This document provides an overview of the Goods and Services Tax (GST) system that is being implemented in India. Some key points:

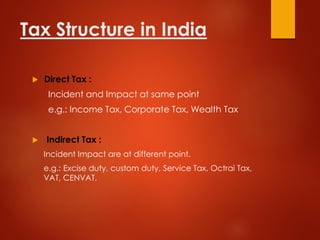

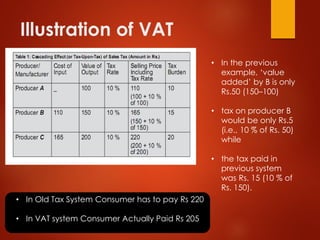

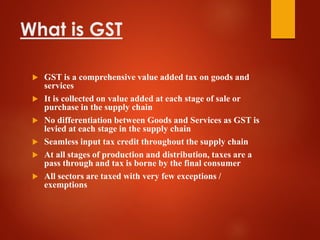

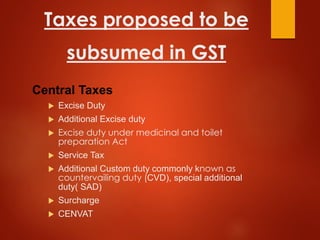

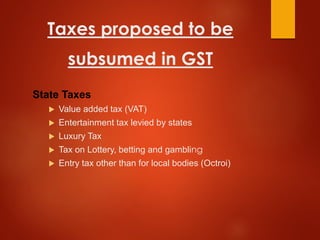

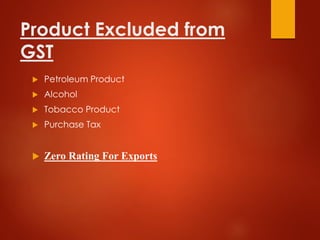

- GST is a comprehensive indirect tax that will combine multiple state and central taxes into one. It is levied at each stage of production and distribution.

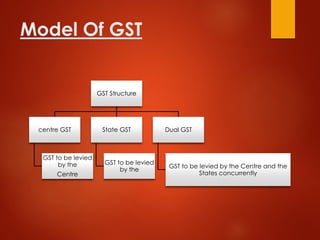

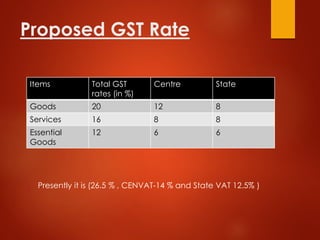

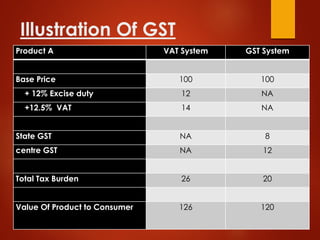

- The proposed GST structure has two components - Central GST to be levied by the Centre and State GST to be levied by the states. Standard rates are proposed at 20% for goods and 16% for services.

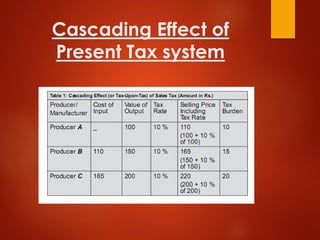

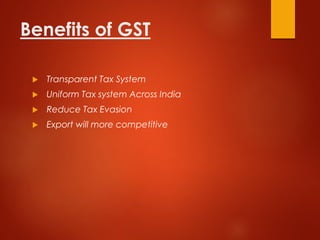

- GST aims to reduce tax cascading and make India's tax system simpler, more transparent and boost the economy by making exports more competitive.

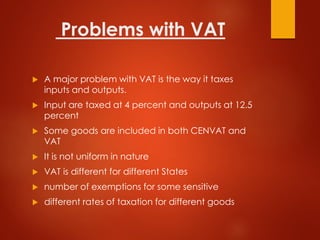

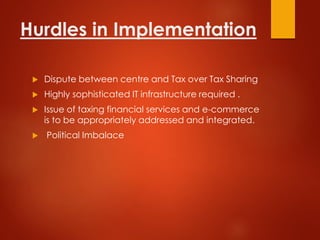

- There were challenges