward estimate of net asset value (NAV) of Rs395 per share. The target price of Rs356 represents a 10% discount to the estimated 1-year forward NAV.