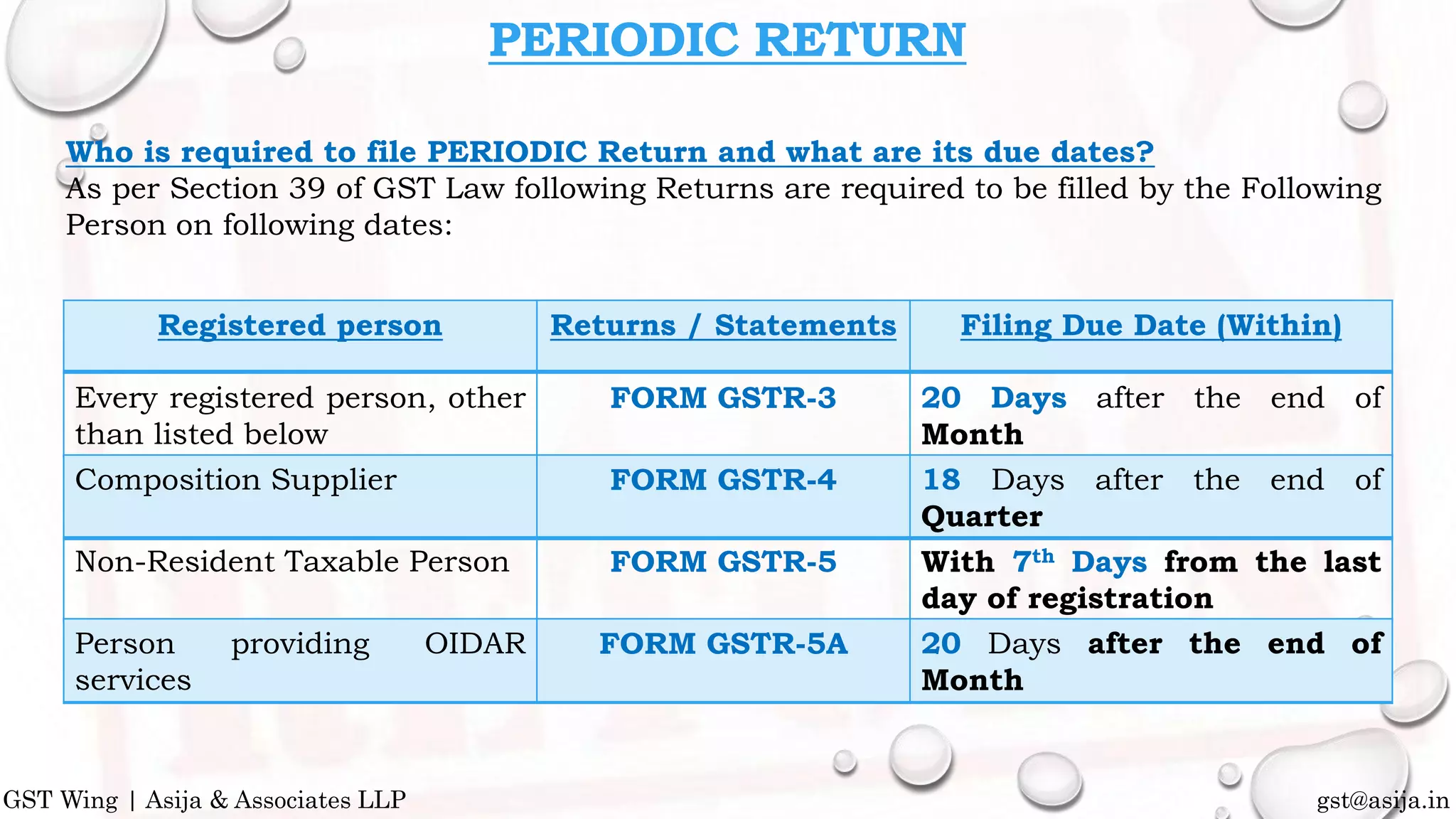

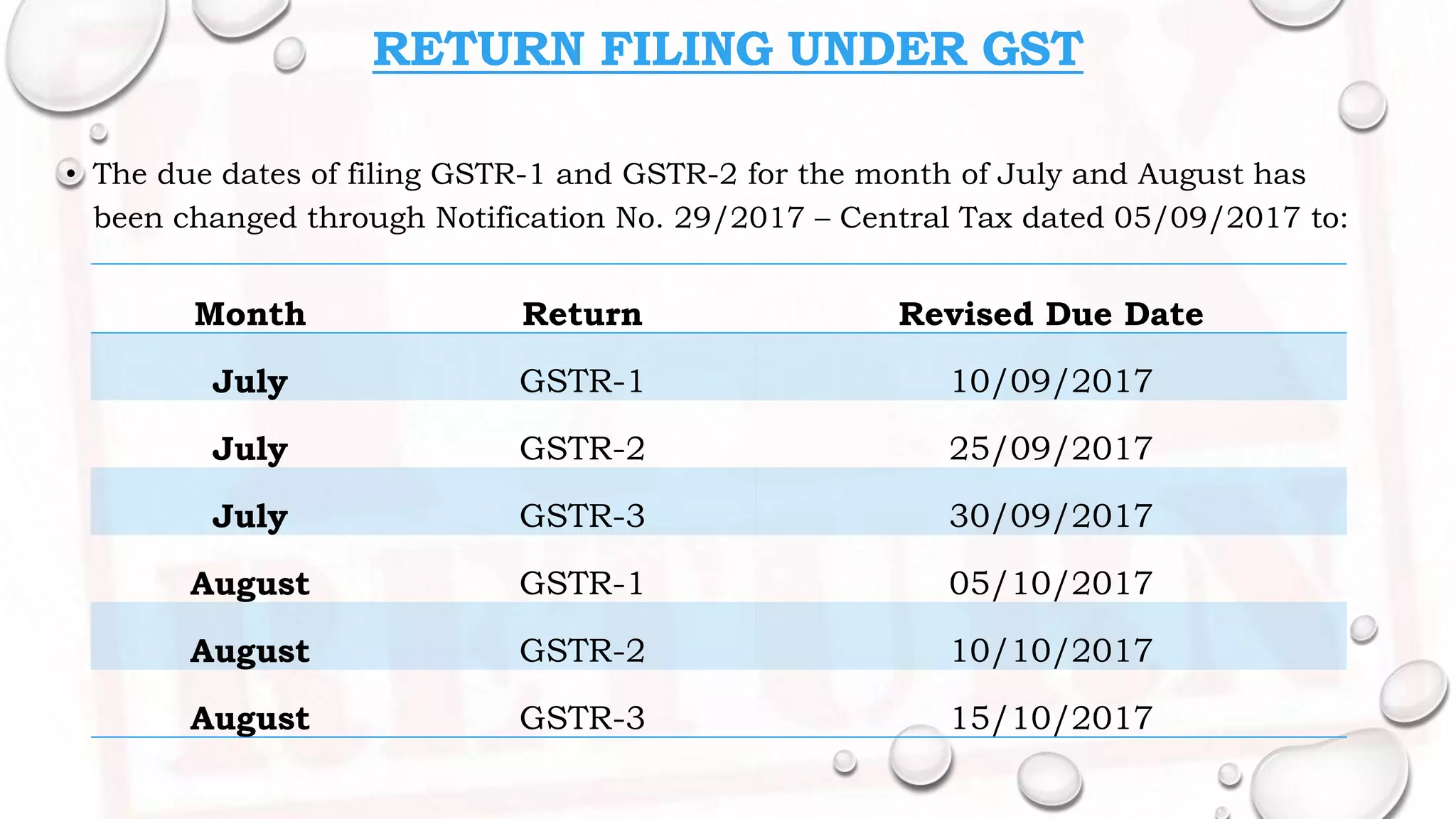

- Periodic returns like GSTR-3 (monthly), GSTR-4 (quarterly for composition scheme taxpayers), GSTR-5 (non-resident taxpayers), GSTR-6 (input service distributors), and GSTR-7/8 (tax deducted at source) must be filed by specified due dates each period.

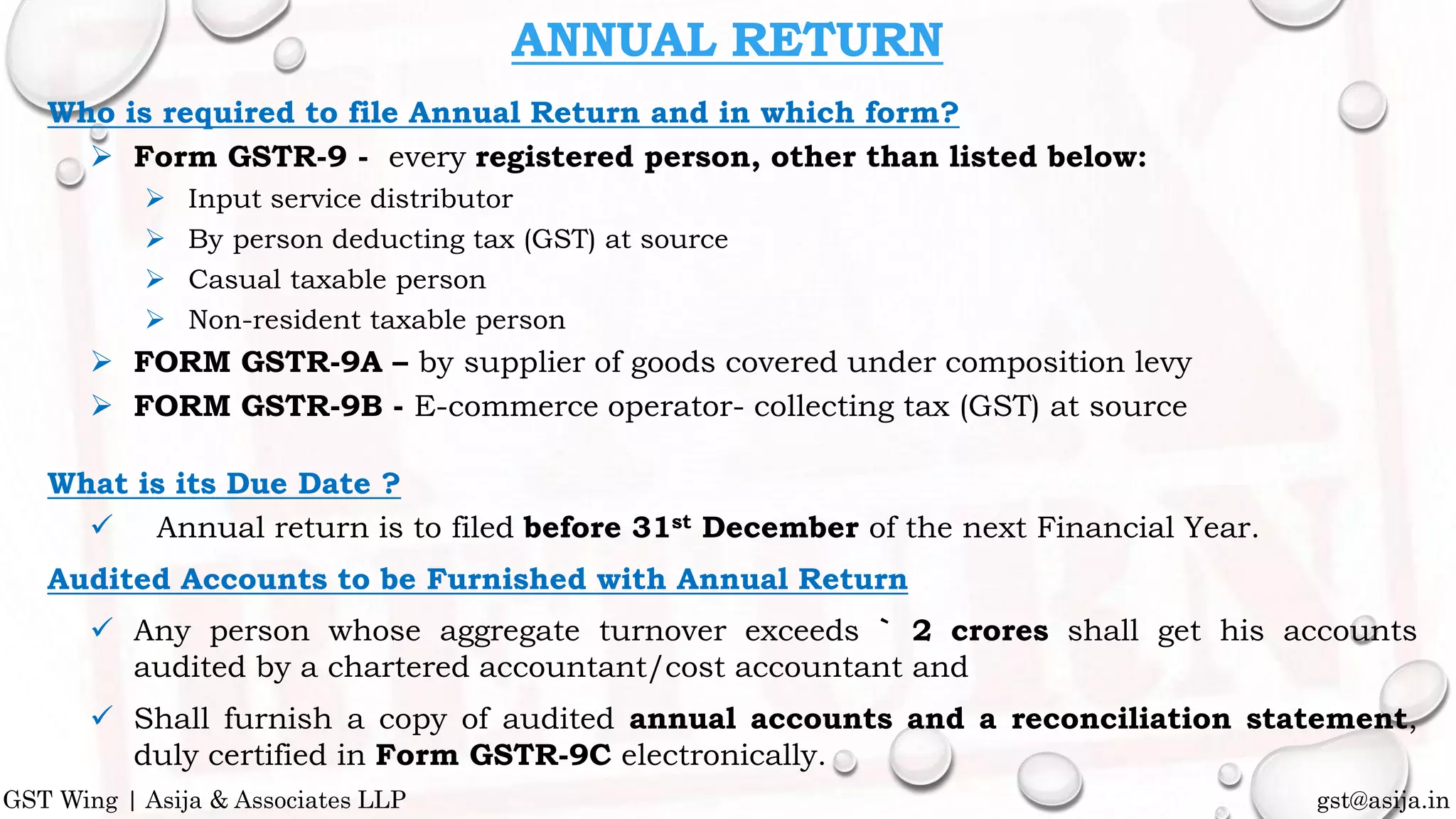

- An annual return (GSTR-9/9A/9B/9C) must be filed by 31 December each year, along with audited financial statements if annual turnover exceeds Rs. 2 crores.

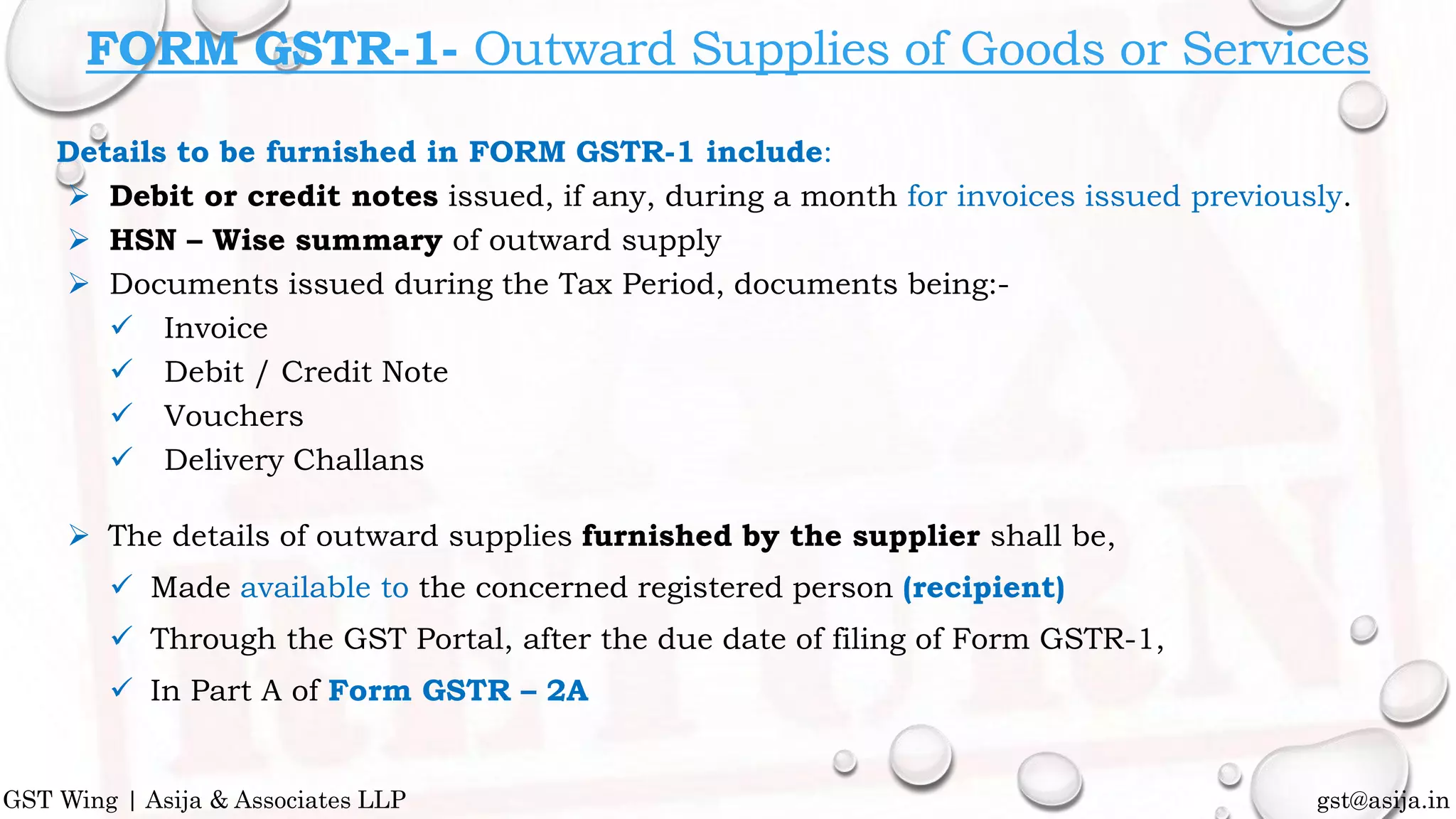

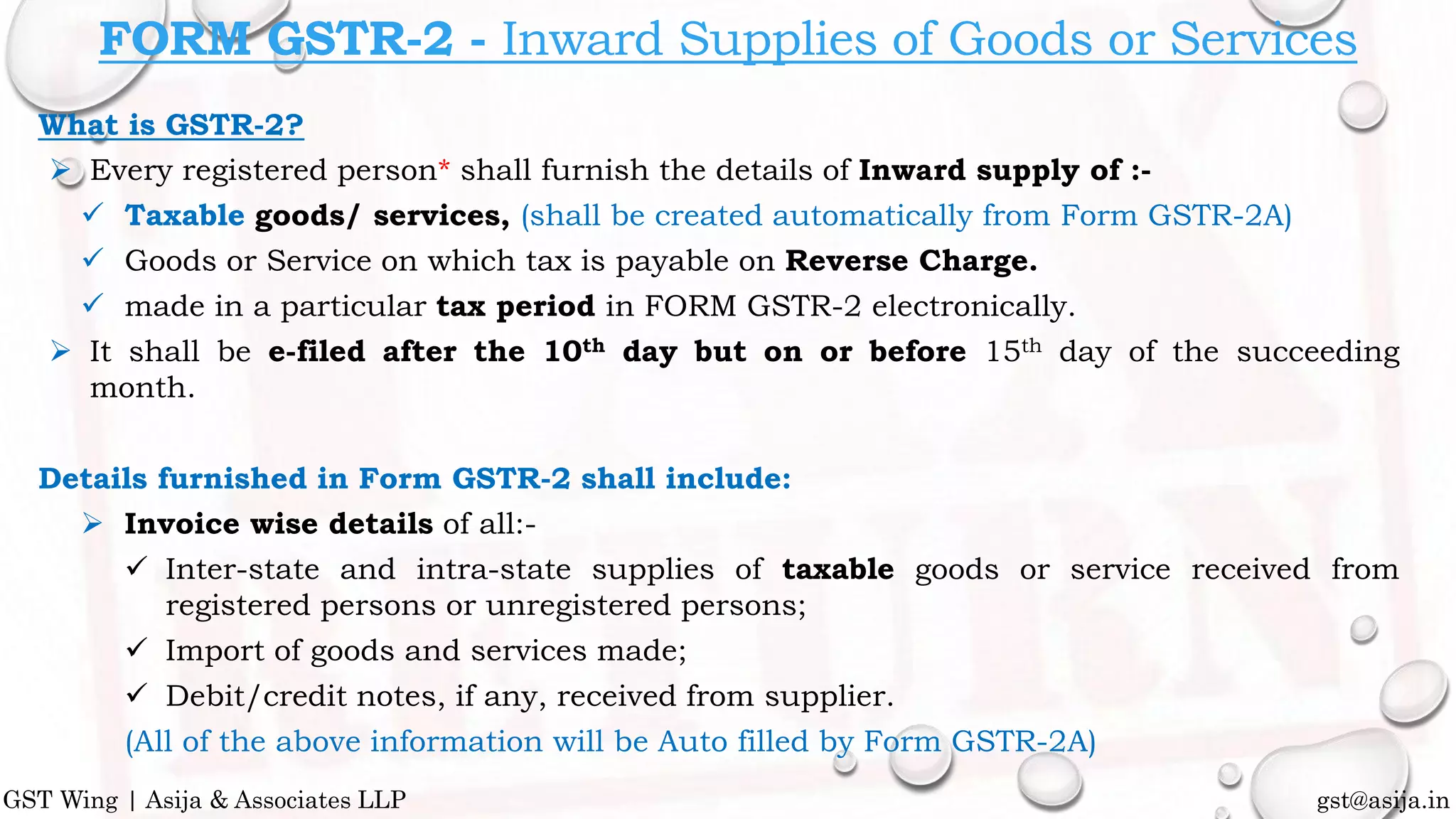

- GSTR-1 provides outward supply details, while GSTR-2 details inward supplies based on GSTR-1 and GSTR-2A (