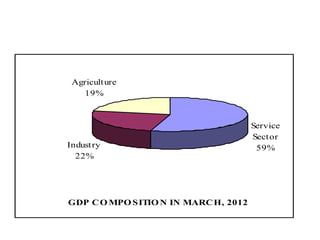

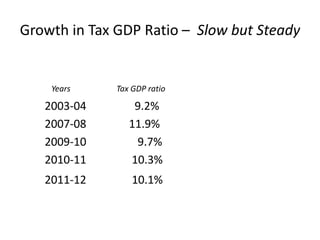

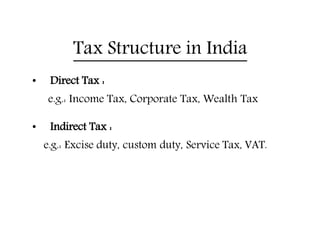

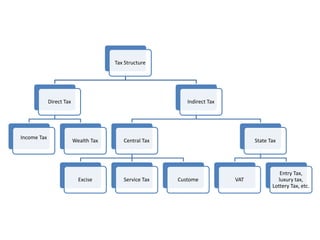

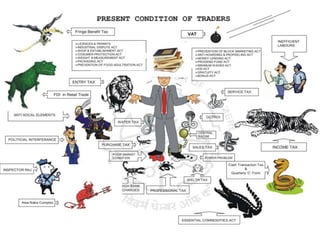

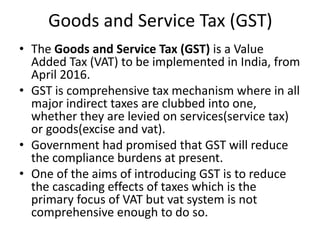

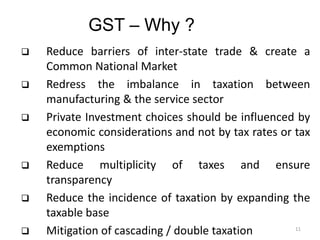

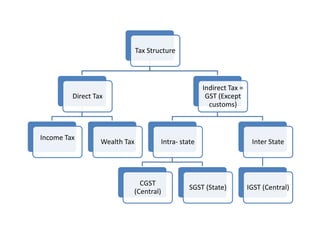

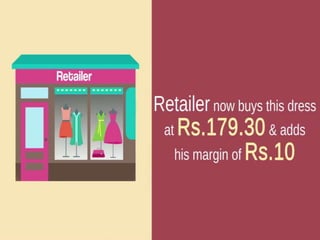

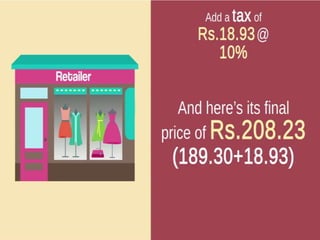

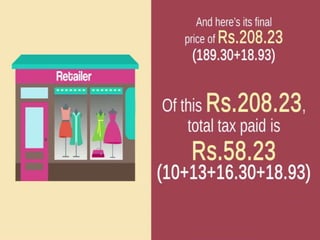

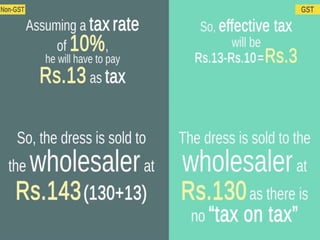

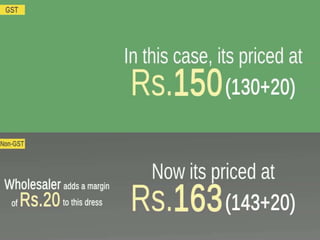

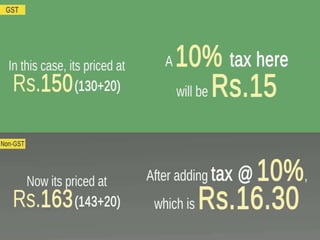

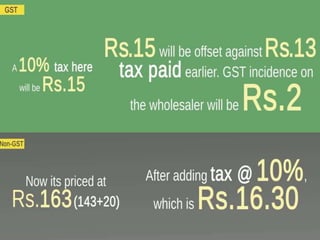

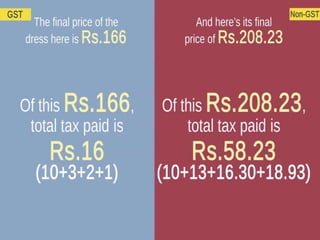

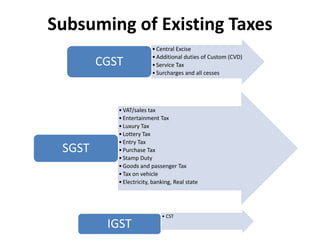

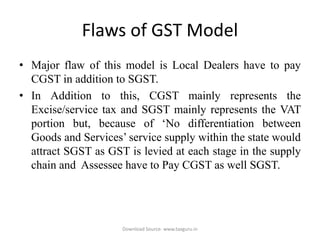

The document discusses India's proposed Goods and Services Tax (GST). It provides an overview of India's economy and current tax structure, which includes direct taxes like income tax and indirect taxes like excise duties and VAT that are levied by both central and state governments. The current system suffers from issues like tax cascading, complexity, and tax evasion. GST is presented as a comprehensive indirect tax that will replace existing indirect taxes and be levied as CGST, SGST, and IGST depending on whether a good or service is transacted intra-state or inter-state. The GST is aimed to simplify taxation, reduce the compliance burden, increase tax collection, and create a common national market. While G