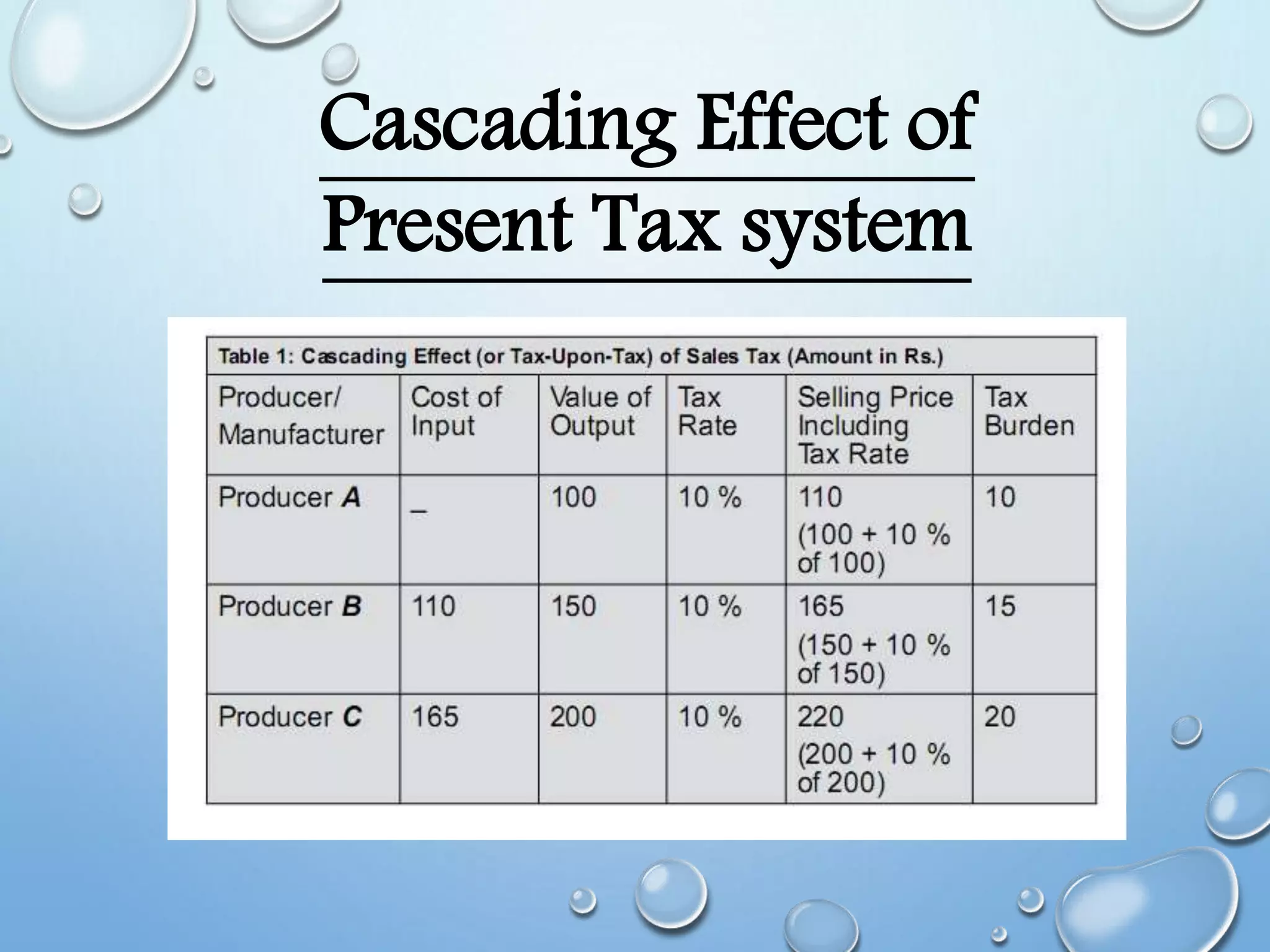

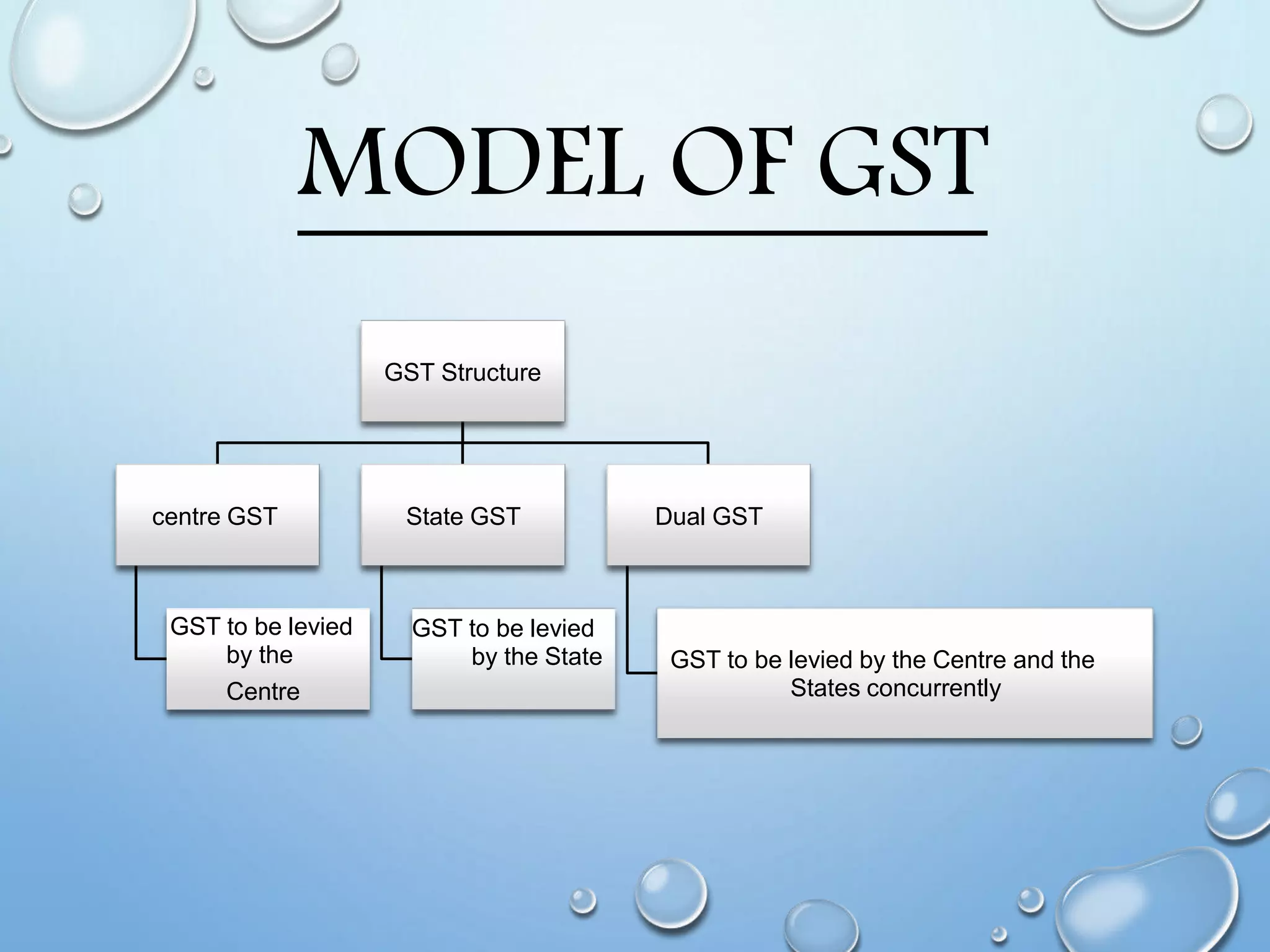

GST (Goods and Services Tax) is proposed as India's biggest tax reform. It will replace existing indirect taxes and provide a comprehensive indirect tax levy. GST is proposed as a dual GST with the center and states concurrently levying it. There are many advantages like removing cascading of taxes and creating a unified market. However, its complex design involving both center and states coordinating poses administrative challenges. Overall, GST has the potential to simplify taxation and boost growth if its implementation addresses all stakeholders' concerns.